”Some urban locations are popular year after year, while others tend to lose their importance over time. Infrastructural and public transport improvements often contribute to the creation of attractive neighbourhoods for commerce and can change the business maps of Polish cities. The rapid development of Poland's office market in recent years has resulted in a large number of new office locations. Examples of this include the areas along the second metro line in Warsaw or Czerwone Maki Street in Kraków”, says Łukasz Dziedzic, Consultant, Research and Consulting, JLL.

Warsaw 'City' in Wola

The most visible change on the Warsaw office market is the drop in tenant interest in Mokotów (accounting for 40% of the capital’s total demand in 2012) in favour of the Wola district (in areas near Rondo Daszyńskiego Roundabout) and areas surrounding the Dworzec Gdański station. Warsaw best illustrates the impact transport infrastructure development can have on the office market. Transport challenges, including modernizations, traffic jams in the Służewiec area, combined with the delivery of the second metro line, has changed 'the balance of power' in the city – in favour of areas in proximity to Rondo Daszyńskiego roundabout.

Kraków – offices begin to reappear in the city centre

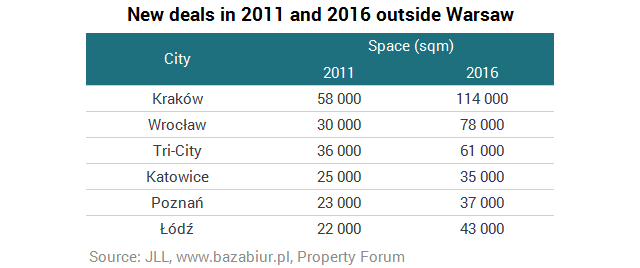

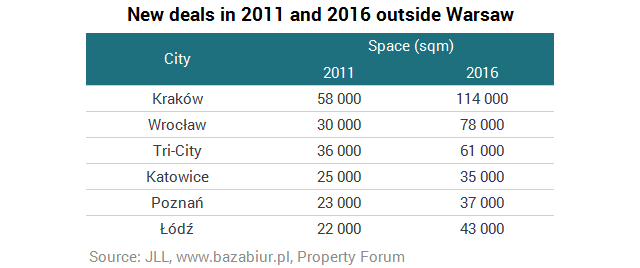

Kraków has always been a star among the office markets outside of Warsaw. This year the city's total office stock will exceed the one million square metre mark. The growth here is sustained by strong demand year after year, and has led to the development of numerous office locations in the city.

“Due to its historic architecture and lack of available land parcels in the very heart of Kraków, office hubs are predominantly established outside the city centre. In recent years though, the most developed office locations such as Bonarka, Lubicz and Lublańska/Bora Komorowskiego, Armii Krajowej as well as Czerwone Maki Street and the area of Powstańców Wielkopolskich/Klimeckiego have been joined by the areas of the centrally located Kraków Główny station and Rondo Mogilskiego roundabout – due to new investments such as High 5ive and Unity Tower - as well as areas near Jana Pawła II/Życzkowskiego”, comments Rafał Oprocha, Head of JLL Office in Kraków.

Wrocław – tenants return to the city centre

Wrocław is the third largest office market in Poland. Constant interest among large investors has resulted in substantial growth in the total supply in the city and, as a consequence, development of numerous new business areas.

“Recently, as a result of the construction of buildings such as Pegaz and Dominikański, we recognize a significant influx of large tenants into the city centre. Such tenants had previously selected other locations due to lack of office projects on an appropriate scale. We also observe the development of the office area in the neighbourhood around Wrocław Główny station. One of the most important business hubs in Wrocław has been, and still certainly is, the area around Strzegomska and Legnicka Street, which is the location for projects such as Business Garden, Green Towers, Millenium Towers and West House”, says Katarzyna Krokosińska, Head of JLL Office in Wrocław.

Tri-City – decentralization

The Tri-City is an extremely geographically concentrated market. It is the fourth largest office location in terms of office stock, yet the vast majority of demand can be found in just one district: Gdańsk Przymorze, where the two largest office complexes (Olivia Business Centre, Alchemia and Arkońska Business Centre) are located.

“Tri-City is a linear metropolitan area. As a result, other projects located along its main axis can also be attractive. Therefore, there are numerous micro-locations in Gdańsk, such as Neptun Business Centre and Opera Office. There is also an interest in the area near Gdańsk airport. It is also worth underlining the development of locations in the area of Main City along with post-shipyard areas where buildings such as Tryton Business House and C200 have recently been developed. Furthermore, the Heweliusza 18 building remains under development as well. Outside of Gdańsk, the most prominent location office-wise is the area around Łużycka Street in Gdynia. The area's major developments are Łużycka Office Park and the Tensor office complex”, comments Marcin Faleńczyk, Head of JLL Office in Tri-City.

Poznań – diversification of demand

Poznań is characterized by an even distribution of office take-up throughout the city. In 2016, the strongest magnet for tenants in Poznań was Maraton, located in the city centre. Traditional buildings in close proximity to the city centre remain attractive for new tenants. Schemes such as Kupiec Poznański, Andersia Tower, Kwadraciak&Okrąglak continue to attract interest from occupiers looking for space in the city. Another established location in Poznań is the area around Lake Malta. Two major developments here (Malta Office Park and Malta House) host a large number of tenants. Another important office hub in the city is in the area around Bułgarska Street, where Business Garden serves as the major investment.

Katowice – the centre and suburbs

The majority of new demand in Katowice in both 2011 and 2016 was for office developments in the city centre. However, compared to 2011 in 2016 there were quite a few new business hubs in Katowice, including one close to the centre, thanks to investments such as Silesia Business Park and Silesia Star.

Łódź – a business hub in the area of the new station

Łódź office market is developing at an incredible pace. Several years ago, there were three major locations attractive for newcomers in Łódź: Green Horizon, Sterlinga Business Centre and University Business Park. Today, there are many more business hubs available in the city.

“Currently, there are a number of new office locations that attract tenants to Łódź. A business hub is being developed in the area of the newly-completed Łódź Fabryczna station. Furthermore, tenants are also interested in two other business centres: Ogrodowa Office and Symetris Business Park, which offer high class office space. There is also much interest in objects such as University Business Park where the biggest lease agreement in Łódź was concluded last year”, explains Łukasz Dziedzic.

Office markets – diversified growth

The markets in Poland move at different speeds, which is a natural process. However, there is one quality that all of them share: they are growing, attracting new investors and making efforts to provide an investor-friendly climate to the companies which are already operating there.

“Despite the fact that in the biggest cities – namely Warsaw and Kraków – there are areas which enjoy increasing popularity year on year, there are also numerous new regions that attract investors. Significant changes in Wrocław resulted in the growth of tenant activity in the city centre. In Katowice on the other hand, the centre has always served as the main business centre. Tri-City, despite being dominated by one location, maintains its strong position and continues to attract new companies. Poznań surprises with unique projects while Łódź impresses with yearly results and new entities entering the market. To sum up, only one conclusion can be made: Poland is an attractive business location and nothing indicates that this will change in the future”, comments Łukasz Dziedzic.