Foreign investors from North America, Asia and South Africa dominated the market, followed by German and Austrian buyers. Domestic and regional capital also increased their market share.

Both global and local investors proved to appreciate Poland’s market fundamentals and were active across all sectors and asset classes, including the emerging residential rented properties segment (also known as ‘PRS’, Private Rented Sector). The market diverged into two trends being limited product and high demand in the core segment and subdued appetite for secondary and tertiary assets.

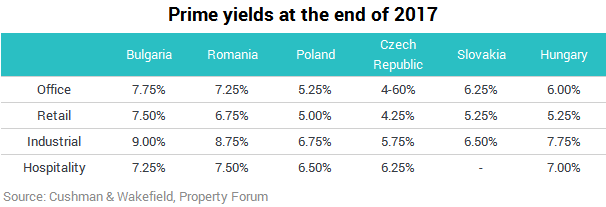

In 2017, commercial real estate investment activity in CEE reached €5 billion in Poland, €3.3 billion in the Czech Republic, €1.8 billion in Hungary, €1 billion in Romania, €876 million in Bulgaria and €470 million in Slovakia. The lowest yields were in the Czech Republic, standing at 4.25% for retail assets, 4.6% for office and 5.75% for industrial, coupled with strong investment volumes.

Poland proved resilient despite political risk perceptions investment volumes up by around 9%: from approximately €4.6 billion to more than €5 billion. The retail sector outperformed with nearly €1.9 billion worth of investments, followed by approximately €1.4 billion in the office sector. The warehouse market accounted for almost €900 million, while approximately €850m was invested in both the hospitality and mixed-use sectors each. Industrial and hospitality yields stood at 6.75% and 6.5%, respectively, with retail and office yields at 5% and 5.25%, respectively.

.png)

In 2017, hotels became a relevant investment product with investment volumes amounting to €862 million and this sector is set to attract increasing investor interest.

"The past 12 months saw the emergence of the ‘power play’ deals in the CEE region, including strategic game-changing platform and portfolio transactions, which resulted in a record-breaking volume noted in 2017. Growing demand across the region will probably result in high investment volume in Q1 2018 due to the slippage of a number of deals from 2017,” said James Chapman, Partner, Capital Markets Group at Cushman & Wakefield.

2018 outlook

2018 is expected to be another good year for the commercial real estate investment market with a robust investment demand driven by a strong economic outlook, inflow of new capital from outside Europe, re-activation of some recently less active buyers and increased focus on alternative asset classes (e.g. PRS, student housing) and hotels.

2018 will see a return of major European names interested in office assets due to low vacancy levels and limited new supply in the region. C&W expects to see new capital inflow from the US, Canada, South Africa and Europe.

The CEE market shall witness further consolidation with a number of platform and portfolio deals. Prime yields will remain under pressure due to a solid investment demand and limited availability of assets especially in the core segment. C&W expects further net effective rental growth as well as yield compression in the office and logistics segments.

In the light of excellent consumer spending growth, we’ll observe value opportunity creating yield differentiation across retail sector.

“In Q1 2018, investment volumes are likely to surpass €3 billion, benefiting from deals closed in late 2017,” said James Chapman, Partner, Capital Markets Group at Cushman & Wakefield.

“The growth of local capital has proven itself across CEE, but perhaps most significantly in CR where it was responsible for over 37% of the volume of investment in 2017, with CPI, REICO and Mint all figuring strongly, as well as IAD in Slovakia. Home-grown capital is steadily on the rise now in other CEE markets, with OTP Fund and Diófa active in Hungary. Local capital as a proportional to market size may still be smaller in Poland but even here companies like PZN and PHU have re-entered the market and are bidding on core offices. So the growth, depth and maturity of local capital continues – and it is now moving cross-border,” said

Jeff Alson, International Partner, Capital Markets Group at Cushman & Wakefield.

Largest regional transactions in 2017

- CIC’s acquisition of Logicor’s warehouse portfolio, which was the largest industrial transaction in Poland in 2017 (Cushman & Wakefield advised the buyer)

- Union Investment’s acquisition of the Magnolia Park shopping centre in Wrocław for approximately €380 million, the largest retail transaction in Poland in 2017 (Cushman & Wakefield advised the buyer)

- Disposal of IKEA’s retail park portfolio (Cushman & Wakefield advised the vendor)

- RREEF’s acquisition of a portfolio of Fashion House outlet centres (Cushman & Wakefield advised the buyer)

- Reico’s acquisition of the Galeria Słoneczna shopping centre in Radom for approximately €160 million, the second largest single asset transaction on the Polish retail market in 2017 (Cushman & Wakefield advised the buyer)

- Globalworth’s acquisition of a majority stake in Griffin Premium Real Estate

- Disposal of a portfolio of 11 retail properties in the Czech Republic, Poland, Romania and Hungary by CBRE Global Investors for approximately €650 million (Cushman & Wakefield advised the vendor)

.png)