In 2016, office supply in Warsaw rose by 65% on the annual average for the period 2011–2015. The largest number of new office buildings was delivered in the City Core and the Fringe. Take-up came predominantly from the business services sector. Cushman & Wakefield presented an overview of the Warsaw office market in 2016 in its latest report.

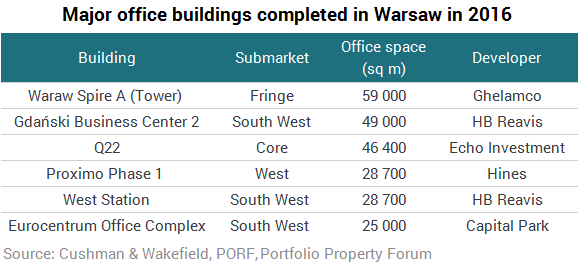

In 2016, Warsaw’s total office stock topped 5 million sqm. 21 office schemes received occupancy permits, providing a total of over 400,000 sqm. Nearly 40% of this space was delivered in three buildings: Q22, Warsaw Spire A and Gdański Business Center 2. The largest volume of new space came on stream in central locations (more than 200,000 sqm), followed by South West (approximately 90,000 sqm) and North (approximately 50,000 sqm). Office supply is expected to remain high in the next two years with the City Core and the Fringe seeing substantial space added to their stock.

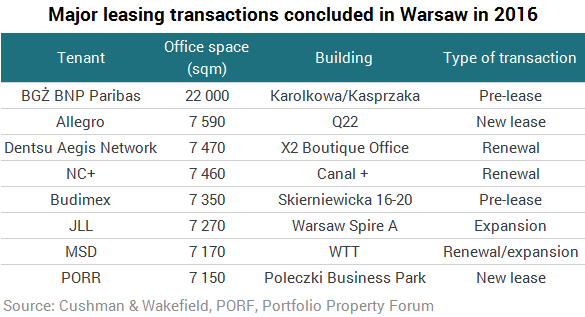

Kamila Wykrota, Partner, Head of Consulting & Research said: “Occupier demand for new office space is expected to remain healthy, fuelled by Poland’s steady GDP growth and continued rapid growth of the modern business services sector. Poland is ranked 7th in the global BPO location index in Cushman & Wakefield’s Where in the World report published in December 2016, and has seen its outsourcing sector grow at a rate of 20% per annum since 1995. BPO businesses are major tenants on the Warsaw office market. Warsaw is a mature market with increased occupier awareness and tenants focused on seeking locations and office space best suited to their needs.”

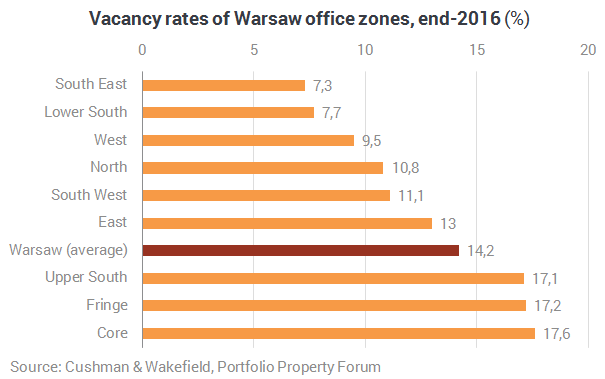

At year-end 2016, Warsaw’s vacancy rate averaged 14.2%. There was more than 700,000 sqm of vacant space, a rise of 2 percentage points on the value recorded at year-end 2015 (12.3%). The vacancy rate stood at 17.3% in central zones and at 12.9% in non-central locations, representing a rise of 4 and 1.1 percentage points, respectively. Prime headline rents fell slightly to €23.5–24/sqm/month in Warsaw’s Central Business District compared to 2016, but remained flat at €13–16.5/sqm/month in non-central locations.