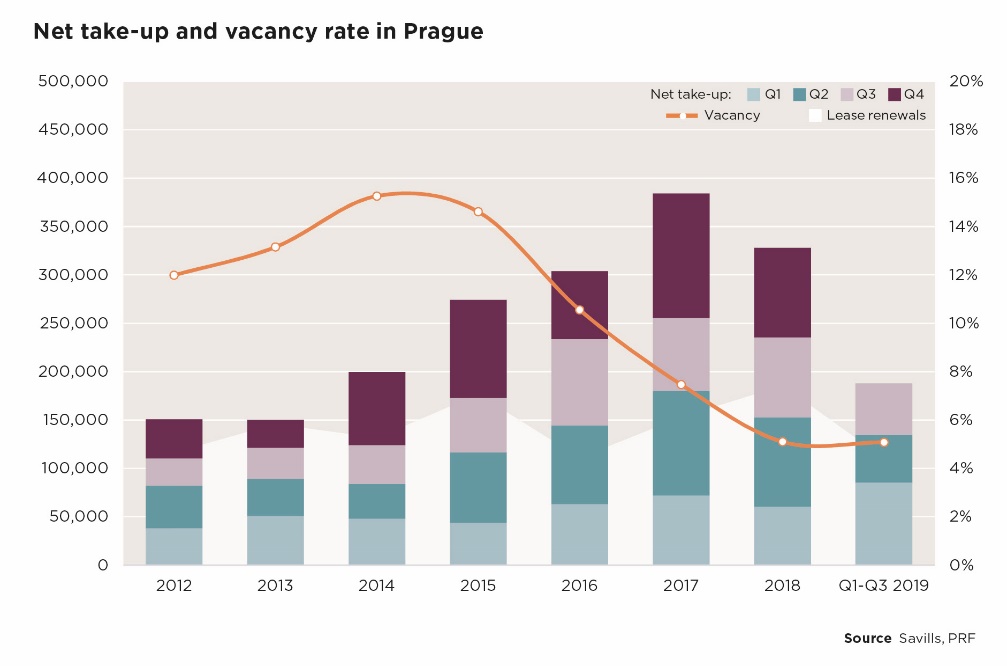

European office take-up is forecast to reach 9.2 million sqm by the end of 2019, down 4% from 2018’s end-year volume. Prague is expected to exceed that decline, with take-up predicted to fall by 22% to 400,000 sqm as demand for office space in the Czech capital continues the downward trend that began in Q2, according to the latest Savills research.

In Q1-3 2019, gross take-up of Prague office space reached 300,000 sqm, which was 16% down on the same period last year. Take-up in Q3 alone reached 85,200 sqm, which was a further fall of 17% q-o-q and 35% y-o-y. This weakening will translate into the lower end-year take-up figure of 400,000 sqm in 2019.

A shortage of good-quality available space across Europe’s CBDs continues to limit occupier choices as average vacancy rates fell from 6.1% at the end of Q2 to 5.6% at the end of Q3. Prague’s vacancy rate remained well below the European average at 5.1% (approximately 183,000 sqm of unoccupied modern office space). Assuming that all six buildings scheduled for delivery by the year-end are completed on time, up to 40,000 sqm of speculative office space will be added to the Prague market in the final quarter of 2019, bringing total annual supply in 2019 to approx. 206,000 sqm – the highest level since 2008. With demand cooling, this speculative development could push up the vacancy rate slightly.

Persistent demand across European capitals accelerated rental growth in 2019, with prime CBD office rents rising 6.2% on average over the past 12 months, up from 4.0% over the previous 12 months. However, because of the cooling demand in Prague and decent pipeline of supply – the capital has 316,800 sqm of mostly new office developments under construction, which should all be completed by the end of 2021 – prime rents increased by just 1% over the past 12 months.

“The ongoing uncertainty over long-term economic growth and also limited labour availability continue to suffocate office occupier demand in Prague. New supply expected to hit the market in 2019 and also 2020 will bring the vacancy rate up a bit, which could create a somewhat more competitive environment on the market. Rent levels are expected to remain largely unaffected, with rental growth likely to occur especially within new and future projects that have had to bear the big rise in construction costs,” says Petr Florián, Senior Office Consultant at Savills.

2019 has proved to be another boom year for flexible offices across Europe, with that segment of the market increasing its market share to 12% of total office take-up in Q1-3 compared with 10.2% of the total in 2018. By contrast, the share of flexible office take-up in Prague is falling, accounting for 4% of total activity in Q1-3, down from 6% in the same period last year.