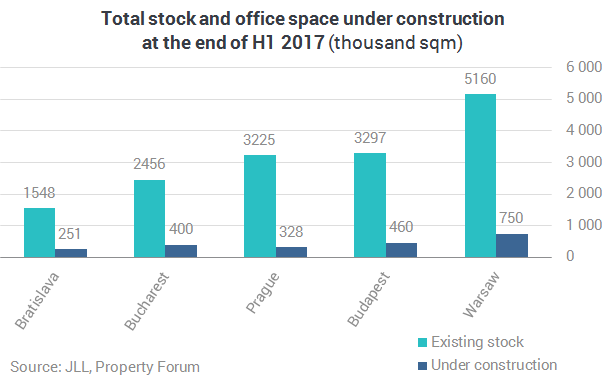

The office markets of Central European capitals are growing dynamically with the number of new leases on the rise and vacancy rates hitting record lows in several cities. In light of all this it is no surprise that development activity is also heating up on the most popular markets of the region.

Based on rental fees in the prime segment of the market, Warsaw is considered the most expansive capital of the region. Office space on average costs €24/sqm/month. Budapest and Prague are somewhat cheaper: tenants need to pay €22 and €21, respectively, for one square-metre of office each month. Bucharest and Bratislava offer the most attractive prices: €18.5 and €15.5, respectively.

Prague

Pressure from the demand side is likely to increase supply on the Prague office market in H2 2017. Total supply in Prague has reached 3.23 million square metres with 343,000 square metres of new office space currently under construction. It is possible that new buildings delivered in 2017 will push the vacancy rate up slightly, but most projects currently under construction are at least partially covered by pre-lease contracts. Limited supply might strengthen the position of landlords which can result in the increase of rental fees. At the same time, developers are trying to increase the speed of the preparation of new projects in order to take advantage of the favourable economic environment.

Bratislava

In spite of outstanding demand and favourable economic indications, weak supply limits the growth of the Bratislava office market. Only 43,000 square metres were delivered to the market in the first half of 2017, less than 3 percent of total supply (1.67 million square metres). In 2018 the market will grow much more significantly, but 70 percent of new developments have already been pre-leased. The fast growing IT and professional services sectors are the key to continued strong demand in Bratislava. The lack of new supply, however, may result in increasing rental fees in the near future. Pressure from the demand side, on the other hand, is likely to increase supply in the longer run, resulting in more stable rental fees.

Warsaw

The 3.5 percent GDP growth forecasted for 2017 and the growth of the business services sector has increased both demand and supply all over Poland. Yields and rental fees in the prime segment remain stable. Total demand continues to be strong in Warsaw; the largest shares of new tenants are banks and IT companies. Renewals and expansions made up 45 percent of the total transaction volume in Q2 2017, while the vacancy rate decreased to 13.8 percent from 14 percent in the previous quarter. Both demand and supply have stabilised at a high level in Warsaw. Total stock is currently 5.16 million square metres and the capital’s office market will be expanded by a further 720,000 square metres once ongoing projects are finished. The fall of rental fees has stopped and new supply is expected to be more modest in 2018. For 2019, the completion of several major projects is planned which may result in the highest new supply ever recorded.

Bucharest

Demand for new office space in Bucharest totalled 60,000 square metres in the second quarter and 80 percent of this volume was made up of net demand. The total supply of 2.61 million square metres is complemented with a construction pipeline of nearly 340,000 square metres. 80,000 sqm of new office space is planned to be handed over until the end of the year. The role of pre-leases is significant: the largest deal closed in Q2 2017 was IBM’s pre-lease of 12,000 sqm of office space. Although construction activity is fairly strong, most projects will only be finished in 2018, which means that rental fees are not likely to increase further this year.

Budapest

The Budapest office market also continues to grow, by the end of the second quarter total stock reached 3.35 million sqm. Thanks to booming development activity, 700,000 sqm of new space will be added to the market during the next two years, 390,000 sqm of which is already under construction. In the second quarter of 2017 pre-leases took the spotlight from new leases as the most popular office buildings – both standing and under construction – are nearly fully let. Demand for office space in Budapest totalled 98,000 sqm in Q2 2017, 47 percent higher than in the previous quarter. Extensions were the main drivers of growth, comprising 38.5 percent of total demand. The vacancy rate decreased by 0.6 percentage points to 8.6 percent, the lowest figure ever on record.

This article was published in the latest issue of Portoflio Property Magazine.