H2 2021 saw the highest number of newly commenced apartment constructions in Prague since 2008. The total number of apartments under construction rose to 12,630 units at the end of H2 2021. At the same time, the number of new apartments delivered was the weakest annual result since 2011 as only 3,700 apartments were completed. Still, the interest in buying flats was record-breaking, the best since 2016 and 22% above the 5-year average, says JLL in its Prague residential market report.

Supply

In H2 2021, a total of 4,460 apartments in 46 projects commenced construction in Prague. It shows a strong improvement both in H1 2021 (up 68%) and H2 2020 (up 72%) and overall, it is one of the strongest half years in terms of newly launched construction units on record. For the full year 2021, new commencements in Prague reached over 7,100 apartments which are by 23% better result than in 2020. Moreover, it is the best result recorded on the market since 2008 when approximately 7,300 apartments commenced construction in Prague.

After the strong level of completions in H2 2020, both H1 and H2 2021 remained subdued in terms of newly completed apartments. Whilst in H1 approximately 1,900 new units were delivered, in the second half of 2021, this level was exceeded only by 6% and reached 2,020 new apartments. These results are 38% weaker than the 5-year H2 average. For the full year 2021, the number of completed apartments reached 3,935 units. It is the weakest annual result since 2011 when approximately 3,700 apartments were completed. As a result of strong commencement levels, the total number of apartments in the under-construction phase rose to 12,630 units at the end of H2 2021 which indicates there is an increase in construction activity by 36% against H2 2020 levels. In biannual comparison, the number of apartments in the under-construction phase increased by 2,300 units. Overall, the construction activity remains high and stands above the 5-year average by 33%.

Out of all the apartments which were under construction at the end of the year, approximately one half are due for completion in 2022. The highest construction activity is currently in Prague 5, followed by Prague 9 and Prague 4.

After the strong level of completions in H2 2020, both H1 and H2 2021 remained subdued in terms of newly completed apartments. Whilst in H1 approximately 1,900 new units were delivered, in the second half of 2021, this level was exceeded only by 6% and reached 2,020 new apartments. These results are 38% weaker than the 5-year H2 average. For the full year 2021, the number of completed apartments reached 3,935 units. It is the weakest annual result since 2011 when approximately 3,700 apartments were completed.

Demand

During H2 2021, a total of 2,880 units were sold in new apartment buildings and fully refurbished projects. Compared to exceptionally strong sales of H1 2021, the total number of sold apartments during the period decreased by 33%. Y-o-y, the sales declined by 20%. The largest volume of sold apartments during H2 2021 was recorded in Prague 5 with approximately 750 apartments sold. Prague 9 and Prague 4 ranked second and third. The three districts accounted for 65% of the total sales. In 2021, the number of sold apartments reached 7,170 units which are by 19% stronger result compared to the previous 12 months and 22% above the 5-year average. It is also the best sales result since 2016 when 7,700 apartments were transacted.

The structure of sales by type of units remained similar during several last years with 2kk apartments being the most demanded by buyers. Nevertheless, as opposed to the same period a year ago, 2kk apartments’ share has decreased from 46% in H2 2020 to the current level of 41%.

Available apartments

At the end of H2 2021, the number of new apartments on offer in Prague further decreased, albeit slightly (-2.5%) to 2,600 units. Approximately one-third of the offer comes from units from the pre-sale stage. Overall, the lack of available apartments for sale on the market continues as it represents the lowest level on record (since 2012) in Prague. Compared to 10 half-year averages, the current level is nearly 37% below. The highest number of units on offer is in Prague 4 with more than 690 apartments available for sale.

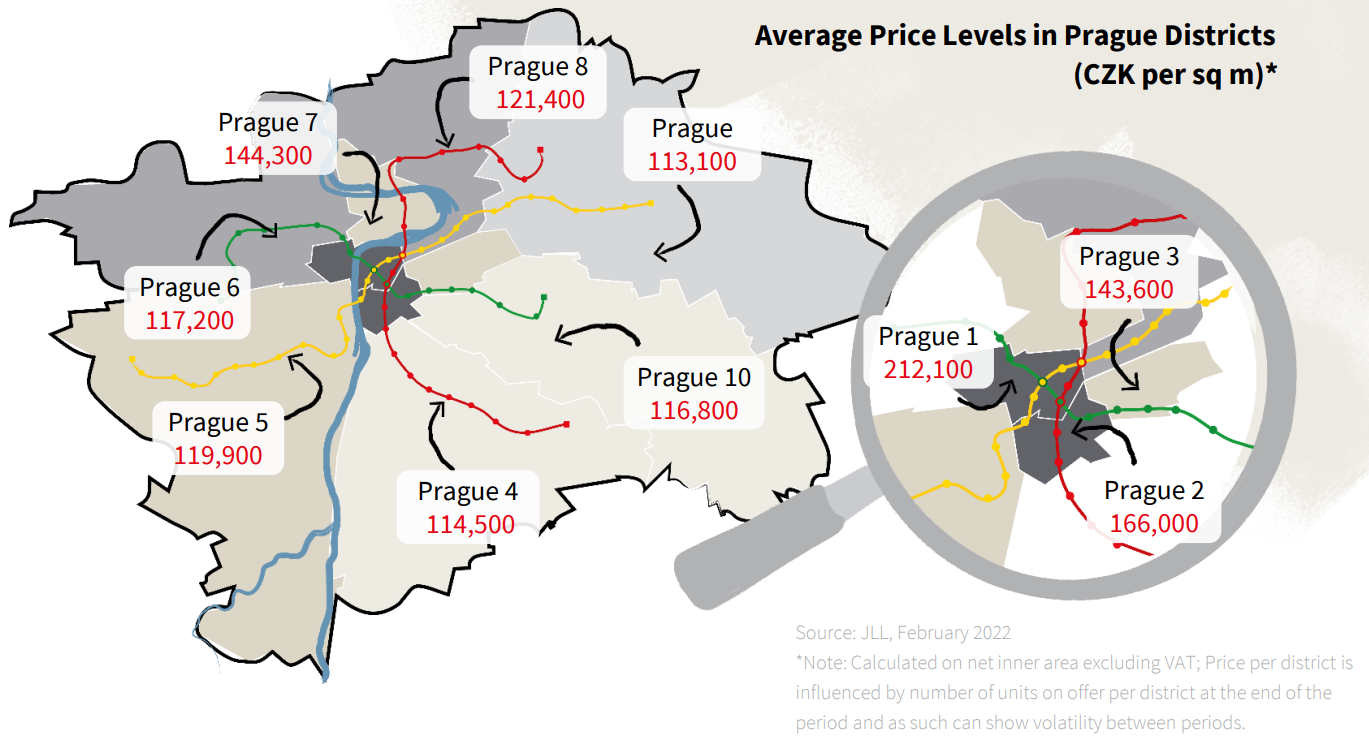

Price levels

Based on JLL statistics following the average net asking prices for purely new development and fully refurbished projects, the average sale price for available apartments during H2 2021 reached 122,200 CZK per sqm (of inner area excluding VAT). Compared to H1 2021, the price increased by 16%.

During H2 2021, the largest share of available apartments on the market offered for sale was for the second time within the price range between 100,000 CZK to 120,000 CZK per sqm. The share of apartments with asking prices between 80,000 -100,000 CZK per sqm, decreased from 30% in H1 2021 to the current level of 9% in H2 2021.