Occupiers looking for quality workspace in Europe will face tough competition for the best space in the leasing market despite the most active period of new office construction in half a decade, Savills predicts. Newly developed offices set to complete in the region this year will provide 26% more space compared with 2020, says the European Office Development report.

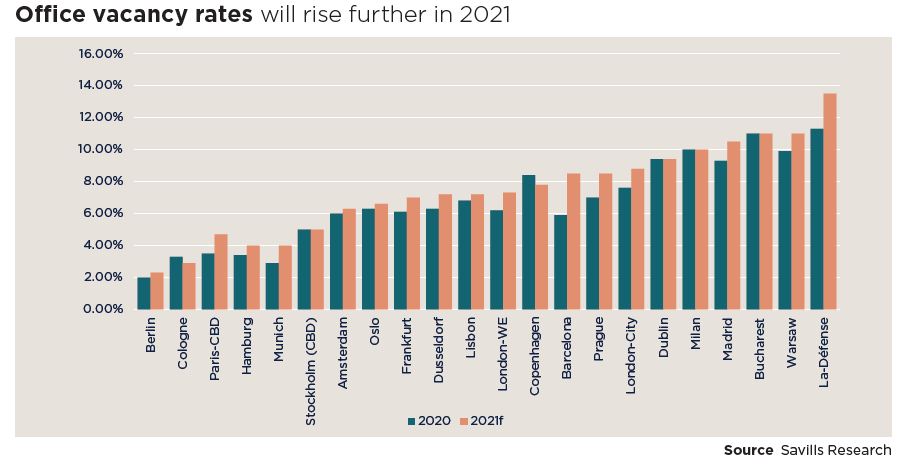

However, average vacancy rates across many cities in Europe - including Berlin, Stockholm, Amsterdam and Paris – will be below 6% making them some of the most competitive leasing markets.

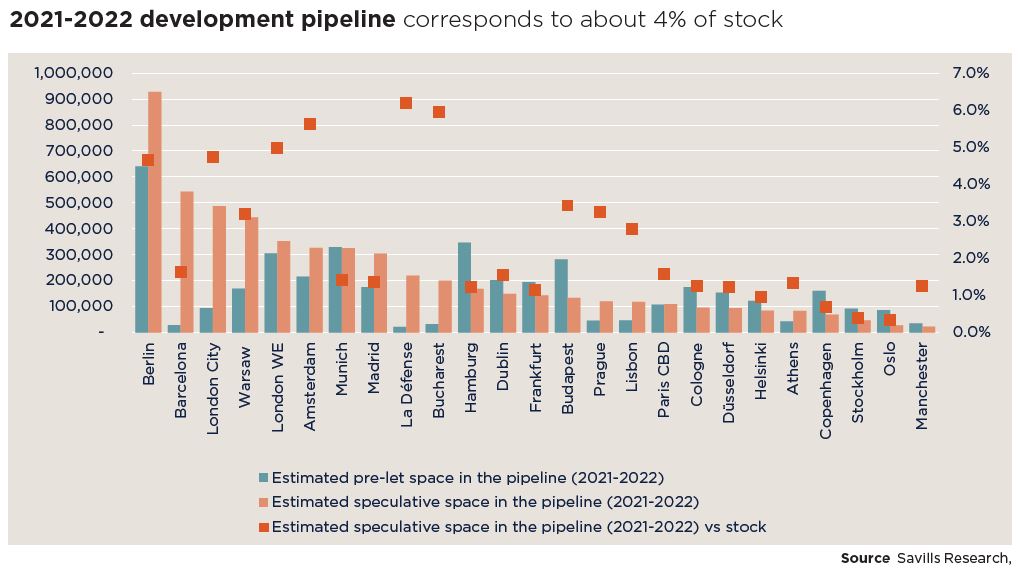

A new building supply of 5.2 million sqm, which is distributed across 24 markets in the region, is due to be completed this year, with a similar amount of supply (5.1 million sqm) due in 2022. This is the highest level of new supply in five years.

But Savills predicts that with half of this space already committed - 54% of new offices in 2021 already pre-let and 39% in 2022 - any new prime space will be absorbed, based upon known levels of demand.

Lenka Pechová, Senior Research Analyst at Savills CZ&SK, says: “The pre-let space in Prague in the 2021-2022 pipeline is estimated at 44,300 sqm and the speculative space in the 2021-2022 pipeline is estimated at 122,000 sqm, with the speculative space in pipeline corresponding to 3.3% of the stock.“

Prime offices will be most scarce in Berlin, which is set to have a 2.3% vacancy this year, with other German cities seeing very little spare capacity. In 2021, Cologne’s vacancy rate will be 2.9%, while Hamburg’s will be 4%.

Pre-let figures are below those in previous years (which were between 55% and 60%), however, Eri Mitsostergiou, Director, European research, Savills, says: “Quality workspace is a priority for occupiers, and as this is expected to continue, supply remains tight.”

The report echoes the sentiment of Savills latest Impacts publication, which was released last month. Impacts identifies that the transition to a hybrid workforce is the biggest challenge businesses will face in the next five years. “Given low office availability in many locations, it’s better to start looking sooner rather than later to find space that will work for you in a hybrid model,” it says.

Savills is also seeing space constraints in Stockholm, which is registering a vacancy of 5%, and in Munich, where unleased office space will be 4% of the market. Lisbon’s will be 7.2%, London’s West End will be 7.3%, while Barcelona and Prague will experience 8.5% vacancy.

The European Office Development report predicts that an increase in secondary supply is expected to cause an overall increase in the average vacancy rate across the survey area, however much of this may not be attractive in meeting current occupier requirements, particularly in relation to ESG and digital suitability.

Savills forecasts the number of vacant offices will lead to an 80 basis point shift upwards, making empty space on average 7.5% of the total area surveyed.

European markets predicted to have the highest vacancy rates are expected to be Warsaw (11%), Bucharest (11%) and Paris La Défense (13.5%), says Savills.

Pavel Novák, Head of Office Agency, Savills CZ&SK, adds: “In Europe alone, almost 1.5 times more modern offices will be added this year than the volume of all office space in Prague. Given that companies have already managed to lease most of this space, despite the uncertainty associated with the pandemic, it would be wrong to assume that the office sector is in decline. Moreover, it is already clear from the figures that next year will be at least similar in terms of supply and demand. Even in the Czech Republic, companies are switching to a hybrid model of working that combines home and office working, and so interest in modern and eco-friendly buildings that are more suited to this style of working is growing.“