Renewals dominated the Budapest industrial property market in the second three months of the year where the vacancy rate has increased for the first time in nearly three years. The Budapest Research Forum has published its Q2 2016 industrial market snapshot.

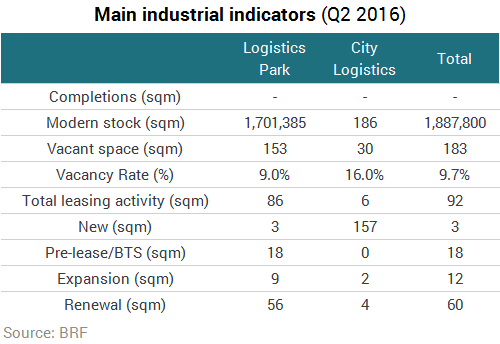

In the second quarter of 2016 no new developments were completed, hence the Budapest agglomeration’s modern industrial stock remains unchanged at 1,887,800 sqm.

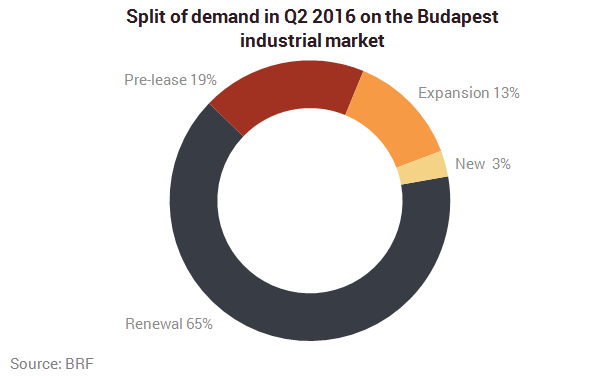

Total leasing activity amounted to 92,100 sqm in Q2 2016, which marks a 22% decrease on the previous quarter and a 13% decline on a yearly basis. Similarly to previous quarters, most of the demand was generated by renewals with 65% of TLA, while new leases made up only 3% and expansions 13%. Due to limited available space several large pre-leases were signed during the quarter, totalling 17,650 sqm and thereby representing 19% of the total demand for the period.

Approximately 93% of the leasing activity was recorded in logistics parks where the average deal size was 5,710 sqm. The average deal size in city logistics schemes equated to 1,080 sqm.

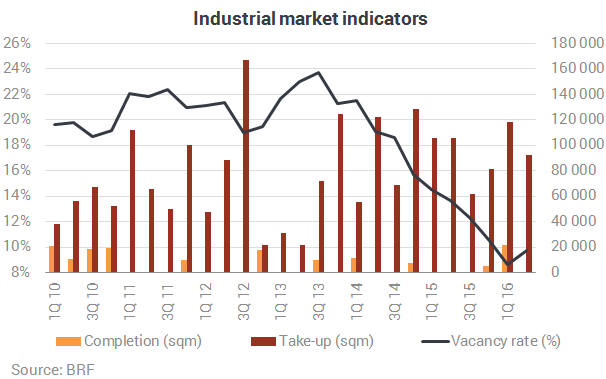

The vacancy rate currently stands at 9.7%, which is 1.1 pps above the level of Q1 2016 and thereby marks the first quarterly increase since Q3 2013. Currently there is 182,650 sqm vacant space, with only four schemes offering available areas larger than 10,000 sqm.

The Budapest Research Forum (BRF) comprises of CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary. BRF analyses modern industrial properties located in Budapest and Pest County, completed after 1995 for letting purposes, comprising a minimum of 2,000 sqm space in terms of city-logistics or minimum of 5,000 sqm space in terms of logistics park warehouses. The industrial stock excludes owner occupied buildings.