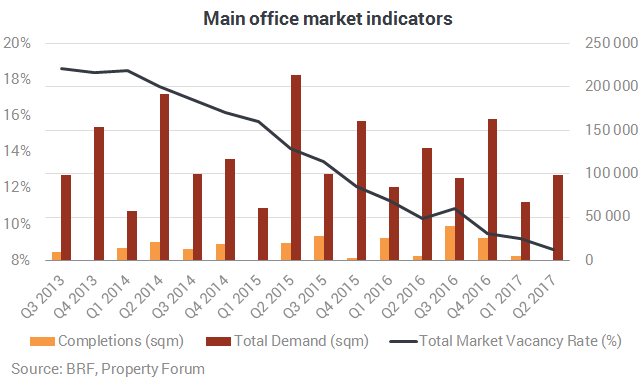

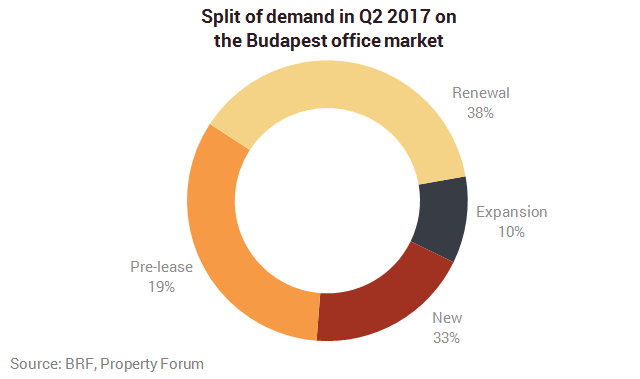

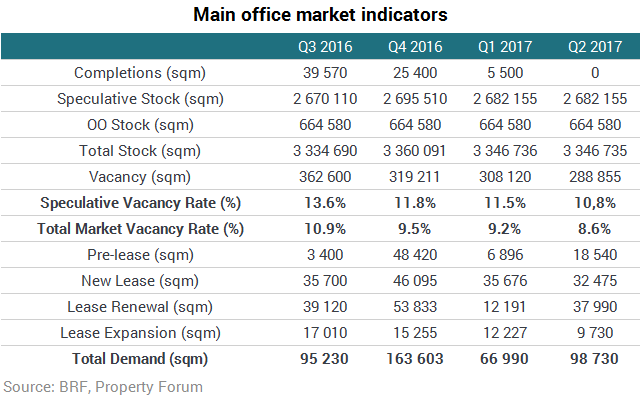

The Budapest office market vacancy rate has decreased to 8.6% in Q2 2017, which is the lowest rate ever on record. Renewals were the major driver of the leasing activity while no new buildings were completed in the quarter. The Budapest Research Forum published its newest figures.

No new office buildings were completed in Q2 2017. The total Budapest office stock totalled 3,346,735 sqm. The total stock comprises 2,682,155 sqm of Class A and B speculative and 664,580 sqm of owner occupied buildings.

According to BRF, 178 deals were closed in Q2 2017, with an average size of 555 sqm. In terms of submarkets, Váci Corridor had the highest leasing activity, representing more than 34% of the total demand, followed by South Buda (25%) and Central Buda (13%) submarkets.

The quarterly net absorption totalled 19,265 sqm in Q2 2017.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.