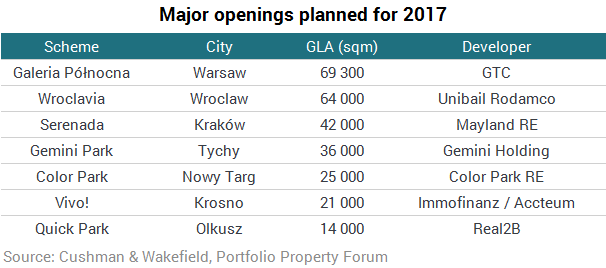

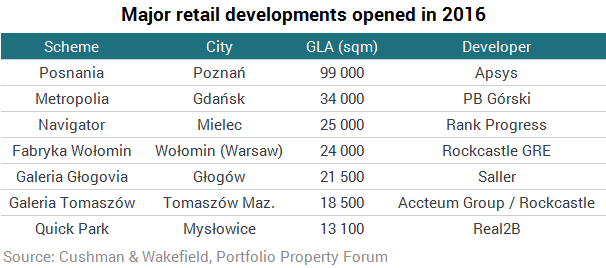

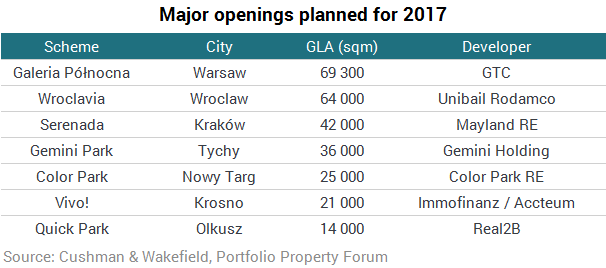

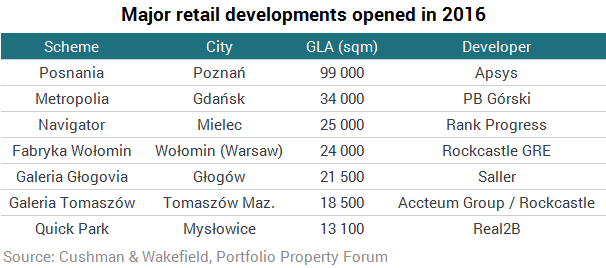

There is currently around 650,000 sqm of retail space under construction, of which 86% or 560,000 sqm is scheduled for delivery in 2017. The largest schemes to be opened this year include Galeria Północna in Warsaw, Wroclavia in Wrocław, Serenada in Krakow and Gemini Park in Tychy. Approximately 300,000 sqm of retail space will be delivered through new schemes and extensions in Poland’s eight largest agglomerations, including Arkadia in Warsaw, Galaxy in Szczecin and Franowo Retail Park in Poznań. Smaller-scale retail parks and strip malls are also to be opened across Poland, in such cities as Krakow, Piaseczno near Warsaw, Oława, Kęty and Zakopane. Towns with less than 100,000 inhabitants are expected to see their share in Poland’s total retail supply rise to 18%.

Renata Kusznierska, Partner, Head of Retail Agency, Cushman & Wakefield, said: “The opening of Warsaw’s Galeria Północna, the first large-scale shopping centre to be delivered in the capital city in ten years, will be this year’s highlight on the Polish retail market. Similarly to 2016, another half a million square metres is expected be added to Poland’s retail stock in 2017. Most of this will be constructed in key cities. Intense competition between both developers and tenants is leading to increased focus on quality improvements. These include refurbishment and extension of existing space, new retail operating models and growth of multi-channel sales.”

Demand for modern retail space remained healthy throughout 2016 and came primarily from expanding retailers representing mid-priced sectors, including sports, fashion, and health and beauty. Existing retail schemes were refurbished and extended also to meet growing customer expectations for new leisure concepts, which led to expansion of cinema and fitness club chains. Retailers with an established market position across all sectors also opted for improvements to introduce new standards.

Twenty two new retail brands entered the Polish retail market, including Skechers, NYX Cosmetics, Kanz, Steve Madden, Forever 21, &Other Stories and Maxi Bazar. In 2016, Westwing Home & Living, previously having an online presence only, opened its first European brick-and-mortar store in Poland.

Kamila Wykrota, Partner, Head of Consulting & Research, Cushman & Wakefield, said: “We expect between ten and twenty new brands to make a debut on the Polish market per annum in upcoming years. The main barriers for entry into Poland for top Western brands are Poles’ low purchasing power, which is half the European average, and absence of the single European currency, making financial and accounting settlements more complex.”

2016 also witnessed an end to the rebranding of Real hypermarkets acquired by Auchan in 2014 and further consolidation of the DIY market, largely by Leroy Merlin and Bricomarché. Retailers who withdrew from the Polish retail market last year included Mothercare, Brice, Kari, and food retailers Marcpol and Alma (currently in liquidation). Marks & Spencer and Dorothy Perkins also announced their intention to leave Poland.

Prime shopping centre rents remain flat. The highest rents stand at €120–140/sqm/month in Warsaw’s best-in-class shopping centres. Other prime retail schemes in the capital city command €100/sqm/month. Rents in other agglomerations are around €40–50/sqm/month.