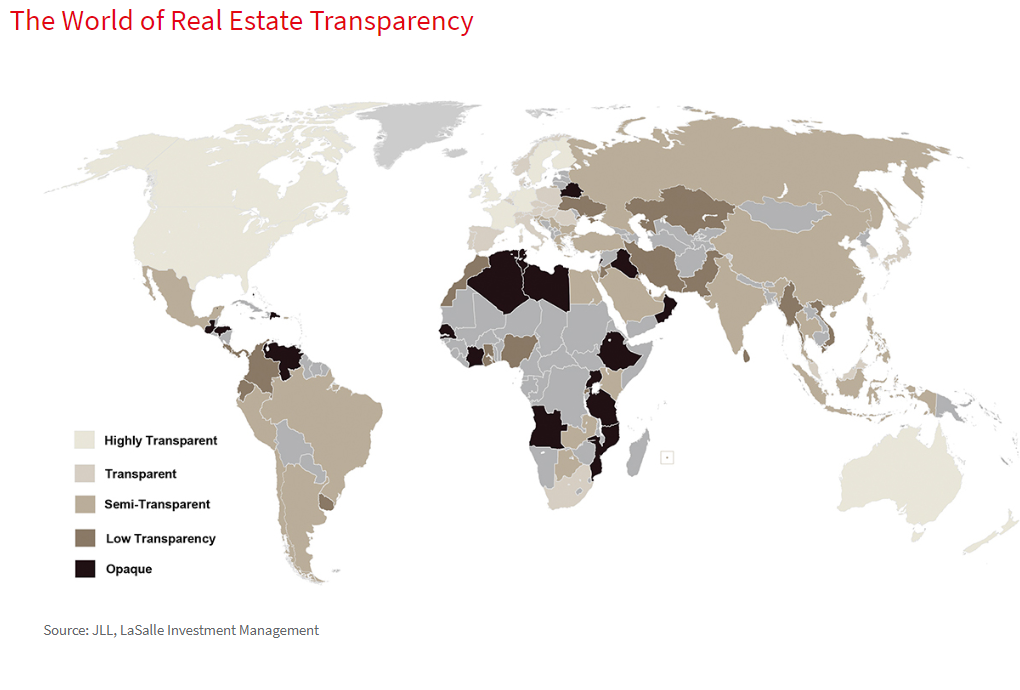

Governments worldwide have been gradually forging greater transparency in real estate markets, addressing growing demands from investors and the public to deliver significant change. JLL’s Global Real Estate Transparency Index reports slow but steady progress driven by increased regulations and new technology.

Governments all over the world are gradually seeking to gain more transparency in real estate markets. Significant changes meet the requirements of investors and the public. The most transparent are the European countries led by Great Britain. Australia and the United States are just behind. The Czech Republic ranked 23rd, Slovakia recorded one of the biggest progresses in the ranking.

“It is great to see that the Czech Republic continues to rank highly in the GRETI. This totally supports my view and those of investors who find the Czech market highly liquid and transparent. I see continuing demand from all sources of international capital plus very strong domestic capital seeking investment opportunities. This combined demand further supports the view that Czech Republic is an open and transparent market,” said Mike Atwell, Head of Capital Markets CEE.

Over the past 20 years, when JLL regularly publishes the Global Real Estate Transparency Index report, the level of regulation and availability of data has increased, resulting in a gradual increase in transparency. Since 2016, 85 of the 100 countries surveyed have seen improvement, with the growing impact of technology further strengthening this positive trend in the future.

Government measures are aimed at improving their competitive position as both real estate investors and companies looking to lease space increasingly demand standardized data.

Technology as a guarantee of transparency

Real estate transparency is slowly moving in the right direction around the world and many countries – including India, China and Turkey – are on the cusp of transparency. Dubai has also passed positive regulation. Such measures are designed to attract higher levels of foreign investment.

While significant progress has been made in recent years, we recognize that further initiatives are required to enhance the level of market transparency. Technology is poised to provide the next big leap in transparency. Prop-tech tools that transcend national borders such as blockchain, brokerage apps and open data could help semi-transparent markets leapfrog the normal process of transparency.

GRETI 2018 - Key Highlights

- Transparency Progress - 85% of markets register progress, but change is too slow in an environment where investors and businesses are demanding much higher standards.

- Prop-tech has the potential to be the largest future driver of real estate transparency - The unintended consequences of new technologies and business models are raising concerns relating to data access, quality and consistency.

- Will the rise of flexible workspace compromise transparency? - In the leading global business hubs, flexible space is reaching a critical mass and the model is spreading globally, this could make it more difficult to track overall market dynamics.

- Beneficial ownership and anti-money laundering in the spotlight - Efforts to combat money laundering and corruption in real estate are advancing, and legislation such as the UK’s proposed beneficial ownership registry and the European Union’s Fifth Anti-Money Laundering directive are leading the way.

- Alternatives transparency - Increasing capital allocations to the alternative sectors result in demand for enhanced market transparency across a much broader range of property types.

- Real estate transparency is a key ingredient of city competitiveness - Greater acknowledgement among city governments that real estate transparency can contribute to a more competitive, efficient and flexible environment for investors and entrepreneurs and is therefore a key ingredient in city success.

- Coverage in the Index has been extended to 158 metropolitan areas. It reveals that most ‘Highly Transparent’ countries – such as the UK, Germany, Australia, and Canada – have consistently high levels of transparency outside primary cities, but others such as the United States show relatively wide divergence between metro areas due to federated governance structures and differences in data availability.

- Transparency of sustainability tools included in JLL’s composite Index for the first time, and coverage has been extended from 37 countries to all 100 countries.

- Top Transparency ranks are dominated by English-speaking countries … but other tech-savvy economies are catching up - The Netherlands has consolidated its position in the top tier and registered among the largest improvements of any market, while Sweden has joined the ‘Highly Transparent’ tier for the first time.

- London tops the ranking with the world’s most transparent real estate market, testimony to its position as the favoured destination for global capital. Los Angeles, Sydney, San Francisco and New York City round off the Top 5.

- ‘Highly Transparent’ markets set higher standards, but face multiple challenges - prop-tech disruption, the rise of flexible space and issues relating to beneficial ownership.

- Large developing economies are moving towards ‘Transparency’ – The Next Big Opportunity? - Many of the world’s most populous developing economies, China, India, Indonesia, Brazil, Russia, Mexico, Turkey and Thailand (accounting for half of world’s population) are clustered on the cusp of the ‘Transparent’ tier. These eight countries have made advancements in recent surveys, although progress is patchy. Further regulatory reforms, and crucially enforcement, will be essential for these markets to move into the ‘Transparent’ tier.