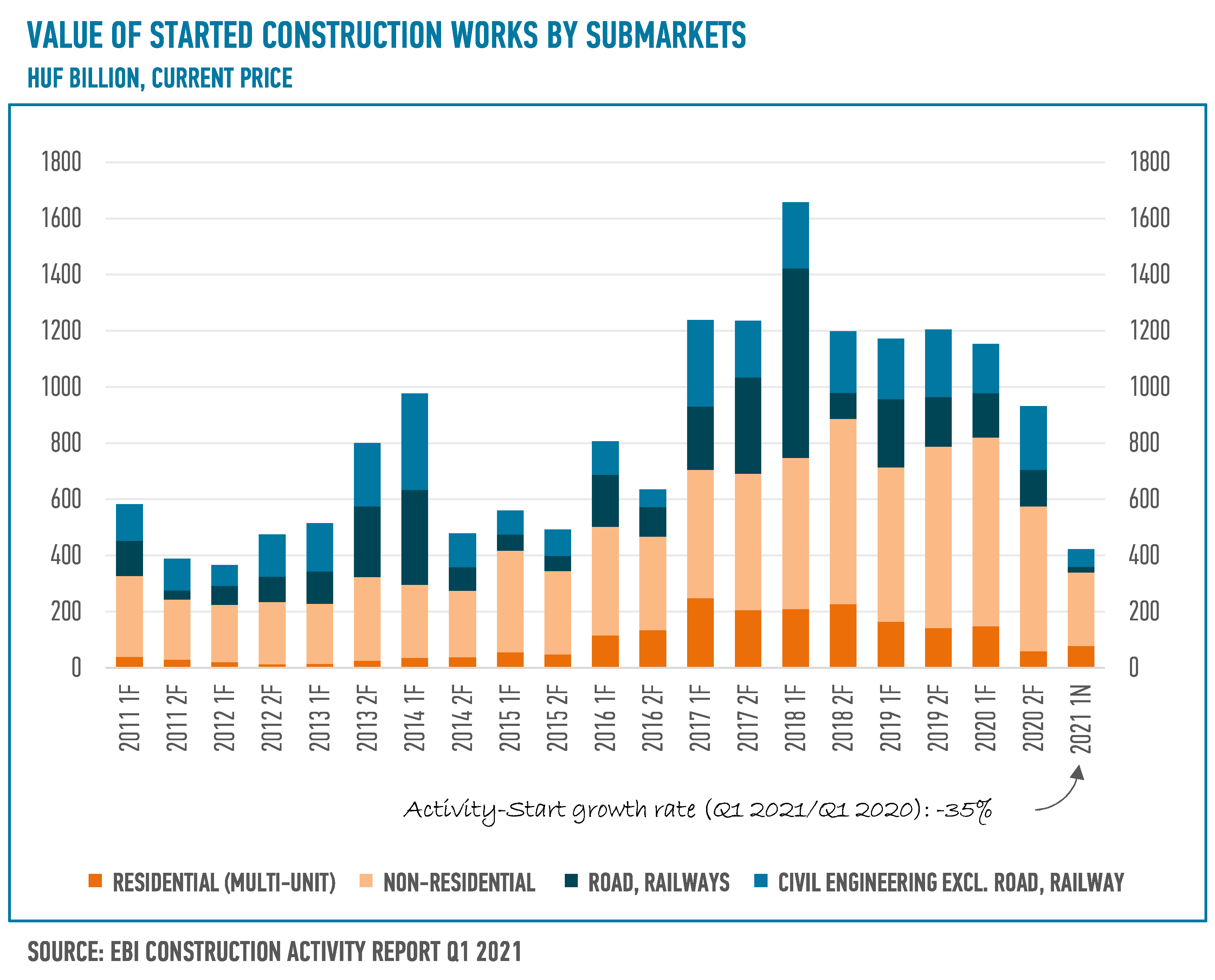

The latest EBI Construction Activity Report has found that the stagnation of the total value of started construction works has not stopped. Between January and March 2021, construction works in the sector started on HUF 421 billion. This, although not greatly different from the values seen in the previous three quarters, is still the lowest Activity Start indicator of the last two years. Compared to the January-March periods of the previous two years, 2021 started clearly weaker: against the positive Q1 2020, the decline was about 35%, but even over the same period in 2019, there is a 15% decrease.

EBI Construction Activity Report examines the situation of the Hungarian construction industry on a quarterly basis, including the volume of newly started construction works, and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

Weak Q1 for building construction

The value of building construction projects in Q1 2021 showed a major decline over the same period of 2020 which brought an outstanding Activity Start, but compared to the other quarters of last year, the total value of started construction projects increased during three months.

In Q1 2021, a total of HUF 340 billion worth of building construction projects entered the construction phase, which was a weak three-month period compared to previous years. The previous trend also applies to non-residential buildings within building construction, where the Activity Start of EBI Construction Activity Report accounted for HUF 261 billion.

Even though the drop was considerable compared to last year's exceptionally high Activity Start in the first quarter, the value of construction works started for three months did not greatly differ from the other quarters of the year and the first three months of previous years. Among the biggest non-residential projects that began in Q1 2021, besides the construction of two office buildings, are the Water Fun Park in Győr, the second phase of Mercedes K1 press plant in Kecskemét, CTPark in Vecsés and HelloParks logistics centre in Maglód. The fortress reconstruction in Diósgyőr also started, along with Hunguest Hotel Panoráma Hévíz project and the construction of the Ice Age interactive showroom of the Zoo in Nyíregyháza.

Plunge in road and railway construction

Civil engineering saw a dramatic plunge; in Q1 2021 the value of such projects entering the construction phase contracted by almost half compared to Q1 2020. Between January and March this year, only HUF 82 billion worth of civil engineering projects were launched, evoking 2015-2016 levels, and representing one of the lowest values in the last five years. The drastic drop in road and railway projects largely contributed to the particularly low level of Civil Engineering Activity Start indicator of the EBI Construction Activity Report. Since 2013, Q1 2021 has registered the third lowest value of started civil engineering projects.

The first three months of 2021 barely saw the start of any major road and railway projects. The Activity Start indicator of non-road and non-railway civil engineering projects also sank to HUF 63 billion, marking the second-lowest amount since 2016. At the same time, Q2 2021 may bring improving numbers in civil engineering as two major projects began in April: the construction of the new Danube bridge between Kalocsa and Paks and the connecting road network, and 2the construction of the M6 motorway stretch between Bóly and the Hungarian-Croatian border. Also, the EU budget cycle 2021-2027 starting this year is set to provide fresh funds for civil engineering projects.

Regional balance

In Q1 2021, the distribution of the value of construction works among the three regions was quite balanced. While the share of Central Hungary slightly dropped compared to the period of 2014-2020, the share of Western regions rose by the same rate. The share of construction projects that started in the Eastern regions remained unchanged.

New impetus in multi-unit housing construction

From January 1, 2021, the VAT rate on new home sales was lowered again to 5% from the 27% in 2020, giving a new impetus to multi-unit housing construction this year. The Activity Start value of the EBI Construction Activity Report in 2021 thus might be way higher than in 2020. This process has already begun and is confirmed by data for the first quarter of this year. It shows that after a steady decline in last year’s Activity Start, growth resumed in January-March 2021: multi-unit housing projects began at almost the same value as in the same period in 2020. The value of the Activity Start indicator for Q1 2021 was HUF 79 billion which was surpassed by only two quarters in 2019 and 2020.

Unlike Activity Start, the Activity Completion of the EBI Construction Activity Report increased steadily last year. This growth came to a halt in Q1 2021, but it comes as no surprise because the value of completed projects is traditionally a bit lower in the first quarter of a year. In the rest of the year, considering the expected completion dates, the value of completed multi-unit projects may remain as high as in the previous year.

Budapest & metropolitan area dominating multi-unit housing projects

In the first three months of 2021, launched multi-unit housing projects mostly concentrated in Central Hungary. The share of this region was 79%; a major increase compared to the average of 60% in 2014-2020. In parallel, the share of both Western and Eastern regions went down. The already low 15% share of Eastern regions fell to 5% in Q1 2021. The launch of several large-scale projects such as Phases 2 and 3 of Park West, BudaBright, Phase 3 of Waterfront City, BudaPart BRF and Sasad Resort SR6 contributed to the growth in Budapest.

Traditionally, large-scale construction projects start in Budapest than in the countryside, and thanks to the already approved but not launched projects, developers here could react to the VAT change more rapidly. The increase in the share of larger projects is shown by the fact that although the Activity Start value improved compared to previous quarters, fewer projects started during the quarter than before.