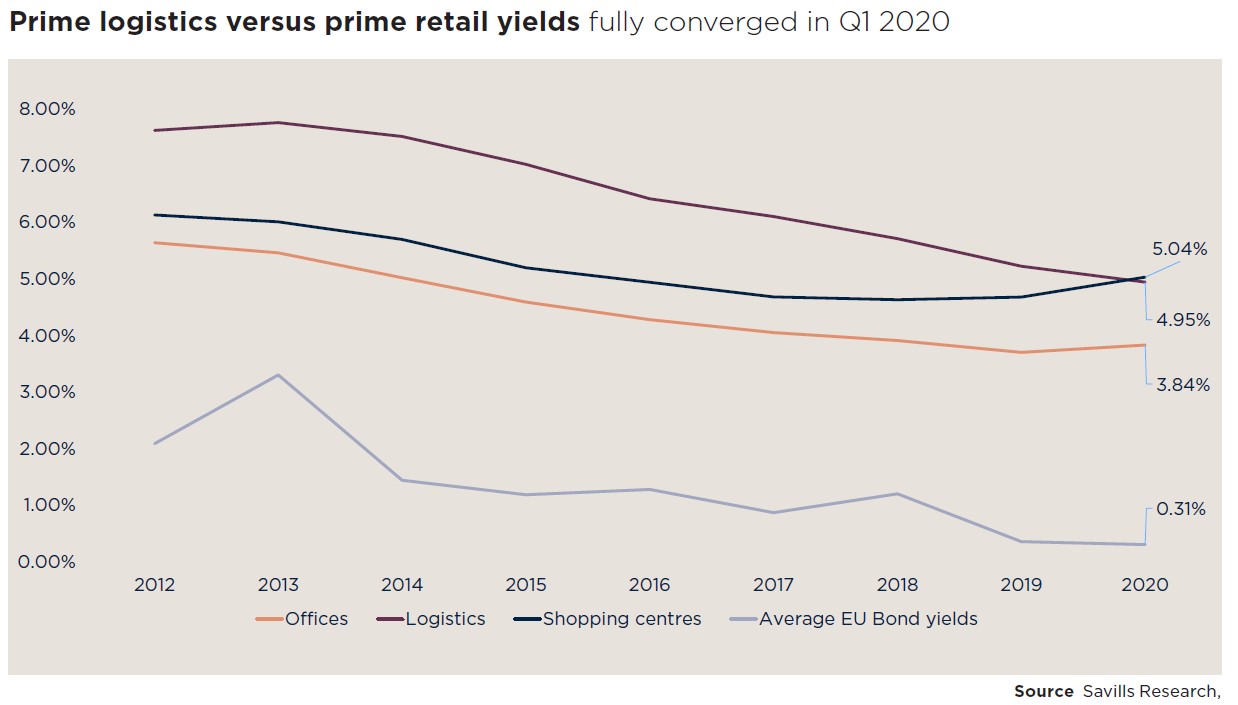

According to Savills, the average spread between prime industrial and prime shopping centre yields across mainland Europe has converged for the first time in its historic series as demand for logistics and soars as a result of increased levels in e-commerce.

Data from the international real estate advisory shows that the historic average spread between prime shopping centre and prime industrial yields was at 143bps until 2018, when it dropped to 108 bps, to 54bps in 2019. Then in Q1 2020, for the first time, prime industrial yields were 9bps lower than prime shopping centre yields, at 4.95% vs 5.04%.

This rapid convergence has also been the result of a gradual softening of shopping centre yields over the past two years, by 40bps.

Marcus de Minckwitz, Director in the Regional Investment Advisory Team, Savills EMEA, commented: “This convergence of prime industrial (mainly logistics) and retail (shopping centre) yields reflects the shift of investor interest into logistics properties and away from physical retail, along with the rise of e-commerce and the growing demand for warehousing space by 3PL providers and retailers. This trend is one that has been exacerbated in recent months with the arrival of COVID-19 across Europe which has meant more consumers than ever have been shopping online; not only out of choice but also out of necessity. Although the end of Q1 has been quieter year-on-year from an investment perspective and, we predict, as has Q2, we expect a strong recovery of the industrial sector driven by logistics transactions. As a result, and with retail being disproportionately hit by the pandemic, the spread between yields for logistics and shopping centres could increase further throughout 2020.”

John Palmer, Head of Industrial Investment at Savills in Poland, ads: “Current sentiment is that industrial yields will compress further and capitals values increase in the industrial and logistics market to the determent of other sectors. This trend was happening before the current pandemic and COVID-19 has acted only as a catalyst to accelerate the movement to industrial. Funds who are into industrial want heavier weighting in the sector and those who are not invested want to get in. The reasoning for this trend is largely occupier driven and investors follow the occupiers. The warehousing market is viewed as sustainable and someway a safe haven from the demand perspective as funds move out of hospitality and from bricks and mortar retail. European nearshoring and less dependence on Asia supply chains will also undoubtedly be a trend going forward into 2021. The percentage of e-commerce sales during the lockdown has double in Poland causing demand for new warehousing space and it is unlikely that this trend will reverse. The main limitation for investors within the industrial sector in Poland is the shortage of investment stock that has led to more forward funding deals. Also, speculative space development has shut off with bank debt hard to obtain that should bring down vacancy rates making the sector look even more attractive.”

Rising allocations in logistics have been supported by strong performance metrics, with the industrial sector returns outperforming all property returns over the past three years across most markets (MSCI). This positive performance will be supported by the growth of e-commerce, which is generating demand for logistics warehouses as well as by the rising weight of capital in the sector.

Eri Mitsostergiou, Research Analyst, European Research Division, Savills, added: “Given the scale of investor demand and low vacancy rates, the prospects for logistics are the most positive, with 79% of our markets expecting an increase in transaction volumes in the second half of 2020. This is a trend expected to be sustained into 2021 and 2022. Logistics capital values are anticipated to increase accordingly, with 47% of markets predicting increases from H2 2020. The pandemic could force many companies to reassess their regional supply chains and nearshoring, potentially creating new manufacturing hubs, boosting further the overall industrial investment volumes.”