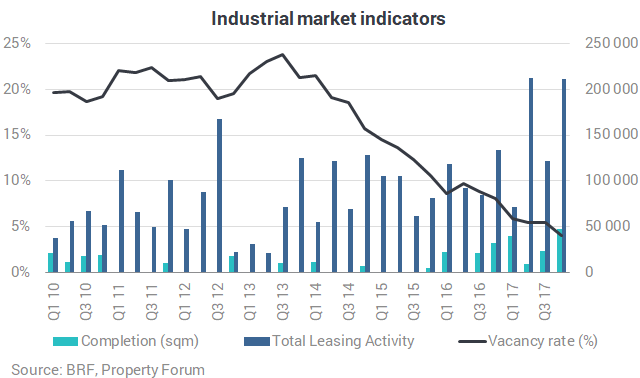

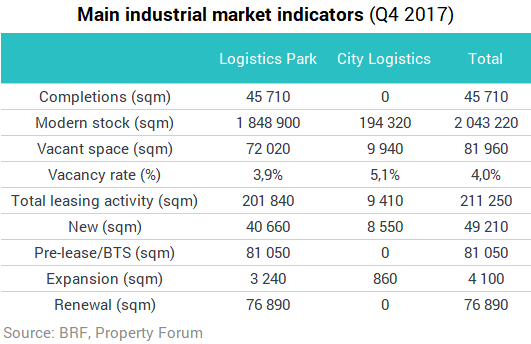

Total demand on the Budapest industrial market amounted to 211,250 sqm in Q4 2017, marking a 58% year-on-year increase. The vacancy rate dropped to a new record low of 4%. The Budapest Research Forum published its quarterly industrial market analysis.

In the fourth quarter of 2017, six buildings with a combined size of 62,750 sqm were added to the Budapest industrial stock. Four new schemes were handed over: a 16,050 sqm BTS scheme on the area of CTP Biatorbágy, a 14,250 sqm warehouse in East Gate Business Park, an 8,400 sqm BTS building in Budapest Airport Business Park and a 7,000 sqm warehouse in Budapest Dock Szabadkikötő. Furthermore, two existing buildings were included in the stock due to adequate quality and occupational status; the 8,550 sqm warehouse component of Logicor’s Fehérakác property and the 8,500 sqm Promesa Warehouse in Dunakeszi.

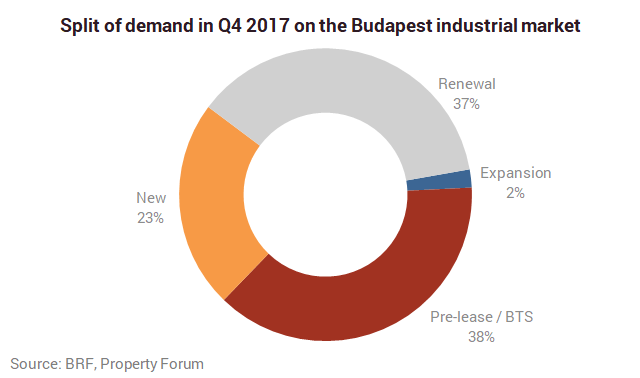

Total demand amounted to 211,250 sqm in Q4 2017, marking a 58% increase over the figure noted in the same period of the previous year. Lease renewals stood for 37% of the quarterly volume, while the share of new leases was 23%. Two pre-leases were signed during the quarter for BTS developments totalling 81,050 sqm, representing 38% of total demand, and expansions accounted for the remaining 2% of leasing activity.

As much as 96% of all leasing activity was recorded in logistics parks, with only two deals signed in city logistics schemes – an 8,550 sqm new lease and an 860 sqm expansion.

The largest transaction of the quarter was a 64,400 sqm pre-lease at Üllő Airport Logistics Center, which was coupled with another 16,650 sqm pre-lease in the same park. The largest renewal amounted to 28,590 sqm and was signed in Prologis Park Budapest – Batta.

Net absorption totalled 73,650 sqm during the quarter, which is the highest figure since 2009.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.