The demand for office space in Prague increased by 29% quarter-on-quarter for the first quarter of 2021 and by 44% year-on-year. Although the largest transactions of the quarter were lease renegotiations – including Seznam.cz (14,800 sqm) in Palác Křižík in Prague 5 or MSD Czech Republic (6,800 sqm) in Riverview in Prague 5 – the share of newly leased space increased to 58%. The increase in newly leased and pre-leased space indicates confidence and healthy growth of the Prague office market. Despite the fact that leasing activity posted record numbers, the vacancy rate rose by 60 basis points quarter-on-quarter to 8.4%. JLL recorded an increase in vacancy rates in almost all Prague districts, as announced in the last report.

Key facts:

- At the end of Q1 2022, the total modern office stock in Prague stood at 3.8 million sqm

- One office building was added to the market in this quarter, Harfa Business Center B in Prague 9

- There is approximately 182,600 sqm under construction with expected completion between 2022-2024

- Despite a very strong rebound in leasing activity in Q1 2022 the vacancy rate rose to 8.4%, this is the highest value since 2017

- Companies from IT, Manufacturing and the Professional Services sector were the top performers in Q1 with a 50% share of total take-up

- Prague office market recorded positive net absorption, the change in occupied office space increased by 1,600 sqm

- Prime headline rents remained stable in the city centre at €24.00 sqm/month

Supply

At the end of the first quarter of 2022, the total modern office stock in Prague stood at 3.8 million sqm. The share of Class A office space reached 73%, with top-quality projects (Class AAA buildings) representing over 17% of the total stock. Prague 4 remains the largest office district with a 26% share of the total stock, followed by Prague 5 with a 17% share and Prague 8 with 16%. Only one office building was added to the market in this quarter. The developer Kaprain completed the administrative building Harfa Business Center B (25,200 sqm) in Prague 9 and is aiming to obtain LEED certification.

Under construction

Currently, there is approximately 182,600 sqm under construction with expected completion between 2022- 2024. The highest portion of new supply is scheduled to be delivered in Prague 1 (25% of the total space under construction), followed by Prague 5 (24%) and Prague 8 (21%). By the end of 2022, eight office projects with a total leasable area of 53,400 sqm should be completed. The largest development to be realised in this year is the office building Dock In Five (20,500 sqm) in the office complex Dock In in Prague 8.

Major office projects under construction in Prague are:

- Port 7 (31,400 sqm) with completion in Q2 2023

- Metalica & Legatica (27,300sqm) with completion in Q3 2023

- Masaryčka (22,100 sqm) with completion in Q1 2023

- Roztyly Plaza (21,700 sqm) with completion in Q4 2023

- Dock In Five (20,500 sqm) with completion in Q3 2022

Vacancy

Despite a very strong rebound in leasing activity in Q1 2022 the vacancy rate rose by 60 basis points q-o-q to 8.4%. This is the highest value since Q2 2017. Compared to the same period last year, the vacancy rate increased by 0.9 percentage points. The largest availability at the end of March 2022 was registered in Prague 4 with 76,100 sqm, followed by Prague 5 with 46,300 sqm. On the contrary, the lowest vacancy was recorded in Prague 10 with 8,900 sqm and Prague 7 with 9,500 sqm. The amount of space for immediate sublease decreased by 24% q-o-q to approximately 59,800 sqm.

Demand and net absorption

Almost two hundred deals exceeding 135,600 sqm were signed on the Prague office market in Q1 2022. This is the highest number of transactions since 2017. Gross take-up increased by 44% y-o-y and rose also by 29% q-o-q. Net take-up, which excludes renewals, has also experienced a strong recovery in Q1 2022 and amounted to 78,900 sqm. Companies from IT, Manufacturing and the Professional Services sector were the top performers in Q1 2022. These three sectors accounted for almost 50% of the total demand, of which one third was attributable to the company Seznam.cz re-letting of Palác Křižík in Prague 5.

Among the key leasing transaction in Q1 2022 is Palác Křižík 14,800 sqm (Prague 5) with the tenant Seznam.cz, Red Court 7,100 sqm (Prague 8) with the tenant Czechoslovak Group, Riverview 6,800 sqm (Prague 5) with the tenant MSD Czech Republic, The Park 6,500 sqm (Prague 4) with the tenant Honeywell and Explora Business Center 3,500 sqm (Prague 5) with the tenant Citibank.

The office demand was mainly concentrated in Prague 8, spread around Karlín and Libeň, which accounted for 28% of total take-up in Q1 2022. Strong demand was also registered in Prague 5 (25%) and Prague 4 (18%). Prague office market recorded positive net absorption in Q1 2022, the change in occupied office space increased by 1,600 sqm. The largest increase in occupancy occurred in Prague 9 (9,200 sqm) and Prague 8 (5,400 sqm). On the contrary, the largest decrease in occupancy was recorded in Prague 3 (-14,400 sqm) and Prague 4 (-4,700 sqm).

Flexible office space

Flex spaces are witnessing increased demand not only in the Prague office market but also in other regional cities. At the end of Q1 2022, there was approximately 93,700 sqm of flexible office space in Prague, of which one third is located in Prague 1. In the first quarter, two centres were opened, mo-cha Vista House (1,200 sqm) in Prague 4, operated by Cimex. Another smaller coworking centre (115 sqm) opened at the new Prague 12 City Hall. More than 12,000 m² of flexible office space is currently being prepared in Prague and will be delivered to the market in the next two years.

Prime rents

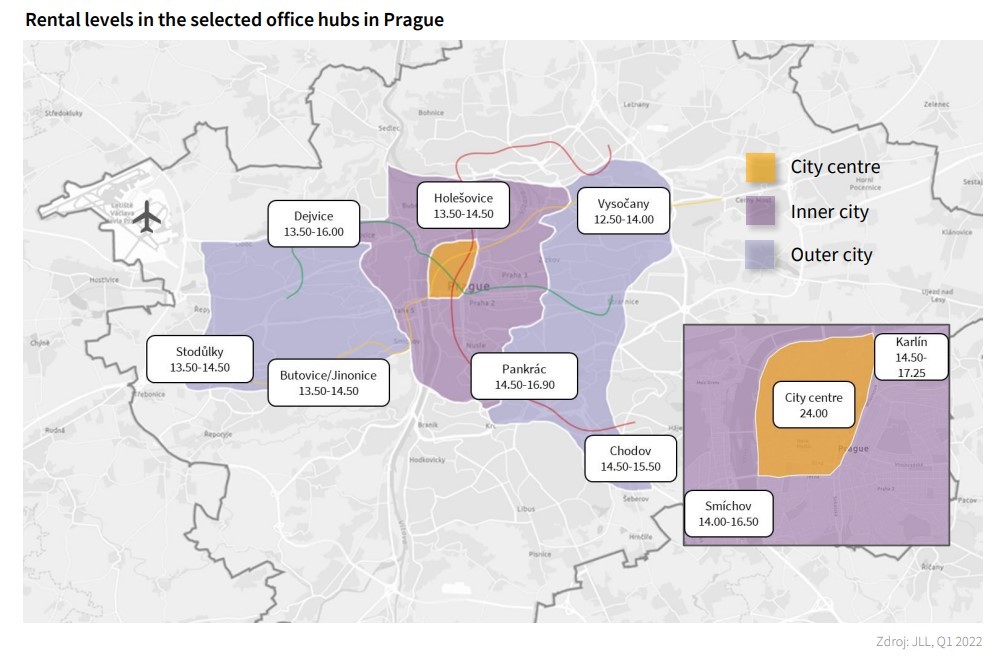

Prime rents in the city centre remained broadly stable at €24.00 sqm/month. Year-on-year, the prime rents registered an increase of 9%. In inner-city locations, prime rents currently stand between €16.00 – 18.00 sqm/month. In the outer city districts rents reached €13.50 – 15.00 sqm/month. The forecasted economic slowdown is expected to make tenants more price-sensitive. However, due to the ongoing limited supply of modern office space in very good locations, some tenants are still prepared to pay prime rents for top locations.