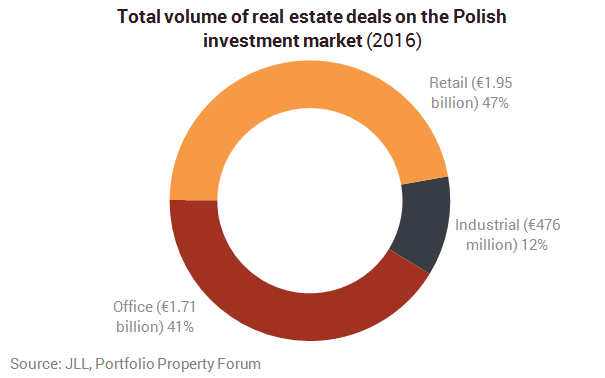

According to JLL’s preliminary forecasts, the total volume of real estate deals on the Polish investment market in 2016 may amount to almost €4.4 billion. The real standout performer was the retail market which came in with nearly €2 billion, followed by the office segment with €1.7 billion and the industrial/logistics sector with nearly €0.5 billion.

“Real estate investment transactions in Poland concluded between 1st of January and 21st of December 2016 were worth €4.13 billion,” commented Tomasz Puch, Head of Office and Industrial Investment at JLL Poland. “The real standout performer was the retail market which came in with €1.95 billion, followed by the office segment with €1.71 billion and the industrial/logistics sector with €476 million. Poland’s real estate investment market in 2016 has already exceeded 2015's result with only pre-crisis 2006's record €5 billion bettering it-“