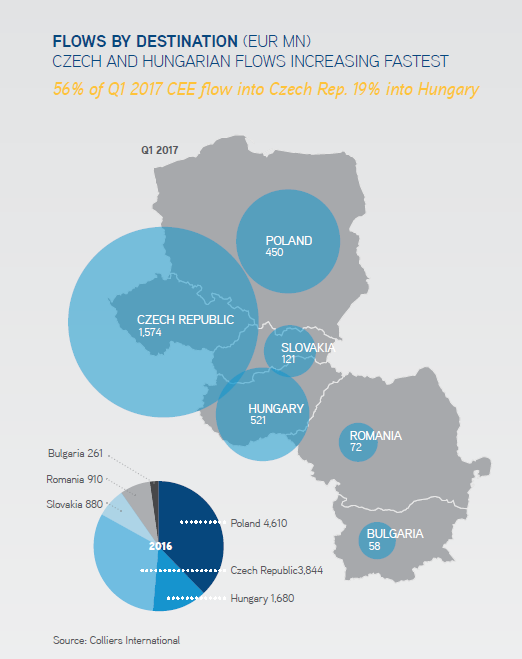

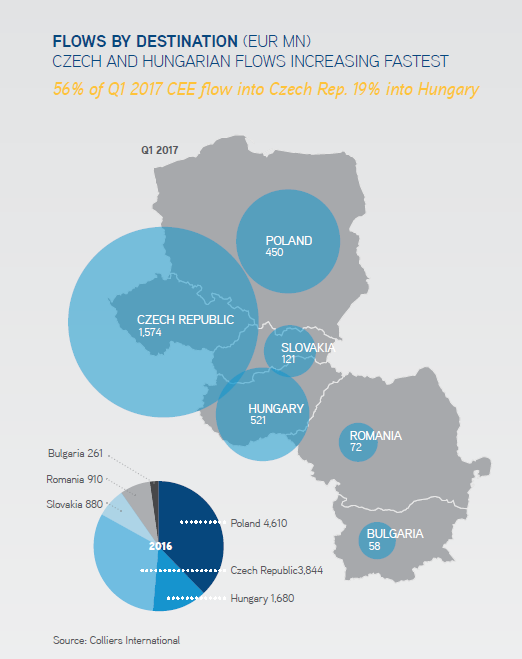

Assessing the origin of funds, Collier noted in its March research, continued in one vein in the first quarter, with domestic CEE flows amounting to 27% of the overall total, with another 18% of the pool of money flowing cross-border in CEE.

“Investment from the Czech Republic targeting Slovakia, Hungary, Romania and Poland made up the bulk of this momentum, even ahead of the 6 April release of the Koruna from its 3-year currency “cap”, which is likely to enhance Czech purchasing power in the future. Amongst 2016’s other big sources of capital, Asian investment totaled only 2% of the region in Q1, whilst we observed no deals from South Africa. Accordingly, Europe clawed back some “market share”, with 31% of the pie”, Mark Robinson, CEE Research Specialist at Colliers International comments.

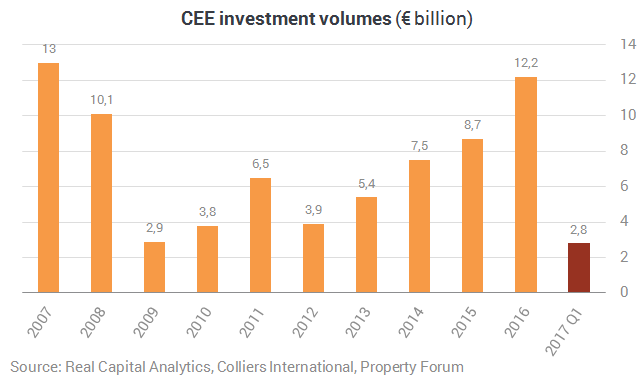

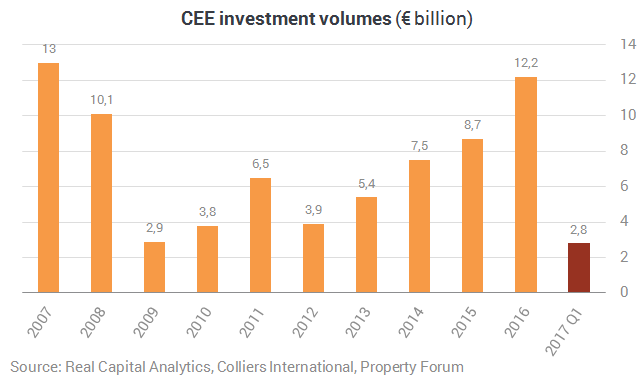

Will 2016’s cycle-high total of €12.2 billion be overhauled in 2017? On the positive side, the strong macro performance across the region in the first quarter surprised most commentators: strong momentum in industrial production, retail sales, exports (including to a booming Germany) all contributed to preliminary Q1 GDP growth readings in CEE registering in an impressive 2.9%-5.7% yoy range. This week’s release of the key German IFO Expectations subcomponent leading index for May at a cycle-high level of 106.5 is further very encouraging news for CEE real estate. As set out in the January 2017 Outlook by Colliers, the key risk remains a rise in transaction funding costs seen through rising bond yields: Thus far, the backing up of bond yields does not look like enough to derail the considerable momentum we have observed thus far this year.