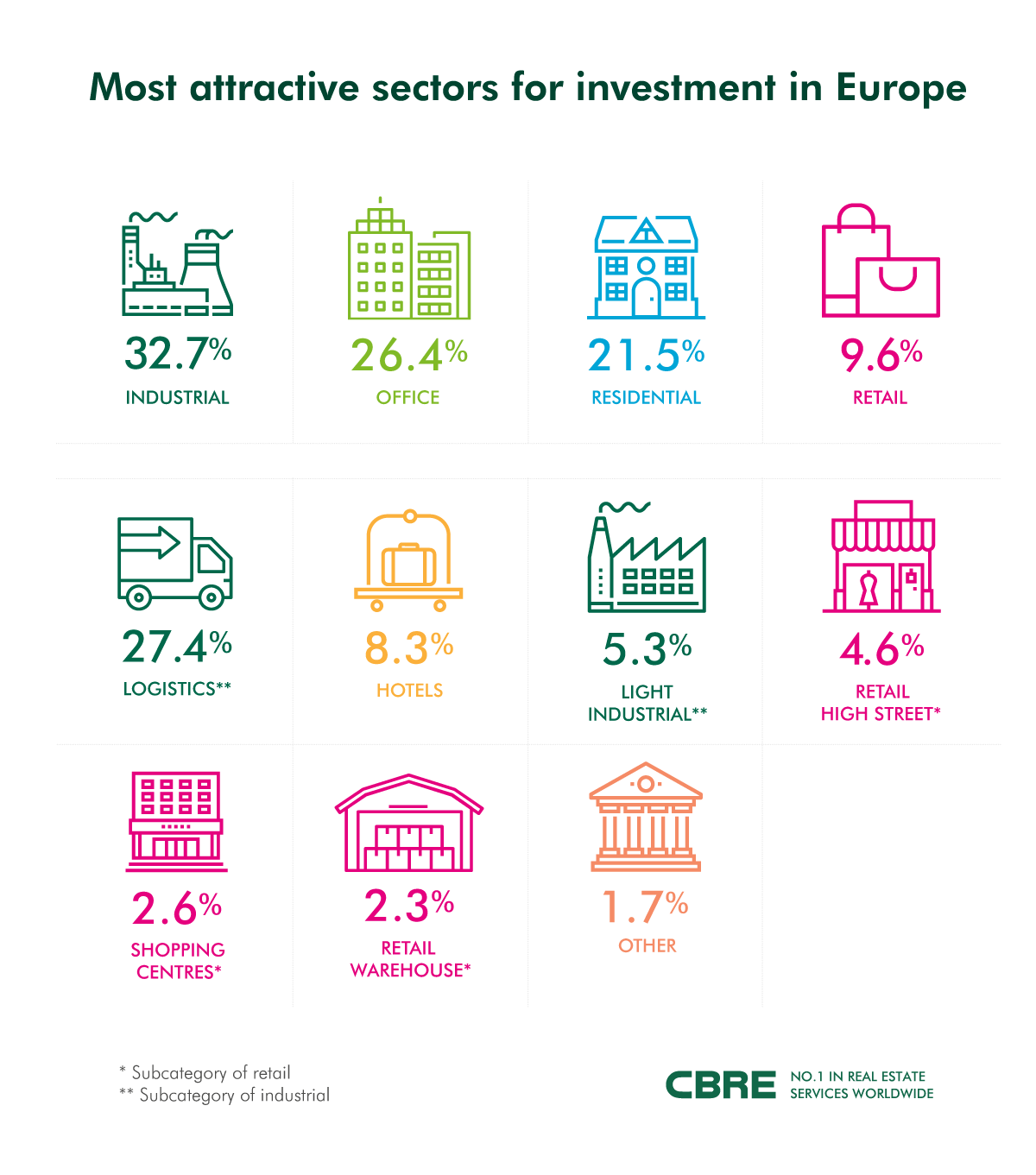

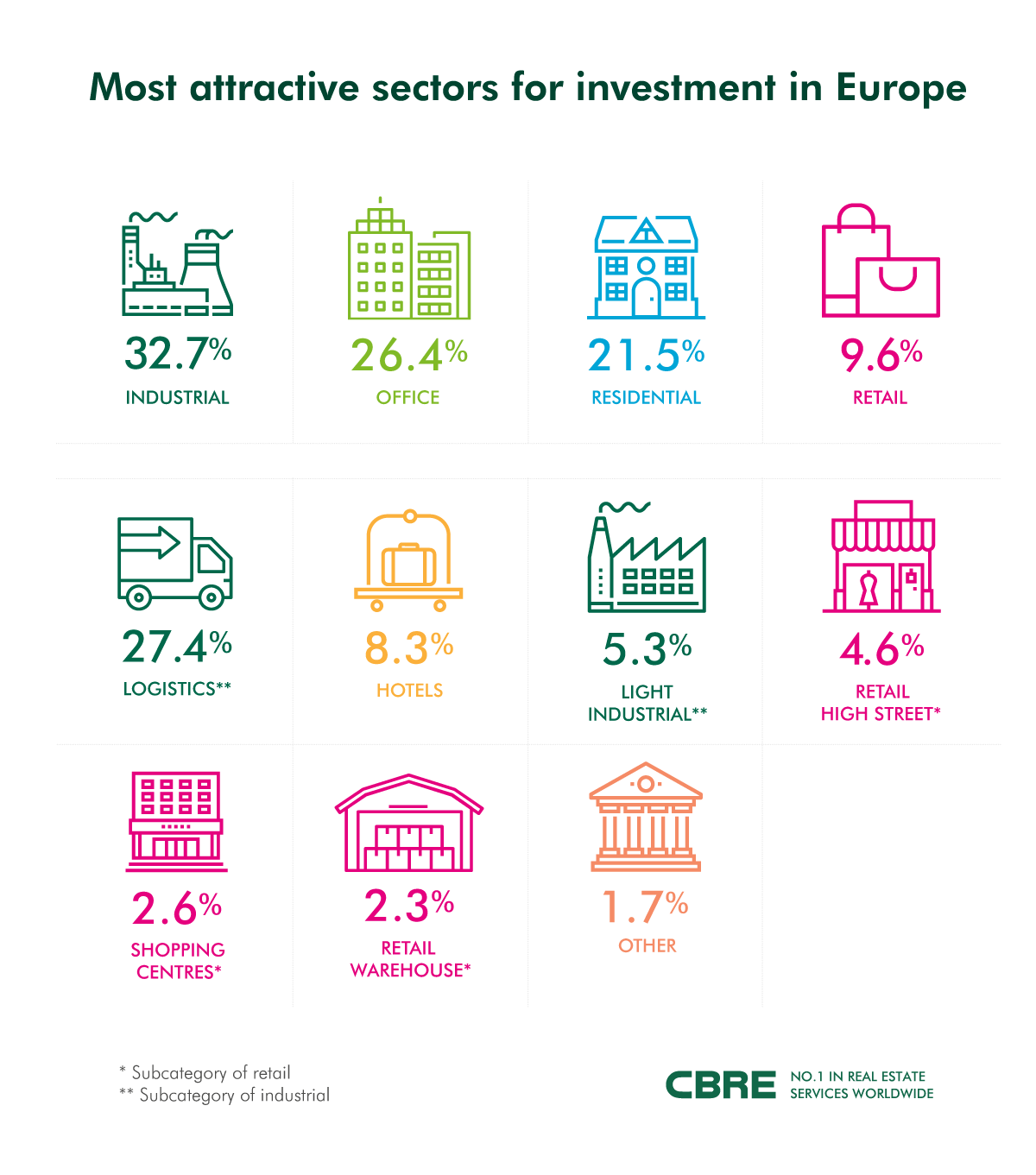

Across EMEA, office was ranked second, favoured by 26% of respondents, with investors seeking markets with strong economic fundamentals to underpin rental growth and high levels of liquidity. Residential has seen the steepest rise in popularity, compared to 2017, and was the preferred asset class for 21% of EMEA respondents.

A defining feature of the market last year was the rise in sales of large portfolios, specifically ‘platform’ deals. Notable transactions included Blackstone’s €12.2 billion sale of the Logicor Portfolio to the China Investment Corporation and Brookfield’s $2.8 billion sale of IDI Gazeley to Global Logistics Properties. Not only did the purchasers, typically large Asian investors, access the market at scale, but by buying an operating platform they also acquired the infrastructure and management expertise to manage the assets and continue to develop the portfolio.

“2017 was the year the industrial and logistics sector was unquestionably re-rated, evidenced by the number and scale of platform deals we saw in the sector. Logistics yields remain at a premium over other real estate sectors, and the sustainability of returns in the sector is underpinned by a robust occupational market, which is attracting investors from around the globe”, Jack Cox, Head of EMEA Industrial and Logistics Capital Markets, commented.

Driven by aggressive asset pricing and limited availability of core stock, investors globally have become increasingly resourceful in finding innovative ways to deploy capital. In EMEA, 72% of respondents indicated that they were already invested in alternatives and 70% said they were actively pursuing opportunities in the sector. Alternatives have seen a 45% increase in investment volumes in the last ten years, resulting in €23.6 billion of transactions in 2017. Investors are most frequently targeting student housing (53%), retirement living (38%) and real estate debt (37%).

In addition to sector preferences, the survey also analysed geographic considerations. Paris, Madrid, Amsterdam, Frankfurt and London were the five most sought-after destinations in Europe for European investors. Paris jumped from fifth to first place, compared to 2017, boosted by expectations that the political and economic momentum from H2 2017 will have a positive impact on the real estate market. London remains the highest priority target for investors outside of Europe and will undoubtedly continue to see the highest volume of investment activity of any European city.

“While sentiment does not always translate directly into investment volumes, investor preferences do indicate which markets may see heightened activity over the next 12 months. We have seen a shift in sentiment in France for many months now, following the election of President Macron and the subsequent economic momentum this has created. Madrid has seen strong investor interest thanks to improving economic fundamentals. The current strength of the German economy and the lack of supply continue to drive investor demand in all of its key markets.”, Jonathan Hull, Managing Director, EMEA Investment Properties at CBRE added.

In Hungary, a total of €231 million worth of industrial volume was transacted in 2017: notably, the majority of this came during the first half of the year, largely on the back of the EMEA-wide Logicor platform sale. The industrial prime yield moved inwards by 50 bps to 7.75% over the year and is under pressure as we go into 2018. Reflecting high levels of investor interest but the very limited availability of prime product – this lack of stock is a result of conservative development activity and a concentration amongst the larger owners opting to hold assets long-term.

“This is likely to remain the main challenge for investors eyeing the sector in Hungary, although steadily improving developer sentiment and potential platform deals could pave the way for rising turnover in the sector”, Tim O’Sullivan MRICS Senior Director, Head of Capital Markets at CBRE Hungary noted.

Despite 2017 being a record year for real estate investment in Europe, with volumes totalling €291 billion, European investors expect to deploy more capital in 2018 than they did in 2017. A third of EMEA investors (33%) expect to spend more this year than last, compared to 26% last year. However, as in 2017, availability of product remains a primary concern for investors in 2018, proving to be the biggest obstacle for 34% of European respondents, a challenge that investors are facing around the globe.