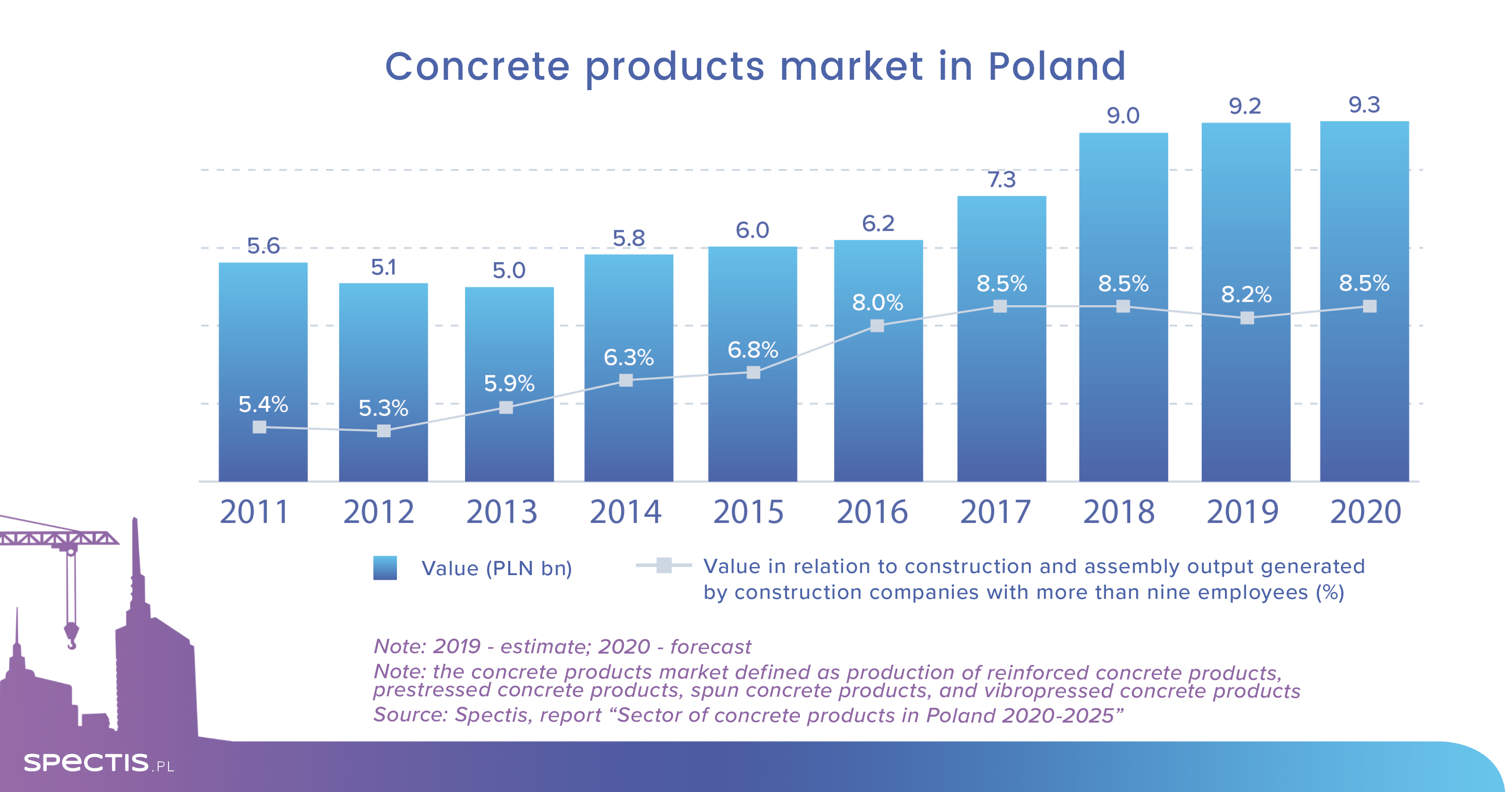

Manufacturers of concrete products in Poland will be able to generate a little over PLN 9bn in revenue in 2019 in spite of slower construction activity, according to the findings presented in the latest report by research company Spectis.

The sector of concrete products – which can be defined as the production of reinforced concrete products, prestressed concrete products, spun concrete products, and vibropressed concrete products – has steadily increased its contribution to the construction industry for over a decade. Accordingly, following predictably slower growth in 2020 and 2021, the concrete products market should return to faster growth in 2022 when it can reach PLN 10 billion (€2.3 billion), double the figure recorded a decade ago.

However, the substantial market growth, in terms of value, is not only down to a swelling volume of orders but also rising costs. Manufacturers of concrete products witnessed a sharp surge in the prices of steel in 2017 and 2018 (steel represents 60-70% of material costs in the heavy prefabrication segment). A similar trend was observed for the prices of cement and aggregate material. Likewise, the prices of labour and third-party services also increased. Rising costs were reflected in markedly higher product prices.

In terms of volume, the broadly-defined segment of paving blocks (including concrete flags, curbstones and edgings) is the main segment of the concrete products market. Conversely, in value terms, the heavy prefabrication segment is the principal market segment. Since steel prices have been on the rise from 2017, the segment has outpaced paving blocks in terms of value. The segment of autoclaved aerated concrete products is the third-largest segment in terms of value. Combined, these three groups account for over 75% of the market’s value. Its remaining part comprises concrete blocks and hollow blocks, pipes, manholes, tanks, culverts, and other parts of sewage systems, roofing products and facade materials, fencing, architectural ornaments, and decorative concrete elements.

The concrete products market is highly fragmented as even the leading manufacturers occupy single-digit market shares. The top 15 market players represent 50% of the total output produced by the 150 companies covered in the report, according to calculations performed by Spectis. From the viewpoint of individual segments, the autoclaved aerated concrete sector is the most concentrated, with fewer than 10 manufacturer groups operating in it. The most fragmented segments are those where entry barriers are low, manufacturing technologies are relatively affordable, and transport of products over long distances is economically unfeasible – these segments include paving blocks or concrete hollow blocks (e.g. foundation, wall, floor or chimney blocks).