The increased use of technology is already changing the way industrial property is being built and used. Tim Davies, Head of EMEA Industrial and Logistics Agency at Colliers International United Kingdom talked to Property Forum about e-commerce, robotics, big data and many more.

What are the top three trends driving European industrial and logistics markets in 2017?

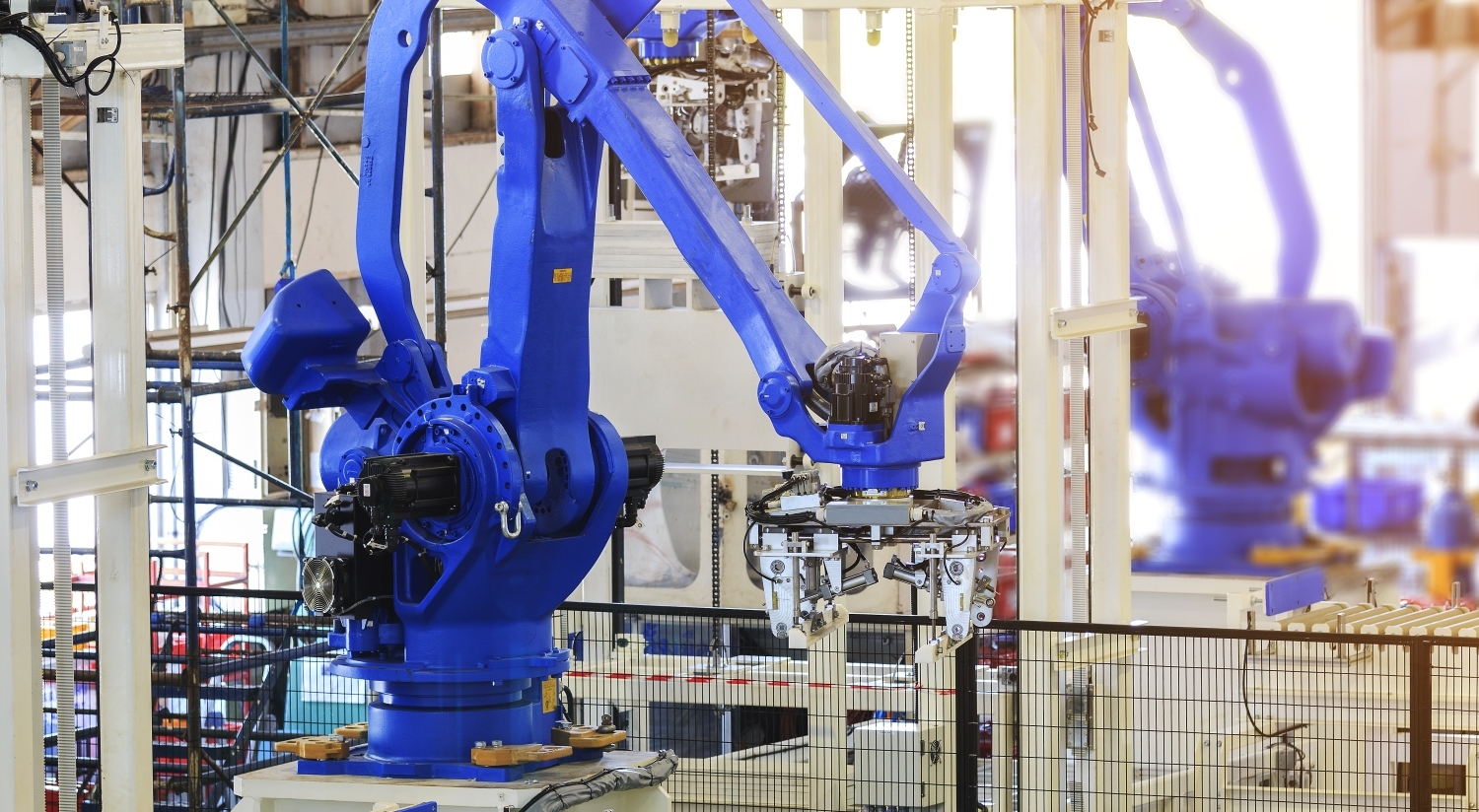

The continued expansion of e-commerce across Europe, the increased use of robotics and the impact of big data to enable efficient time management and tracking of goods.

Overseeing the EMEA region from the UK, what kind of potential do you think CEE markets offer?

There are tremendous opportunities in CEE. Compared to the UK and Western Europe, the markets are less well-developed but the potential for growth cannot be underestimated. The region has the benefit of a plentiful supply of land combined with forward thinking regional and national governments that are ambitious and hungry for success. A willing labour force is a further benefit that is hugely important for investors and occupiers.

How do you think the growing popularity of online shopping will change the way logistics property is built?

The emergence of online shopping has already had a significant impact on the logistics property market. Retailer occupiers are driven by customer demand and in response to this they need new high quality warehouses. Each occupier has specific operational needs and developers are designing buildings in accordance with these requirements.

What does the growth of e-commerce mean for shopping centres? How can they adapt to changing consumer needs?

The internet revolution has led to a societal change in the way we shop. Already more than 20% of all shopping in the UK is done online and within the next few years it is predicted that this will increase to over 50%. This pattern will be repeated across Europe in due course. It is inevitable that this will lead to the demise of many shopping centres. This will be especially the case for centres in secondary locations and for those that are outdated and tired. Owners are working hard to ensure that shopping centres are still attractive to customers and many are thinking laterally so that the whole “day out experience” goes beyond just shopping.

In your opinion, what are the proptech innovations that can transform the European industrial and logistics landscape within the next few years?

Increased use of technology will inevitably impact on the logistics property market. Our sector is already invested heavily in robotics and buildings are being designed and constructed with robotics in mind. Big data is becoming readily available to companies and they are responding and reacting to this information. The ability for e-commerce companies to predict customers’ requirements based on previous trends will help them to occupy the right size buildings in the optimum location.

Do you think that the new industrial and logistics projects are less green that other type of property developments? How can owners and developers of industrial and logistics property increase sustainability?

Adopting a sustainable approach to logistics development has often been frowned upon because of the perceived costs involved. Occupiers are increasingly aware of their corporate social responsibility and the need to behave sustainably. Equally, investors are also focused on sustainable design and development. In response, developers are incorporating a range of sustainable features including photovoltaic cladding, environmentally friendly heating systems and LED lighting. Looking to the future, sustainability will continue to be of increasing importance and developers and landlords will view the provision of sustainable features as essential to new construction.