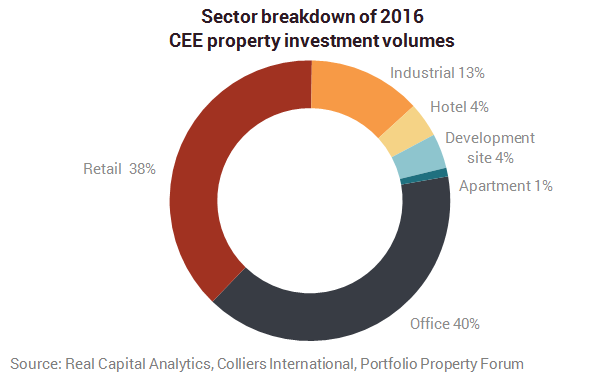

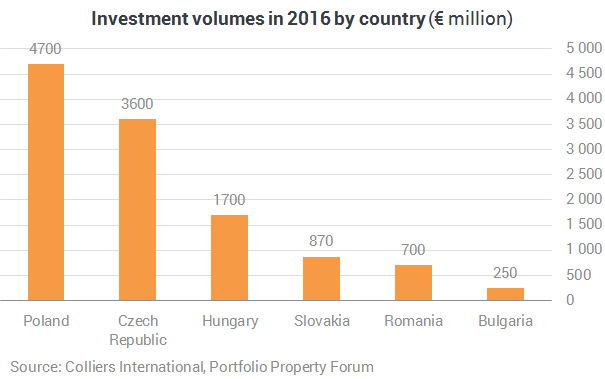

2016 reached the volume of €11.8bn in investment markets across Poland, Czech Republic, Slovakia, Hungary, Bulgaria and Romania, according to a research report by Colliers International. Aside from Poland, investment flows in 2017 will be close to or higher than 2016’s. The retail sector might see continued rental growth and high investment levels across the region.

“The report presents a positive outlook for the CEE real estate arena in 2017 but also highlights significant risks to yield levels to consider. Strong momentum in consumption in particular should propel GDP growth, service sector growth and underpin rents in the Retail and Industrial sectors”, commented Mark Robinson, Colliers’ senior researcher for the CEE region.

- The rise in bond yields (with inflation expectations and the USD) witnessed in global asset markets since last summer. The CEE-6 markets are relatively safe havens and may also be so if there is further political instability in Western Europe

- The size of the debt pile in China, which could well destabilise global financial markets

- Taxation risk in the new “Trumpian” world of more populist governments

- EU funding to CEE being reduced as a “punishment” for populist defiance of Brussels or due to EU political instability

- The retail-positive outlook for wage growth may be a negative for BPO/SSC and manufacturers. Romania and Bulgaria might do well relative to the Visegrad-4 countries on wages

- For CEE Retail, a disrupter risk may come from e-commerce.

Factors in favour of firm growth:

- Consumption and wages are expected to stay buoyant, indicated by sentiment surveys and rising inflation rates.

- Strong GDP growth across the CEE region led by consumption in this cycle but with strong support from the export sector

- The low levels of the region’s currencies, even against a relatively weak EUR, have created competitive labour conditions

- Large funding gaps when assessing prime real estate yields vs. funding rates. A funding rate shock should be absorbed without backing up of prime yields, especially in H1 2017.