In H1 2016, total modern retail stock in Poland rose to more than 13.5 million sqm GLA. The key trends include new shopping centre and retail park openings in cities below 100,000 inhabitants and the growth of the outlet centre sector in agglomerations with 200,000–400,000 inhabitants. Cushman & Wakefield has released its data on the Polish retail market in H1 2016 in its report Property Times: Increased market competition calls for a quick response.

At the end of H1 2016, Poland’s modern retail stock reached 13.53 million sqm. Shopping centres account for 73% of the country’s total stock (409 schemes providing 9.83 million sqm), followed by standalone retail warehouses with an 18% market share (255 schemes providing 2.43 million sqm), retail parks with a 7.5% market share (63 schemes providing around 1 million sqm) and outlet centres with 1.5% (13 schemes with 218,000 sqm).

One of the key trends is the constantly growing share of retail schemes in cities below 100,000 inhabitants in Poland’s total stock. Shopping centres in such cities account for around 17% of the total shopping centre stock compared to 12% five years ago and a bare 7% ten years earlier. A similar trend is seen in the segment of retail parks. Small cities are seeing a strong growth of the concept of strip malls (small-scale retail and service schemes with a row of stores having separate entrances from parking lots) which enable retail operators to extend their catchment area to cover smaller markets. The leading sectors include health and beauty, consumer electronics and household appliances, low-end fashion and footwear, and home accessories. Given the current retail development pipeline, these market trends are expected to continue.

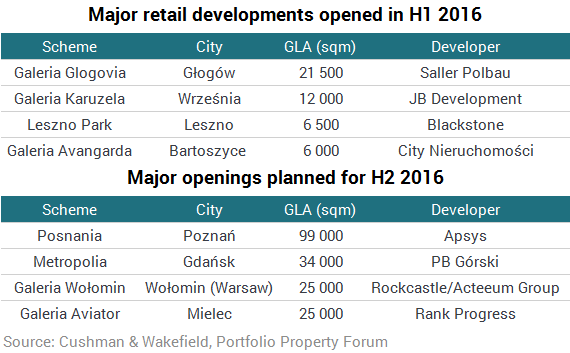

New retail space supply in H1 2016 totalled only 121,000 sqm and comprised the following:

- three shopping centres: Galeria Glogovia in Głogów (21,500 sqm), Karuzela in Września (12,000 sqm) and Galeria Avangarda in Bartoszyce (6,000 sqm);

- extensions of existing shopping centres (Atrium Promenada in Warsaw and Auchan in Gdańsk);

- extensions of retail parks (for instance, Leroy Merlin in the retail park near Galeria Sudecka in Jelenia Góra and Leroy Merlin in Wrocław’s Futura Park); and

- standalone retail warehouses which provided a total of 44,000 sqm.

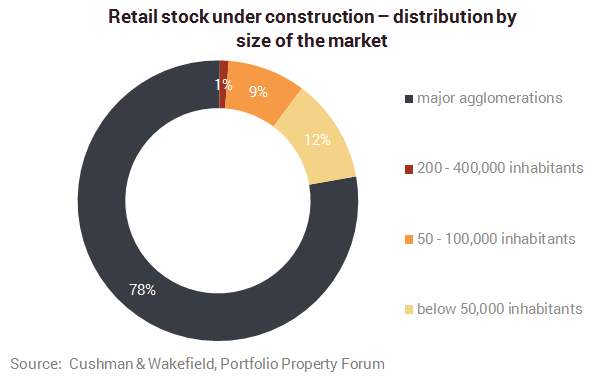

There is currently 690,000 sqm of retail space under construction scheduled to be completed by year-end 2017. Some 57% of this development pipeline will be delivered through openings of large shopping centres, including Posnania in Poznań, Galeria Północna in Warsaw and Forum Gdańsk in Gdańsk. Shopping centres and retail parks to be added to the markets of cities below 100,000 inhabitants are expected to account for around 40% of the new supply, while extensions of existing schemes in regional cities with 200,000–400,000 inhabitants will make up a bare 3% of the development pipeline.

More than half of the current development pipeline (363,000 sqm) is scheduled to be delivered onto the market by the end of 2016, bringing this year’s total retail supply to around 490,000 sqm (down by approximately 25% on 2015’s total). The largest scheme planned for 2016 is the Posnania shopping and leisure centre to open in Poznań, which is among leading Polish cities in terms of modern retail space saturation.

Tenants believe the Polish market represents strong future growth prospects. They continue to focus on established retail schemes offering high footfalls and satisfactory revenues, both in the major agglomerations and in smaller cities.

Renata Kusznierska, Head of Retail Agency, Cushman & Wakefield, said: “Retailers with a long-standing presence in Poland are coming up with new concepts. For instance, the LPP Group has added a new premium fashion brand Tallinder to its portfolio, Carrefour is developing the concept of a premium supermarket branded Market, and Media Markt has created a new format of smaller stores to expand into smaller markets. Newcomers to the Polish market in H1 2016 included, among others, Skechers, NYX Cosmetics, U.S. Polo Assn., and the kids fashion brand Kanz from Germany. More brands are expected to enter Poland in H2 2016, including H&M’s & Other Stories, the Swiss homeware retailer MaxiBazar and the US fashion brand Forever 21.”

The vacancy rate in the eight major agglomerations remains stable at around 3%. Of the core Polish cities, Warsaw and Szczecin have the lowest vacancy rates at around 2%, whilst vacant space in the most competitive markets of Poznań and Łódź accounts for around 4%–6% of the two cities’ stock. In H1 2016, the average vacancy rate for regional cities with 200,000–400,000 inhabitants rose considerably to around 5%. The lowest vacancies were in Lublin and Toruń at around (2%–3%), while the highest were in Bydgoszcz (around 8%) and Radom (9%).

Prime retail rents remain stable, the highest standing at EUR 130–140/sqm/month for a prime unit in Warsaw’s best-in-class shopping centres. Other leading retail schemes in the capital city command EUR 80–110/sqm/month. Prime rents stand at EUR 45–55/sqm/month in other key agglomerations and at EUR 33–40/sqm/month in regional cities with 200,000–400,000 inhabitants.

Patrycja Dzikowska, Associate Director, Consulting and Research, Cushman & Wakefield, said: “Diversification of rental rates between prime and secondary retail schemes is expected to continue as a result of the increasing market competition and the planned high supply levels. Rents in secondary schemes and in projects under construction in particular are under strong downward pressure with tenants seeking fit-out contributions and rent-free periods at the start of operations. Base rent is only one of financial components of lease packages which include a number of incentives and financial contributions, particularly for the largest and most prestigious anchor tenants.”