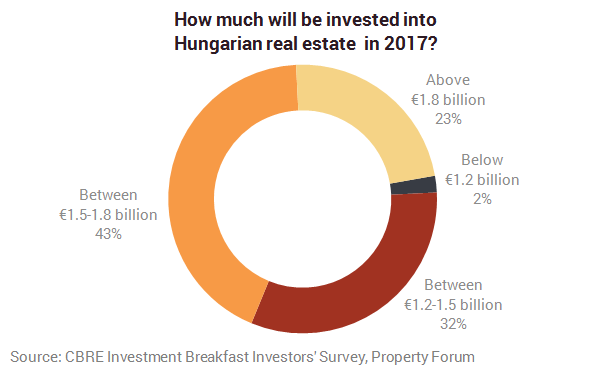

In 2017, following its international assessment, CBRE has created a survey among real estate investors in Hungary asking them about their market expectations. At the CBRE Investment Breakfast investors turned out to be optimistic about the future. 43% of the respondents stated that the investment market might grow even by one-fifth from last year’s €1.5 billion and 23% stated that this year they might reach their highest turnover ever.

The CBRE international survey reveals that after 2016, 2017 is also promising to be a strong year in the European real estate market; according to it, 85% of investors would spend at least the same amount as last year to purchase real estate, with the total amount reaching $475 billion globally.

43% of the respondents at the event stated that the investment market might grow even by one-fifth from last year’s €1.5 billion, and 23% stated that this year they might reach their highest turnover ever.

In contrast to the pan-European investment market where only one-third of investors named offices the primary target of capital, office buildings have an outstanding (69%) appeal among investors active in Hungary, followed by hotels (14%) retail (8%) and industrial real estate (8%).

Over the last few years the general compression of yields has urged real estate investors to find new alternative investment targets, such as student housing, theme parks, or even private educational or medical institutions. These types of transactions have not been closed in Hungary yet, but according to the industry players present at the CBRE Investment Breakfast, student housing (49%), housing loans (27%), and medical and educational buildings (20%) in Budapest can become attractive investment possibilities in the future.

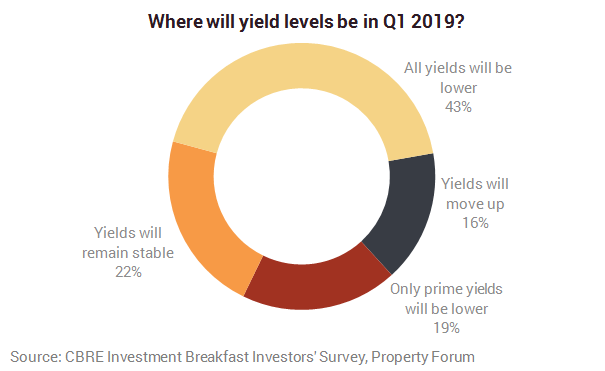

However, participants of the Investment Breakfast do not fear the contraction of the developments’ marketing possibilities yet, but for 56% the rising construction costs are causing a great concern. 35% of respondents trust that rents will rise and 38% expect further yield reduction, but according to 24% the current construction cost rally cannot be avoided without a profit decline.