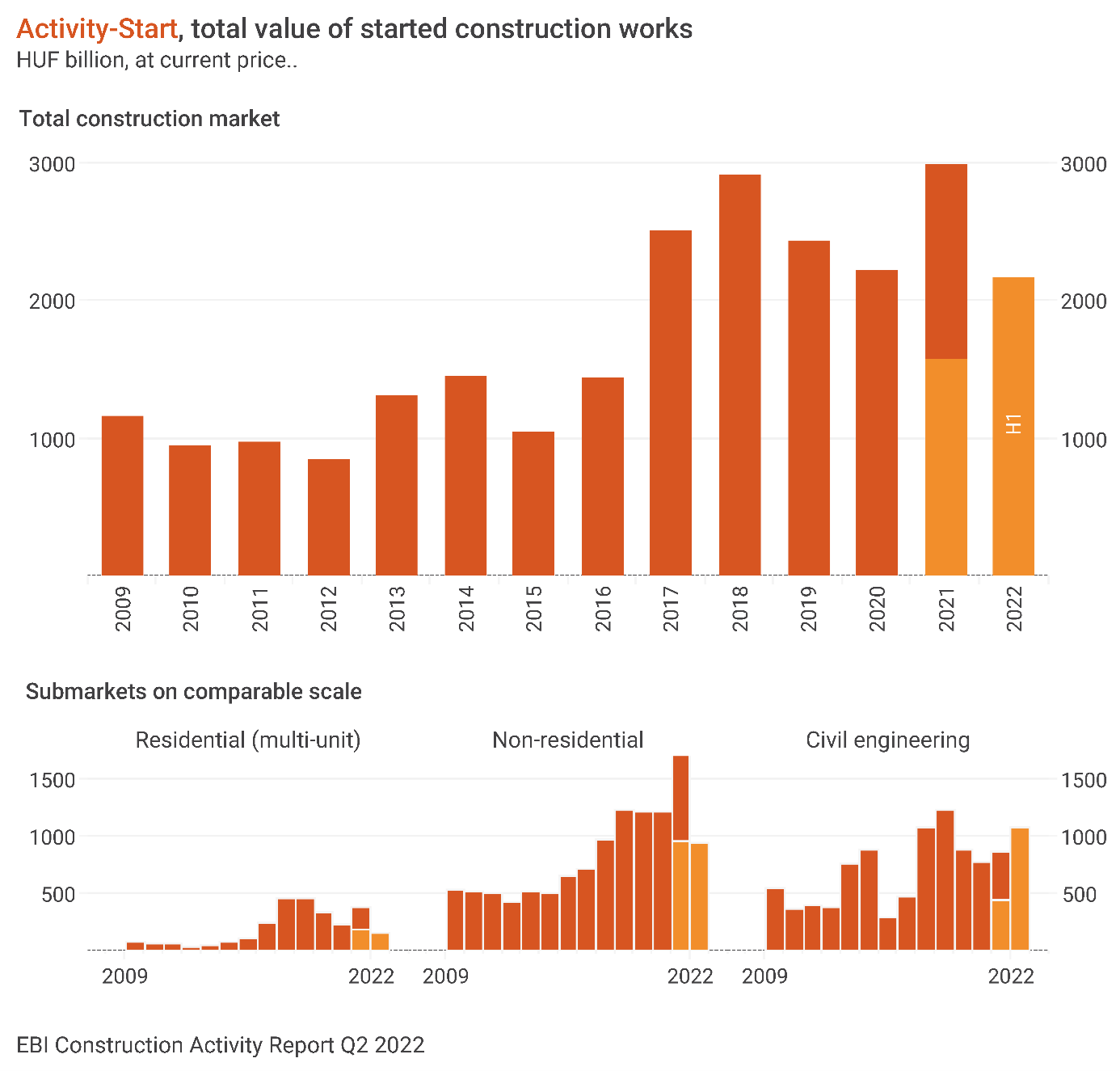

Hungary’s high construction activity start in Q1 2022 was followed by a slowdown in Q2 2022. The EBI Construction Activity Report has found that between this April and June construction works started at a value of around HUF 800 billion. Although the value of projects entering construction decreased in Q2, these are not low numbers at all as Activity Start has been the 5th highest (on a quarterly basis) of recent years. It should be added, though, that recently construction costs have dramatically increased, massively pushing up the Activity Start indicator calculated at current prices, while at constant prices the volume would be lower.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

The value of building construction works increased

In terms of building construction works, Activity Start rose in Q2 2022: the value of started construction works in the segment exceeded Q1 2022 and accounted for more than HUF 560 billion, the second highest level in recent years (after the period between April and June 2021). It is also true here that Activity Start calculated at current prices has significantly increased due to the hike in construction costs in recent years.

Within building construction works, Q2 2022 brought a massive drop in residential buildings. At the same time, non-residential buildings had a major expansion with Activity Start indicator going up to over HUF 500 billion between April and June 2022, the second highest after Q2 2021.

The largest building construction projects that started in Q2 2022 included the renovation works of the church buildings of the castle district in Veszprém, IV. Béla király High School in Dunakeszi, and VSZC Lányi Ferenc Vocational Training School, as well as the construction works of Kárpáti György Swimming Pool, the construction of Sisecam glass packaging material manufacturing plant in Kaposvár, HelloParks project in Páty and Maglód, the first phase of the BMW painting plant and central office building in Debrecen, phase 1 of Rubin NewCo’s half-shaft and cardan shaft manufacturing plant in Felsőzsolca, the construction of Center Point 3 office building, the construction of the Hungarian Post’s (Magyar Posta) Central Parcel Processor in Maglód, and the construction of the outdoor training fields of the Budapest Athletic Stadium.

Less active multi-unit residential developers

Multi-unit residential buildings (MURBs) started to be built on less than HUF 60 billion in Q2 2022, the lowest value since 2016 (excluding H2 2020). Construction costs have greatly increased since then, that is, at constant prices, this means a much smaller construction volume.

Compared to Q1, the decline in Activity Start was around 40%, but compared to Q2 2021, there was a much smaller fallback (around 18%). Overall, multi-unit residential construction activity in the first half of this year has been rather modest with about HUF 150 billion worth of started projects, lower than all H1 figures registered since 2016. Project launches continue to be hindered by market uncertainties, the difficult procurement of building materials and their price increases that are hard to predict. At the same time, demand also seems to be dropping due to economic hardships, and financing is provided under worse and worse conditions.

On a positive note, the preferential 5% VAT applicable to new home purchases has been extended until end-2024, so developers don’t have to rush to obtain building permits until the end of this year. Another change is that the introduction of stricter energy regulations originally effective from 1 July 2022 (occupancy permits are not to be issued for dwellings with an energy rating lower than BB) has also been postponed by two years. However, a new administrative burden has been introduced: in case of buildings larger than 5,000sqm, and in case of new MURBs with a total useful floor area of more than 1,500sqm on one building plot and consisting of at least 6 dwellings, the National Architectural Planning Council led by the chief architect will have a veto right.

In Q2 2022, the total value of completed MURBs slightly grew against Q1, meaning that Activity Completion in the first half of this year was over HUF 100 billion in the segment. A large number of additional projects is set to be completed this year, but completion may be delayed in case of several projects owing to current market conditions.

The regional distribution of multi-unit residential construction works is still uneven. In H1 2022 more than 60% of the Activity Start was registered in Central Hungary, more or less the same as the level in 2014-2021. Eastern Hungary's share in H1 2022 was higher than previously, while Western Hungary had a lower share in the first 6 months of this year.