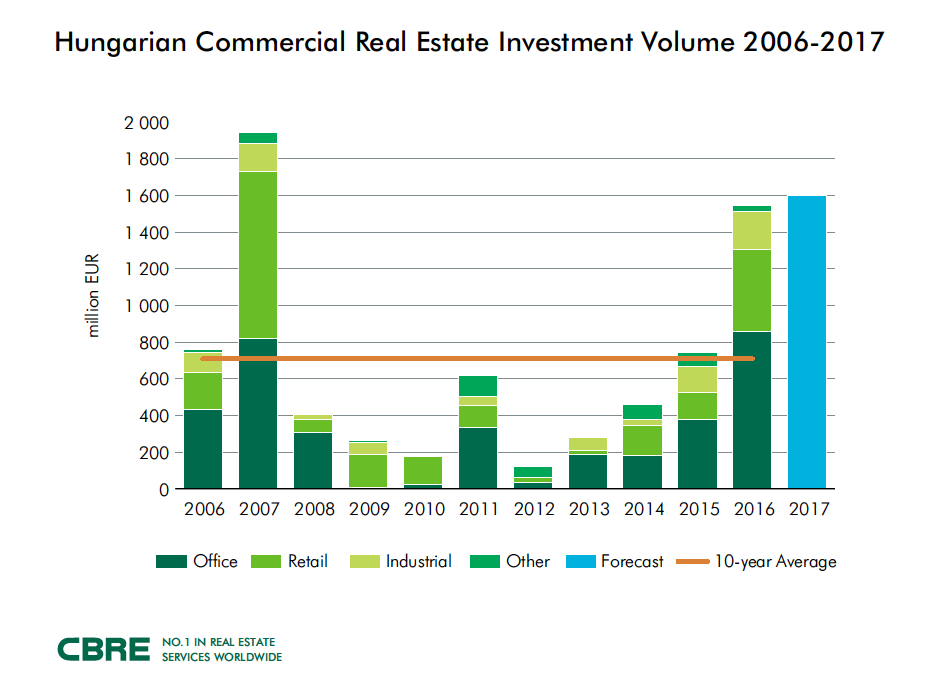

Investors spent €1.54 billion in 2016 in the Hungarian commercial real estate market surpassing the 2015 level by 107%. Last year both office properties and retail properties were in request, thus CBRE is expecting a similar or even higher turnover for 2017.

Commercial properties changed hands in the amount of €745 million in 2015 in Hungary, and in 2016 the turnover was more than double, €1.54 billion. The growth in the office market was 129 per cent, which is explained by the demand for the increasingly attractive second and third class properties appearing in the market in addition to the modern office buildings. The investment turnover of retail properties increased by an even more significant 203 per cent, due in part to the change of ownership at the major Mammut shopping centre. The 44 per cent growth of the industrial property market falls short of the other two sub-markets because of limited supply, as currently there are only a few industrial and logistics properties for sale in Hungary.

"We are expecting a strong turnover in the Hungarian commercial property market also for 2017. The stable economic growth and the increasing household consumption make the country attractive for investors, and moreover, all three credit rating agencies graded Hungary "suitable for investment”, thus more institutional investors may enter the market. The investment sales have quadrupled since 2013 in Hungary. This extraordinary growth has positively affected also the advisors; the market grew by an annual 20 per cent in the last three years. CBRE has managed to grow in this period at a rate of 40 per cent per year, which was only possible through the trust and confidence of our customers and our strategic cooperation with them”, Lóránt Kibédi-Varga, Managing Director of CBRE Hungary said.