7 million citizens of the CEE-6 countries reside in Western Europe and the return of even a relatively small portion of these would boost regional GDP, stimulating the development of real estate markets, says Colliers International in its latest research report "Labour Force Boomerang"

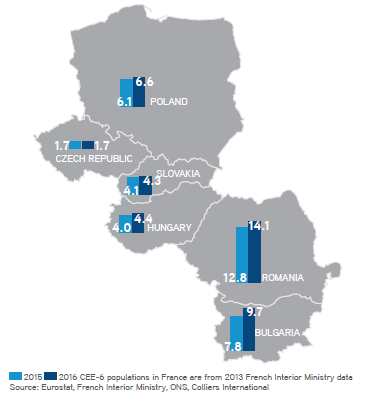

Significant portions of the citizens of the CEE-6 countries, including 14.1% of Romanians, 9.8% of Bulgarians and 6.6% of Poles, reside in Western Europe. Over 1 million Romanians live in Italy, for example. Vast numbers of emigrants, mostly young, skilled and educated people, taking advantage of the EU’s free movement of labour rules have contributed to the situation of significant labour shortages in CEE economies. Faster future wage growth in the CEE region is likely, inter alia, to encourage some return migration. Such a "boomerang effect" would most likely translate into increased investment and higher demand for office and industrial real estate space. The demand for consumer goods would also see a boost, helping growth in the retail and logistics sectors.

Shifting "push" and "pull" factors for emigrants

Looking at the financials, tighter labour markets in CEE are forcing wage inflation for skilled workers especially. Minimum wages are rising significantly (7-15%) this year in the CEE-6. Currency effects (including a weaker Pound in Brexit Britain) and tax rates are pointing towards a faster closing of the still-yawning net wage differentials over the next 5-10 years. CEE's cost of living is rising, but that factor is increasing faster in places such as the UK.

Emotional factors, such as use of native language or education as young people progress into family status are up to each individual to judge. Arguably, some of the prior CEE "push" factors, such as corruption, political instability and institutional weakness have ebbed somewhat. OECD data suggest deterioration in the "quality of life" in some Western European countries. Despite these "push and pull" factors pointing in favour of a repatriation of CEE workers, employee surveys in CEE still point to a desire of young people to follow their peers westward.

The exodus- scope of the diaspora

The westward drift of the populations born in the CEE-6 countries turned into more of a flood after EU accession of the Visegrad-4 countries in 2004 and the lifting of all restrictions on free movement of Romanians and Bulgarians in 2014.The large income disparity between sources and destinations was the prime motivator for the flow of people.

Geographic spread

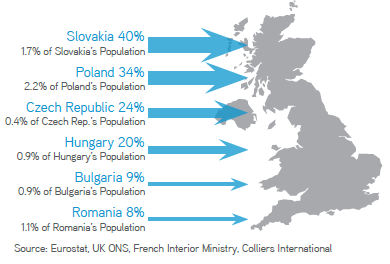

Equally interesting is the geographic spread of the CEE populations. Romanians make up the largest proportion of CEE-6 migrants in Italy. Around 845,000 Poles are estimated to be in the UK at present, a third of their Western European total and equivalent to 2.2% of Poland's population. The percentage of Hungarians and Slovaks residing in Western Europe are significant at 4.4% and 4.3% of their populations whilst the lowest proportion, the Czechs, static at 1.7%.

The UK – a popular destination for CEE emigrants

A significant proportion of CEE emigrants reside in the UK: 40% of the Slovaks in Western Europe, for example. "Brexit" has of course dealt the "European project" a blow. But thus far, one year after Brexit, there are no real signs of change in the politics of the free movement of people (excepting the UK), including that thus far anti-EU-immigrant platforms have not garnered significant political influence in Western European legislatures.

Will the emigrants return?

A combination of wage rises, low taxes, better governance and legal frameworks, more modern education systems, a more familiar cultural milieu and encouragement from the governments could well be "pull" factors to encourage those who migrated to return.

Mark Robinson, CEE Research Specialist, Colliers International comments:"Future wages will grow faster in CEE which is the argument for workers to stay in their native countries. The far superior rate of wage cost growth historically in the CEE-6, is something that, with low unemployment rates and high GDP growth rates, looks very likely to sustain over the next 10 years".

Provided that worker productivity can keep pace with Europe, increased investment in the future should also occur. This should mean higher demand for office and industrial real estate space and increased retail spending.

Currency and tax aspects

Currency effects will also most likely enhance in the future the purchasing power of workers in the home country versus the emigrant. By staying at home since EU accession, Czech or Polish workers gained 19.4% and 9.4% in purchasing power in EUR terms by being paid in local currencies.

Workers located and paying taxes in CEE are paying income tax at lower rates than Western European peers in the €1,000-1,500/month salary bracket (with the exception of France at this level).

Are governments helping?

Slovakia and particularly Hungary appear furthest along the road to putting in place a strategy to attract migrants home. Hungary in particular faces linguistic issues when thinking of sourcing cheap labour from Slavic countries and has the most acute labour shortages. Slovakia's programme is due to be launched in the autumn of 2017. Romania has tapped EU funds to make up to €30 million available to returning entrepreneurs who might be able to secure up to €40,000 in funding (4.5x annual wages) to set up new businesses. But as of yet, nothing in Poland or Bulgaria and only a specific programme for scientists in the Czech Republic.