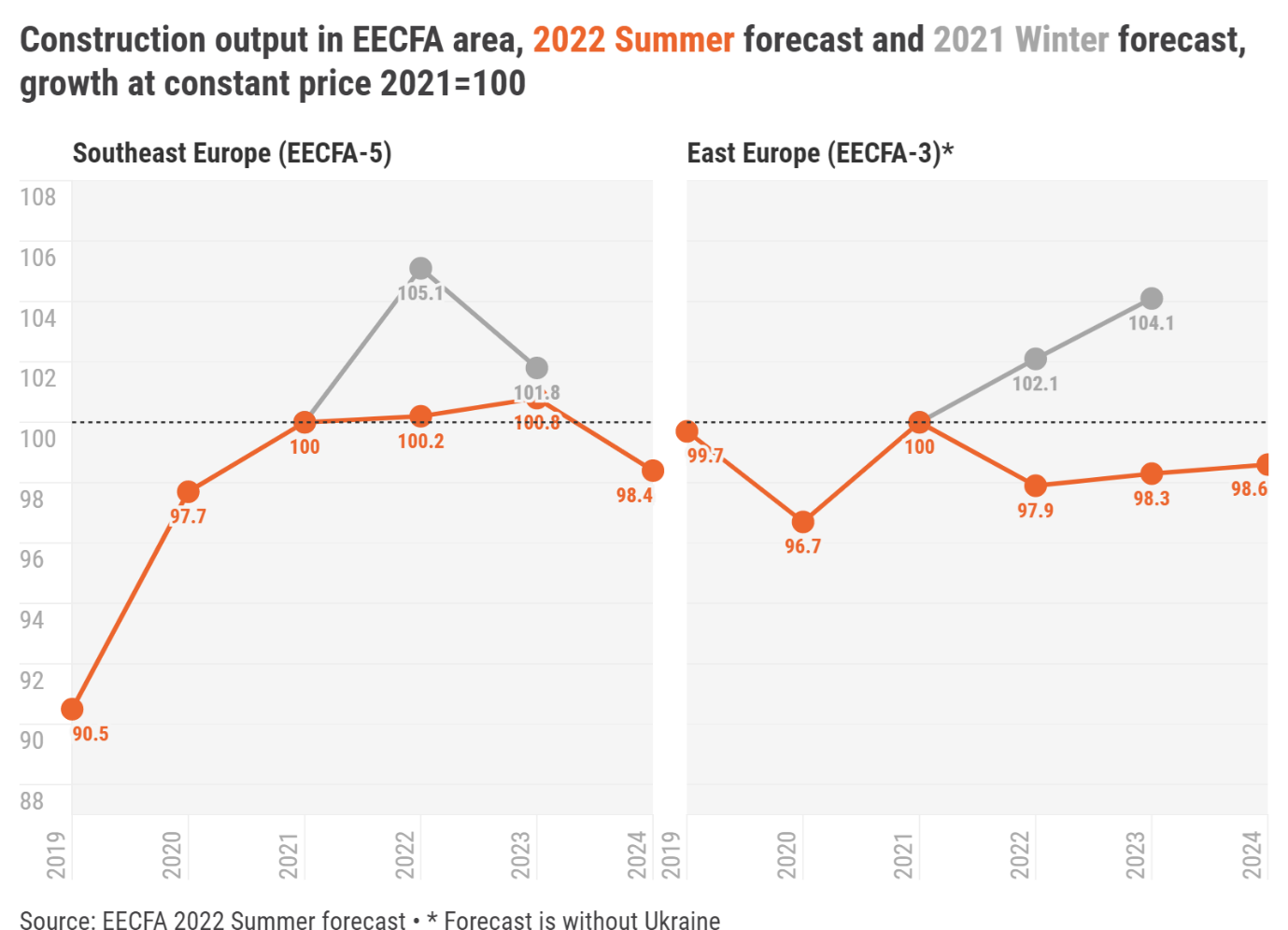

Previous optimism over the prospect of the construction market in the Southeast European region is gone, the Eastern European Construction Forecasting Association (EECFA) reports. The current forecast is foreshadowing almost no growth until 2023 and contraction in 2024. The main reason behind is the worsening climate for construction due to the consequences of the Russian invasion of Ukraine.

In the Eastern European region, the EECFA has turned pessimistic. The market of Russia and Turkey together is projected to stay below its 2021 level until 2024. The EECFA hasn’t been able to provide its standard forecast for Ukraine in this summer round, but a status report has been compiled. The association will resume providing forecasts as soon as construction-related data collection of Ukrstat returns to normal.

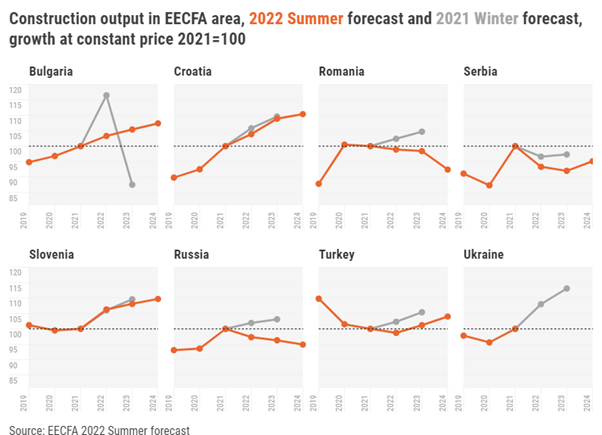

The forecast for Romania, the largest Southeast European construction market, has been revised downward. Instead of expansion, shrinkage is the current scenario. Serbia, which was the fastest-growing market in the past 7 years, has an even more pessimistic outlook than in the previous forecast round. In Bulgaria, a whole different trajectory of spending EU funds is the reason behind the revision.

Bulgaria: Owing to several external and domestic factors, the outlook for Bulgaria’s economy to grow faster in 2022 has been reduced. And this year the construction market has entered a period of increasing unpredictability and heterogeneous performance. Residential construction has benefited from favourable financing conditions, and residential property has been used as a hedge against inflation. However, this will not last forever. EECFA is not optimistic about non-residential construction, while civil engineering could expand over the forecast horizon. Total construction output is prognosticated to be in the black with low, but positive growth rates in 2022-2024.

Croatia: The picture for Croatia’s construction sector is mixed, both from sector to sector and within sectors. Sector-to-sector, the output growth rates of Croatian construction sectors are decoupling, as some come close to completing the post-transition catch-up growth phase, while others are not nearly so far along. Within sectors, the strength of crucial output drivers, e.g., tourism season results, construction cost inflation, interest rate evolution, is uncertain and very dependent on events and policymakers’ reactions to them. Overall, the picture looks bright now, especially for residential construction, but the fight against inflation or a serious new COVID-19 outbreak could darken it rapidly and considerably.

Romania: As the short-term effects of the pandemic dissipate, the economy faces new challenges such as inflation and global trade disruptions. GDP is set to grow by 2.9% in 2022, in real terms, down from the previous prediction, but by 2023 (+4.4%) and 2024 (+4.8%) growth could accelerate (source: the National Forecasting Commission). Construction showed signs of recovery, so total construction output is to nominally grow, but slightly decrease in real terms this year. Material and energy prices have battered infrastructure projects hardest as seeking extra financing can be lengthy and difficult. Threats to construction growth in this forecast horizon are evidently increased costs of materials and energy, counter-inflationary policies, and the instability caused by the neighbouring war to regional and global trade networks. Countering these are the positive outlook for wages, employment, investment, and the overall economy. The availability of EU programs for co-financing, including the Recovery and Resilience Facility, could also help certain construction segments.

Serbia: In these challenging times, it will be a real endeavour to keep the pace and level of construction activity, even for a heated and growing Serbian economy. Unfortunately, economic and political developments in Europe are threatening to forcefully subdue the growing cycle in construction and the economy as a whole. So far, the economy is showing relative resilience and construction activity has only slightly decreased compared to its expected performance in 2022, while permits are still keeping a good tempo. Nevertheless, the risks are still there, and a prolonged instability could produce a much deeper downturn and longer recovery. The strong performance of civil engineering and residential will assist this year's output levels, but prospects for the rest of this forecast period are still quite conditioned by external factors. The ongoing economic crisis in the EU could easily escalate and produce further adjustments for 2023 and 2024 figures.

Slovenia: Construction output increased fast in 2021 as the pandemic subsided. With rapid economic growth following in 2022, total construction output will likely exceed €4 billion for the first time since 2008. Real growth will be slower, though, as the construction cost index has also increased at the fastest pace in a decade, up by more than 10% in 2021 and 2022. Future growth is projected to be slower, especially if interest rates grow faster than expected due to high inflation rates. Still, several large civil engineering, as well as residential construction projects, are set to continue and prevent construction output from decreasing.

Ukraine: Since February 2022, Ukraine has been at war with Russia. As of June 2022, the Russians destroyed up to 30% of Ukraine's infrastructure and damaged 2% of overpasses and more than 23,000 km of roads in Ukraine. About 20% of Ukraine's territory is being occupied. Russia blocked the seaports through which imported goods were delivered to Ukraine. Building material factories and warehouses mostly remained in the occupied territory and most developers have frozen their projects for an indefinite period. Despite this, some positive signs are beginning to appear in the construction market, mainly in residential where the market is gradually reviving, and adapting to the military situation (especially in the relatively safe western region). Little by little, critical infrastructure is being restored (destroyed bridges, roads, electricity and gas supply, communication lines). Under these conditions of major uncertainty, and before the end of the war, predicting future developments in the construction market of Ukraine is impossible. Therefore, Uvecon, EECFA’s Ukrainian member institute in Kyiv, prepared a brief Status Report this time instead of the usual Forecast Report.