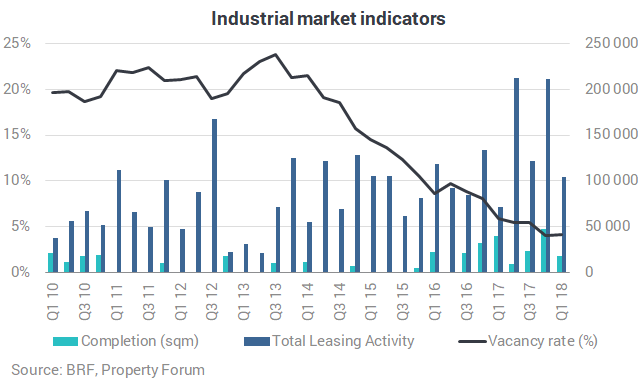

Total demand on the Budapest industrial market amounted to 103,790 sqm in Q1 2018, marking a 45% year-on-year increase. At the end of the first quarter, there were only four existing schemes with more than 5,000 sqm of available warehouse space. The Budapest Research Forum published its quarterly industrial market analysis.

In the first quarter of 2018, two new buildings were handed over with the size of 18,020 sqm: an 11,020 sqm warehouse in East Gate Business Park, and a 7,000 sqm hall in the next phase of Budapest Dock Szabadkikötő building C. Furthermore, one existing building was included in the stock due to adequate quality and occupational status, the second building of Logicor’s Fehérakác property raised the industrial stock with 4,400 sqm. The total modern industrial stock in Budapest and its surroundings stood at 2,068,900 sqm at the end of Q1 2018.

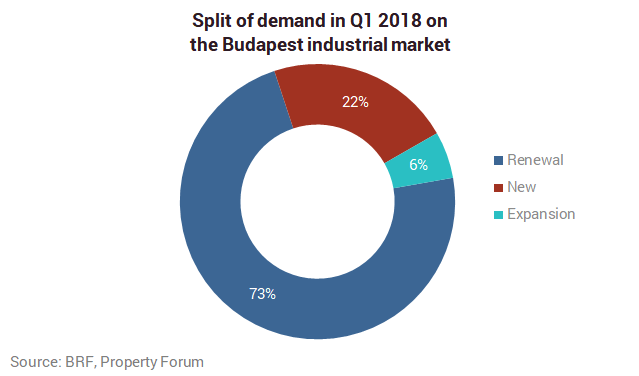

Total demand amounted to 103,790 sqm in Q1 2018, marking a 45% increase over the figure noted in the same period last year. Lease renewals accounted for 72.7% of the quarterly volume, while the share of new leases was 21.8%. Expansions stood for 5.5% of the quarterly volume. No pre-lease agreement was signed in the first quarter of 2018.

24 leasing transactions were recorded in the first quarter, out of which two agreements were signed for more than 10,000 sqm. The average transaction size was 4,320 sqm during the quarter, which is one and a half times the average level of the previous five years’ first quarters. 98% of all leasing activity was recorded in logistics parks, where the average transaction size was 4,620 sqm, while the average deal size in city logistics schemes equalled 1,075 sqm.

The two largest transactions of the quarter were lease renewals. HOPI at Goodman Gyál Logistics Centre renewed its contract on 21,700 sqm, while in Prologis Park Budapest – Sziget Schneider Electric signed a lease renewal for 19,960 sqm. The largest new lease agreement amounted to 7,000 sqm and was signed in Budapest Dock Szabadkikötő. The largest lease expansion was recorded in Prologis Park Budapest – Batta on 4,180 sqm.

The vacancy rate slightly increased by 0.2 pps q-o-q to the current 4.2%. At the end of the first quarter, a total of 87,070 sqm area was vacant and there were only four existing schemes with more than 5,000 sqm of available warehouse space.

Net absorption totalled 24,360 sqm in the first quarter of 2018.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.