Occupier and investment sentiment remains positive across all Central and Eastern European countries tracked by the RICS Commercial Property Monitor. Results for Q2 2017 show that Hungary and the Czech Republic continue to post the strongest overall results. The vast majority of respondents expect new investors to enter the market with the presence of local and CEE investors predicted to increase across the region in the year ahead.

Occupier market

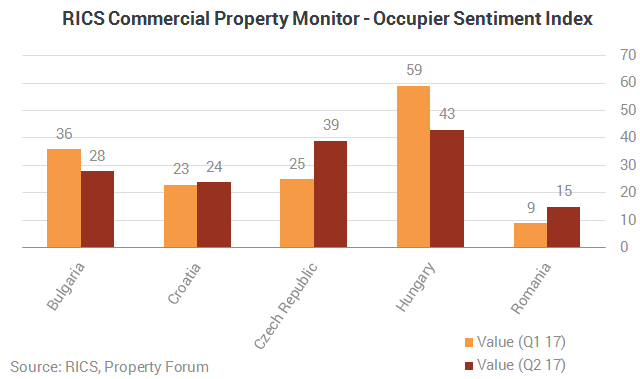

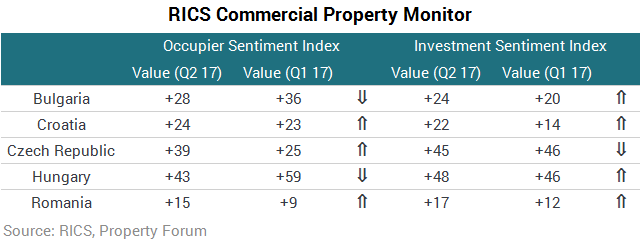

The RICS Occupier Sentiment Index (an overall measure of occupier market momentum) returned a positive reading in each CEE country tracked within the RICS Commercial Property Monitor.

Hungary continues to post the strongest overall results, albeit the index eased somewhat from the first quarter’s record high. Tenant demand continued to increase robustly across the board, while availability of leasable space declined further. Rental growth projections were broadly unchanged compared to Q1 2017, coming in at 3.5%.

“The sentiment reflected in the current survey is confirmed by the buoyant market conditions over the last few months in Hungary. Development levels are reaching record highs, while vacancy remains low. There has been a flurry of investment deals with properties trading to international and also local institutional investors. Hungary is a sought after investment destination but retains its competitive advantage. The market outlook per the sentiment survey for the coming period remains bright,” commented Noah M. Steinberg FRICS, Chairman & CEO of Wing and Chairman of RICS in Hungary.

Noah Steinberg will chair our senior CEE investor, developer and banker roundtable at CEE Property Forum 2017 in Vienna on 19 September.

The Czech market gathered significant momentum over Q2 2017 with the OSI rising from +25 to +39, which is the strongest reading since the survey was formed in 2008. Solid demand growth, particularly in the office sector, has pushed near term rent expectations noticeably higher, with prime office and retail rents anticipated to rise sharply over the year to come. Projections for secondary locations, however, remain subdued.

Elsewhere, robust results were again reported in Bulgaria, with rising demand being met with a modest decline in availability. This is expected to translate into an increase in rental values across all areas of the market in the 12 months ahead. Rental growth prospects remain firmest in the prime office sector.

Meanwhile, although still comfortably positive, momentum appears a little more modest in Croatia and Romania. In Romania, availability continues to rise, despite reasonably strong demand growth, which is weighing on near term rental growth projections. Further out however, respondents envisage rents rising across each segment (to a greater or lesser degree) over the next twelve months. By way of contrast, rents across secondary locations in Croatia are anticipated to remain flat at best, while prime sub sectors exhibit positive projections, with the strongest growth expected across prime retail space.

“The Romanian property market has shown clear signs of growth in both levels of activity and investor interest, supported by several years of strong economic growth. Occupier demand has increased across all sectors and steep growth in retail sales has helped to drive rental growth in the retail sector. The manufacturing sector continues to attract new entrants to the market, with logistics being fuelled by the trend in retail sales. Foreign investor activity has gradually increased in 2017 and the overall level of interest in the market is significantly higher than 2016. The Romanian market retains a yield advantage for investors over more core markets of CEE, while offering a risk profile which is lower than often perceived. A positive outlook for the market heading into 2018”, added Tim Wilkinson MRICS, Chairman of RICS in Romania.

Tim Wilkinson will chair our panel discussion on Romania at CEE Property Forum 2017 in Vienna on 19 September.

In Bulgaria, the Czech Republic and Hungary development starts continue to rise significantly in the office sector, with a majority of respondents reporting an increase in new construction activity.

Investment market

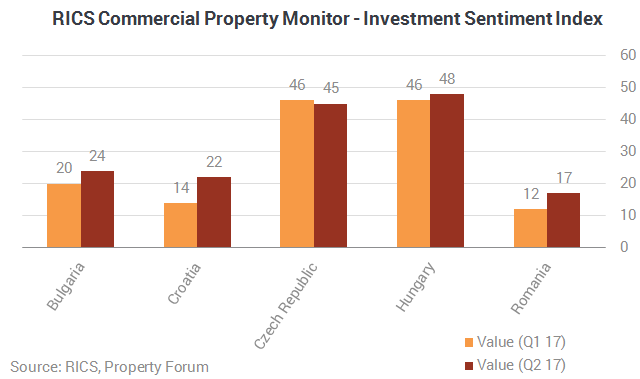

Hungary and the Czech Republic remain the two countries with the most upbeat investment outlook, as captured by the RICS Investment Sentiment Index (an overall measure of investment market momentum).

Hungary posted yet another record high ISI reading, at +48, while the Index came in at +45 in the Czech Republic. Domestic as well as foreign demand continues to rise sharply in both cases, driving near term expectations for capital value gains. In the Czech Republic, the outlook for the next 12 months is mostly flat across secondary locations, while in Hungary all sectors exhibit firm capital value projections.

“The external geo-political factors seem to be having little influence on the Czech market with strong demand from occupiers and investors. I am expecting the market to maintain its current momentum for the next 12 months with lack of investment supply allowing pricing to be maintained. Domestic capital is playing a strong part in the capital markets alongside more traditional and exotic sources”, said Paul Betts, Managing Director at M7 Real Estate.

Paul Betts will join our panel discussion on the Czech and Slovak markets at CEE Property Forum 2017 in Vienna on 19 September.

Although ISI readings across Bulgaria, Croatia and Romania remain less robust than in the aforementioned markets, each country did see momentum strengthen slightly in the latest results. In fact, twelve month expectations across Romania and Bulgaria are pointing to robust capital value growth over the next year, with growth expected across both prime and secondary assets. Meanwhile, the picture is more mixed in Croatia, with only the prime retail and office sectors expected to see material growth, while the outlook is flatter across all other segments of the market.

“The solid economic growth and improving occupier sentiments give strong impetus on the Bulgarian property market which results in tremendously high investment activity. In the first half of 2017, the highest ever investment volume was recorded and we expect this strong performance to continue through the remainder of the year with acquisitions surpassing €900 million in total. Increasing liquidity is another positive effect which we expect to further support the investors interest”, commented Michaela Lashova MRICS, CEO of Cushman & Wakefield Forton.

Michaela Lashova will join our panel discussion on Bulgaria and other SEE markets at CEE Property Forum 2017 in Vienna on 19 September.

In all five CEE countries the majority of contributors feel that the market offers fair value at present. It is worth to note, however, that in Romania a large share of respondents still feel that the market is undervalued, while in the Czech Republic the portion of respondents who see the market as expensive increased significantly.

Credit conditions improved further in all five countries, with the majority of contributors reporting some degree of improvement. Only some respondents in Romania noted a more challenging financial environment.

In response to an additional question included in the Q2 2017 survey, a large majority of contributors across all five nations reported that they expect new investors to enter the market over the next year. The strongest return was Bulgaria (100%), while the Czech Republic’s share of 81% was the lowest. Likewise, a near unanimous majority in each market expects the presence of local and CEE investors to increase in the year ahead.

When asked what sources of capital respondents expected to be present in the local market over the next twelve months, the top answer for Bulgaria was South African capital. In Croatia and Romania the largest share of respondents expect CEE cross border transactions to dominate the market over the next year, while in the Czech Republic and Hungary the relative dominance of local investors is expected by RICS professionals.