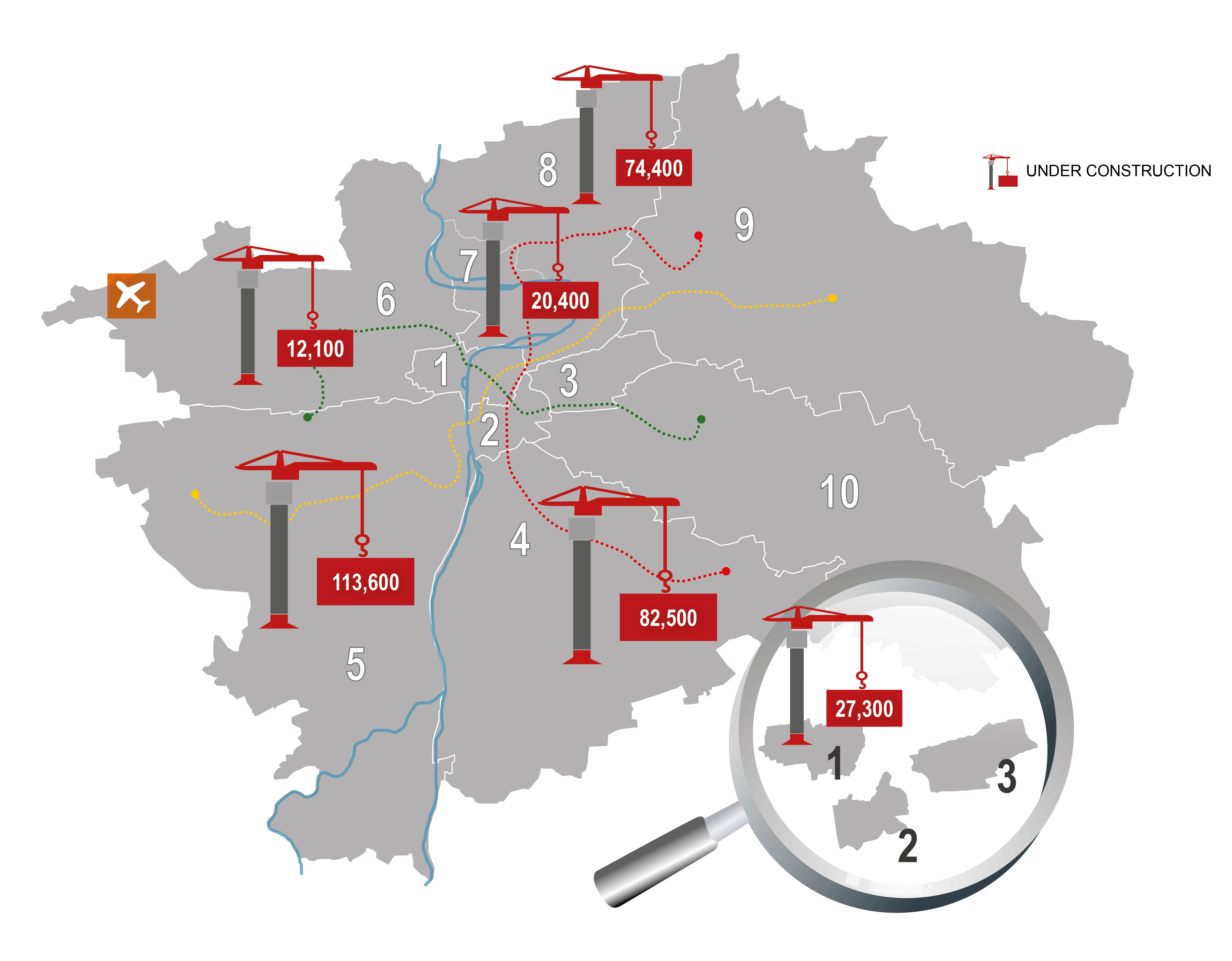

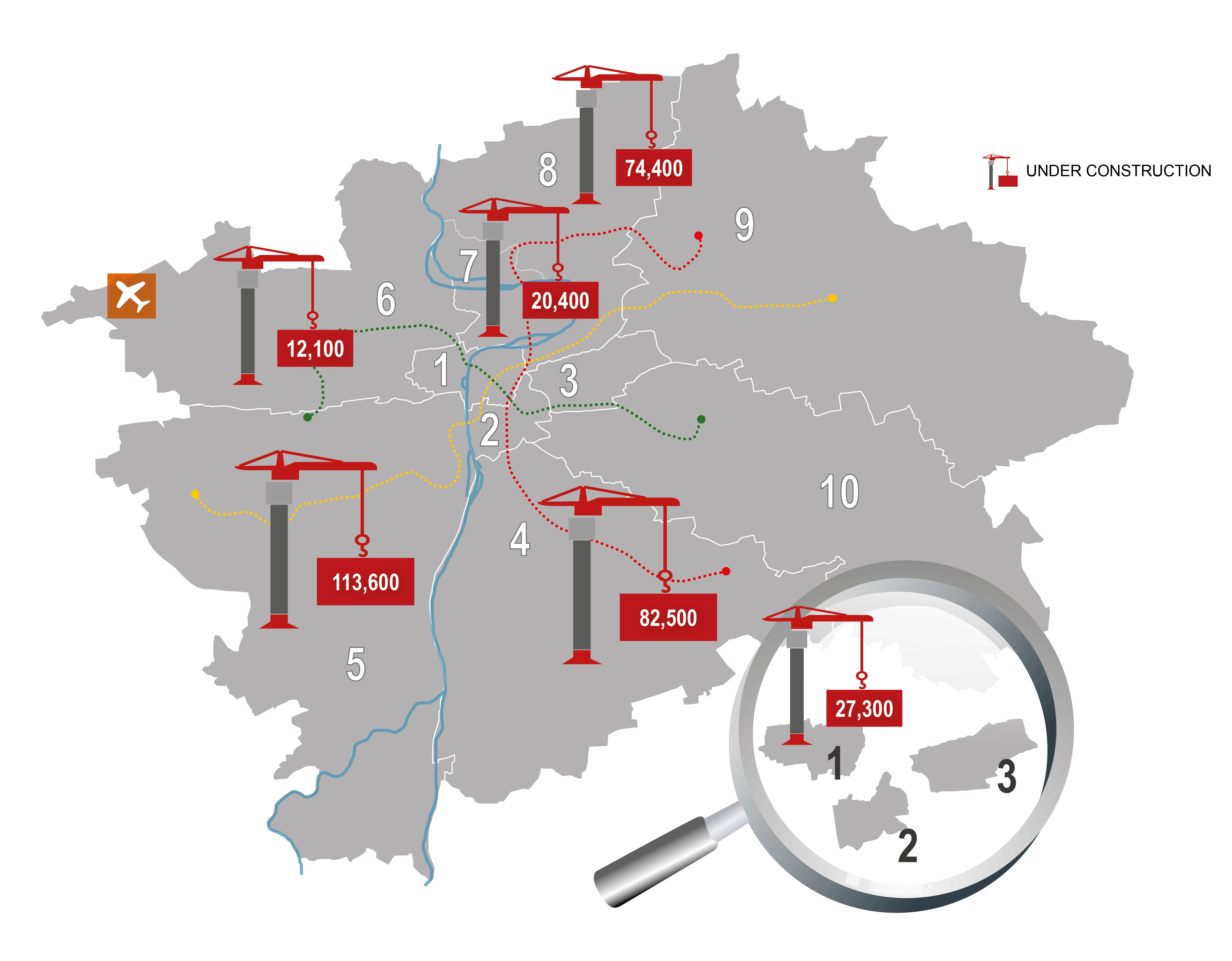

Prague 4

With its 26.8% share of the total stock, Prague 4 forms the largest office district in Prague. Prague 4 is characterised by several large scale developments such as unique projects as The Park, BB Centrum or the intensively developed area around the Pankrác metro station. Currently, there are 82 500 sqm within 5 office schemes being developed in Prague 4 which are expected to be completed within the next 2 years. The largest are Main Point Pankrác (24 000 sqm), the complete refurbishment of two buildings of BB Centrum (A – 21 400 sqm and C – 11 600 sqm) and Trimaran / City Deco (18 300 sqm). The Pankrác Prime (7 000 sqm) close to the Pražského povstání metro station provides an interesting alternative for tenants who appreciate smaller scale projects.

Prague 5

The largest amount of new office premises (113 600 sqm) is currently being developed in Prague 5 which has got 16.2% market share of the total stock and therefore is the second largest office district in the Czech capital. A few schemes are intensively developed around Radlická metro station such as it the second headquarters of ČSOB bank (30 000 sqm) or new buildings of the Waltrovka office complex (buildings such as Mechanica 31 100 sqm or Dynamica 13 400 sqm). The Mechanica´s pre-lease of 15 000 sqm to Johnson & Johnson is a big success of Waltrovka´s developer Penta. An interesting microlocation in Prague 5 is the Smíchovské nádraží railway station where Skanska Commercial Development is preparing Five office building which has been pre-leased (11 300 sqm) to MSD, a pharmaceutical company.

Prague 1

Prague 1, with its 15.8% market share of the total stock the third largest office district, is going to provide the tenants with 27 300 sqm of new office space. With respect to the historical centre of Prague, the new office schemes are of smaller scale. There are 5 projects under construction – a newly built Palác Národní and 4 complete reconstructions (Šporkovský palác and buildings Albatros, Mango and Omnipol). Šporkovský palác, developed by Sebre, can also boast preleases signed for 80% of the total premises, after its completion, it is to become a seat of a prestigious law firm.

“The current situation on the Prague office market reminds in many aspects of the peak of the office market in the last decade (in 2007). The economic situation allows the companies to expand, although due to their increased cautiousness, the decision making process generally takes more time. A number of tenants are looking for new premises, which shows also in the office market statistics as the new lease proportion is significantly higher compared to the renegotiations that significantly declined in 2016. The tenants are usually changing their seat after 10 – 12 years which provides them with an excellent opportunity to create more effective and more attractive office space in line with the modern trends that meet the companies´ staff needs,” says Petr Kareš, Head of Tenant Representation of JLL Czech Republic.

„Compared to the last decade, the rents of modern office space have been growing moderately and the incentives are decreasing. The Prague office market is restoring the balance, i.e. coming back to rents without crisis discounts. One of the reasons, apart from the booming economy, is also a change in the tenants´ behaviour as they came back to value the quality of the space and the location as the key aspects in the decision making process regarding new company seats. The process of office development is also indirectly affected by the war for talents and the companies are required to create an attractive and friendly working environment which is subsequently perceived as one of the benefits offered by the employer. The architecture and the function has increased their value in the eyes of the tenants. All these aspects enable the developers to create more sophisticated and visually attractive buildings where cost savings are not the key, as it was typical of the crisis era,” concludes Eduard Forejt, Business Development Director of JLL Czech Republic.