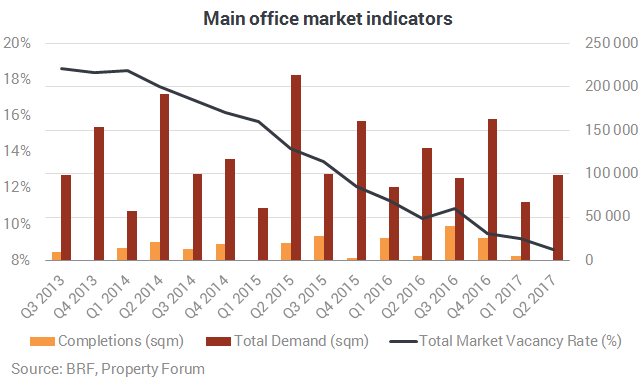

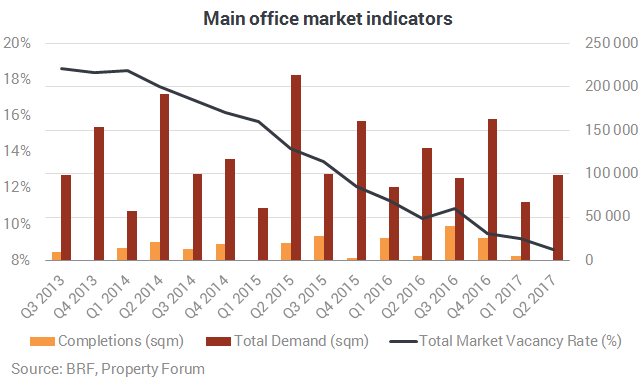

Prospects on the Budapest office market are remarkably positive for the next year or two. Last year was a record concerning leased properties, followed by more modest statistics in the first two quarters of this year. Still, the vacancy rate is at an all-time low of 8.6%. Consequently, finding the right office for a larger company can be a significant challenge. In the future this problem will be ameliorated by the current property developments.

For a long time new office developments were scarce in Hungary, with barely one or two projects a year being realised. In 2012, only 23,000 and in 2013 only 30,000 square metres of new offices were added to the market. 2014 and 2015 came with far better numbers at 50,000 and 69,000 square metres of office space, respectively. This was a significant jump compared to the preceding years, but still did not reach the 2005 level. The post-recession plans and constructions seem to have borne fruit by 2016, as several projects were completed and more than 96,000 square metres of office space were opened, which, though still significantly less than before the recession, shows a definite trend in the right direction.

The existing crop of office buildings requires modernisation, as the last five years combined have yielded less than 300,000 square metres of new office space, thereby causing significant problems for companies wishing to rent in the most modern buildings.

After the recession, developers were tentative to invest. They focused primarily on built-to-suit projects, meaning that they already had the tenants lined up before construction began, and the properties were built specifically to their needs. This shows how no one was willing to take risks, and it is worth noting that this was the only way to gain financial support. However, seeing the market results emboldened developers and speculative investments finally began. In 2017, the completion of 110,000 square metres of speculative investment is expected. According to the construction activity report of the EBI, office property projects to the value of HUF 150,000 billion were started in 2016. In the first quarter of 2017 these orders constituted HUF 35.8 billion, which was made up of 53 new projects.

Property developers are significantly challenged by the tight capacity of the construction market as well as the additional costs incurred by rising wages. Compared to the 330,000 people working in the construction industry in 2007, this number was only 280,000 in 2016, meaning that the sector lost some 50,000 workers. This begs the question of who will construct the properties that are being planned in such high numbers, since competition for the workforce is shared with a similarly booming housing market as well as government contracts.

The following 2-3 years promise to be very strong ones, and private investors are certainly at a disadvantage to government players. Many construction companies would rather choose the latter because of the certainty of payment. Nevertheless, office developers are pleased to note that the housing market faces even greater challenges: construction companies consider housing construction to carry the highest risk, as many companies were bankrupted by just such projects during the recession. This gives office developers a better chance to grab a slice of the competitive construction market. However, it may not only be difficult to find a construction company in the near future, but also significantly more expensive, as material costs as well as wages are rising. As a result, newly built office buildings will only be available at higher rent prices, due to higher construction costs.

An unprecedented number of developments have been announced in Budapest, indicating optimism among market players. However, most investments are linked to one location, which shows that investors are still striving for safety. The result is that the highly popular Váci Road is the primary choice for developers, though there are construction projects under way in other places too.

Váci Road will play host to Futureal’s new building, the Advance Tower, a project the company announced last year. Also on Váci Road, the GTC White House office building is under construction, which will offer some 21,500 square metres of space. The remodelling of the hundred-year-old elevator factory building will result in 2,000 square metres of loft office, while the rest will be located in the new building. Váci Road is also the location of Horizon Development’s project, the 25,000 square metre Promenade Gardens, due to be completed in 2018. Meanwhile, Atenor continues its Váci Greens project with Building D. HB Reavis have also taken aim at the popular office location, and have begun construction on their HUF 140 billion office building near Árpád Bridge. The Agora Business complex is expected to be completed in 2023, housing some 136,000 square metres of office space in five buildings that will be supplemented by retail properties.

But let us leave Váci Road for the moment. Passers-by at Népliget have surely noticed the ongoing construction next to the Groupama Arena, where Telekom’s new 58,000 sqm headquarters are being developed by WING, and are expected to be completed by the end of 2018. Wing is also constructing the Ericsson headquarters as the first project in the Hungarian Nobel Prize Winner’s Park.

Getting out of the city somewhat and driving along the M1-M7 motorway, one can see that construction has resumed on the long abandoned Tópark project, which is expected to provide 14,000 square metres of office space by the end of 2017, with a total of 50,000 square metres to follow in subsequent years.

Futureal is busy elsewhere too, as they continue work on Corvin Promenade, where the Corvin 5 office building is expected to be completed at the end of 2018. The complex is the final project in the Corvin Promenade office project, alongside the recently completed Skypark. The first building will house 14,200, with the second boasting 12,800 square metres of office space. Skanska is constructing their Mill Park project in District 9, which will contain 36,000 square metres, and will be completed in two phases. In South-Buda, BudaPart’s first wave of construction is expected to complete Building C next year, financed by Property Market; all the while Office Gardens may also be expanded with new buildings supported by the GRT Group.

The list goes on: simply consider that Hungarian National Bank’s foundations are also planning a massive office development on Váci Road. They plan to construct 150,000 square metres of office space on the 7.5 hectare area purchased for HUF 17 billion in the next three years, as of their statement in September last year.

The full version of this article was published in the latest issue of Portfolio Property Magazine.