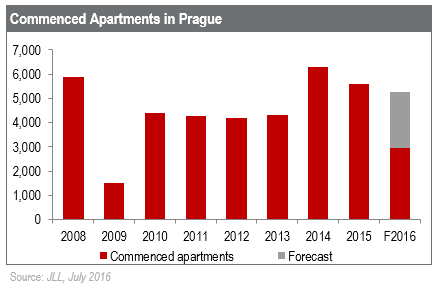

In H1 2016, a total of 3,350 apartments in 47 new residential schemes were completed in Prague. For the second half of the year, another 3,200 units are estimated to be completed in the Czech capital. In total, JLL expects 6,500 units to be completed in Prague, which is the highest figure since the real estate crisis in 2009.

This level is naturally arising from the high level of commencements going back to 2014. In H1 2016, a total of 2,970 apartments in 43 projects were commenced (started construction) in Prague. For the entire year 2016, based on preliminary figures, a total of 5,250 new flats are estimated to start construction in Prague, which, compared to 2015, is a slight decrease of 6% and a decrease of 16 % compared to 2014. For 2017, ca. 5,000 apartments are estimated to be commenced.

Despite high construction activity, the number of available units on the market has been gradually decreasing since H1 2015. At the end of H1 2016, there were 4,430 available units for sale on the Prague market in completed projects, projects under construction and projects in pre-sales phase. The number of available units on the market decreased by approximately 23% compared to the same period of last year.

Demand for New Flats in Prague

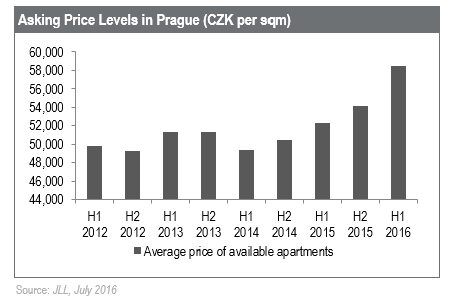

During the first half of 2016, a total of 3,960 units were sold in new apartment buildings and villa houses which is approximately 11% more than what was sold during H2 2015. Based on JLL´s statistics, which follow average prices for purely new development projects, the average sales price for apartments which are currently available (for sale) on the market reached 58,500 CZK/sqm (of inner area excluding VAT). It shows an increase of 8% on H2 2015 levels. The average price for available apartments which are now being offered on the market is approximately 12% higher than it was a year ago.

The majority of sold apartments were in the price category between 45,000 CZK and 55,000 CZK/sqm, accounting for 36% of the total. The share of sold apartments with an average price, excluding VAT, of below 45,000 CZK/sqn decreased to 28%.