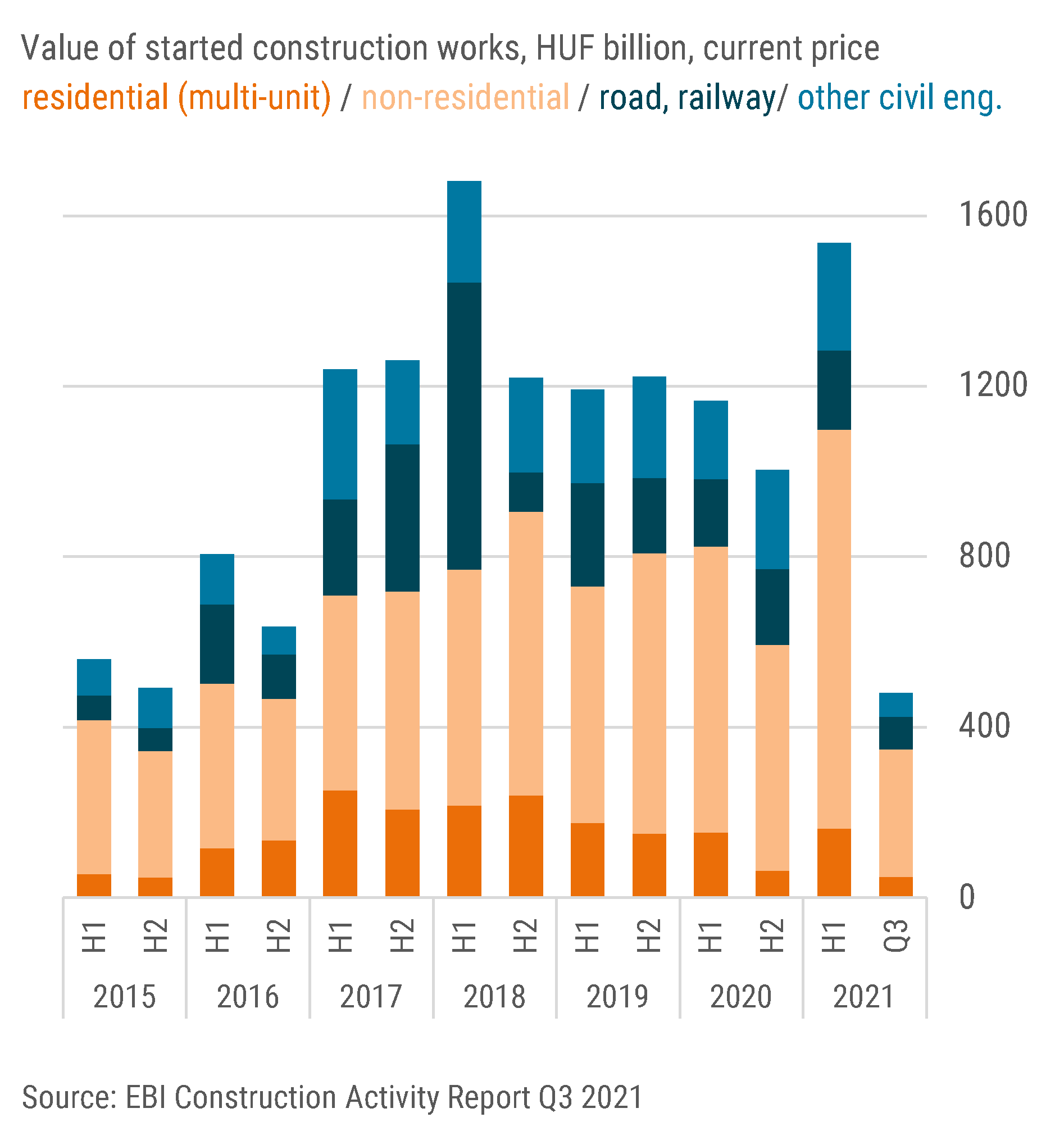

After a significant expansion in Q2 2021, the value of started construction works in the Hungarian construction industry marked a major drop between July and September. Yet overall, the Activity Start indicator remained high for Q3 2021 due to the exceptionally good second quarter, according to the EBI Construction Activity Report.

Prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database), the EBI Construction Activity Report examines the situation of the Hungarian construction industry on a quarterly basis.

Based on the projects listed in iBuild construction project information and company database, a total of more than HUF 2 billion worth of construction works started in the sector. The Activity Start indicator of EBI Construction Activity Report for the first 9 months of the year exceeded not only 2020, but also 2019, the former by 24% and the latter by 4%.

Smaller-scale building construction activity in July-September 2021

Similarly to the construction industry as a whole, building construction registered a weaker Q3. The Activity Start indicator of EBI Construction Activity Report was below the level of the first two quarters, but construction works in the sector started in a higher value than in the corresponding period of 2020. Thanks to the successful H1, in the first 9 months of the year the value of the Activity Start indicator was close to HUF 1,500 billion, marking a 24% increase like-for-like and also significantly higher than in the same period of previous years.

Multi-unit and non-residential also recorded a feeble Q3. However, in the latter, the value of started construction works in January-September exceeded the one in 2020 (by 31%) and the one in 2019 (by 36%) thanks to the high Activity Start of Q2 2021.

In Q3 2021 projects entering construction phase included the renovation of the new North Buda Unified Hospitals. In addition to the construction of several office buildings and industrial warehouses which will be described in detail later, the construction of Hotel Aria Residences and of the Szekszárd Knowledge Center also started.

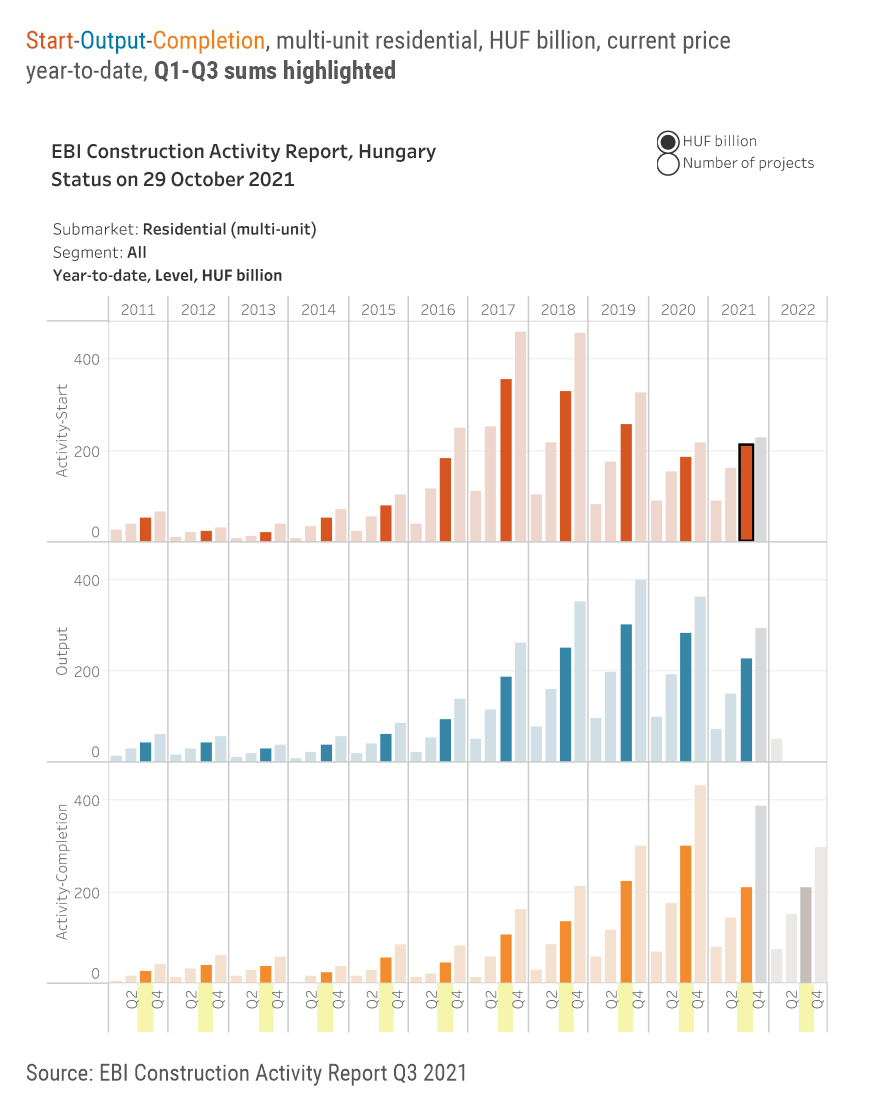

In the multi-unit housing segment, after the weak Q2, Q3 saw an even lower Activity Start. The value of launched construction works in the first 9 months was only 14% more than in the same period of the already poor 2020, and well below the level of previous years.

Frailing civil engineering in Q3 2021

Civil engineering also posted a reduction in Q3 2021. The Q3 2021 EBI Construction Activity Report has found that following an outstanding Q2, a rather low value of construction works started in the subsector. This was also true to road, railway, as well as non-road and non-railway segments. In the first 9 months, the Activity Start indicator of Civil Engineering exceeded the like-for-like indicator of 2020 (+15%), but it was much lower than in previous years.

The biggest launched civil engineering projects were the construction of the Sajószentpéter-Berente bypass on main road 260 and the works of the Gesztely-Szerencs stretch on main road 37.

Started construction works more evenly balanced regionally

In Q3 2021, the biggest share of construction works started in the eastern regions, but overall, in the first 9 months of the year, the western regions had the largest proportion of the total value of started construction works which exceeded the value of the previous years.

On the whole, East Hungary registered the fewest started construction works in January-September, in spite of the growth in Q3.

Multi-unit housing construction works slow to kick off

Despite the drop of the VAT rate on new homes down to 5% from 1 January 2021 (from 27% in 2020), there is no visible growth in multi-unit housing construction. In Q2 fewer multi-unit construction projects started than in Q1 and Q3 also saw a further decline. Yet due to the better Q1, the value of Activity Start of EBI Construction Activity Report for multi-unit housing construction in the first 9 months of 2021 was still 14% higher than in the same period of 2020.

Despite the VAT reduction, multi-unit home constructions are slow to start. According to the housing permit statistics of the CSO, ‘simple declarations to build a home’ played the main role in the growing number of permits this year. This may be due to the fact that since last fall's announcement to lower the VAT, developers haven’t had the time to prepare for large-scale projects and permits have not yet been obtained (which is the prerequisite to start construction works). But overall, as a result of the VAT reduction, we still expect the Activity Start of multi-unit housing construction to pick up in the future, especially because the recently launched ‘green loan’ might also boost demand for new homes.

Between July and September, the value of completed multi-unit projects was roughly at the level of Q2, falling short of previous expectations due to delays. In the first 9 months of the year, a total of HUF 208 billion worth of multi-unit housing projects reached completion.

Like in the first half of the year, most multi-unit construction works started in Central Hungary in the first 9 months. Although the rest of Hungary had a proportionately higher Activity Start in Q3, they still lagged behind their previous years’ share. Between January and September, only 10% of construction projects started in the eastern regions and 18% of them in the western regions against the 72% share of Central Hungary.

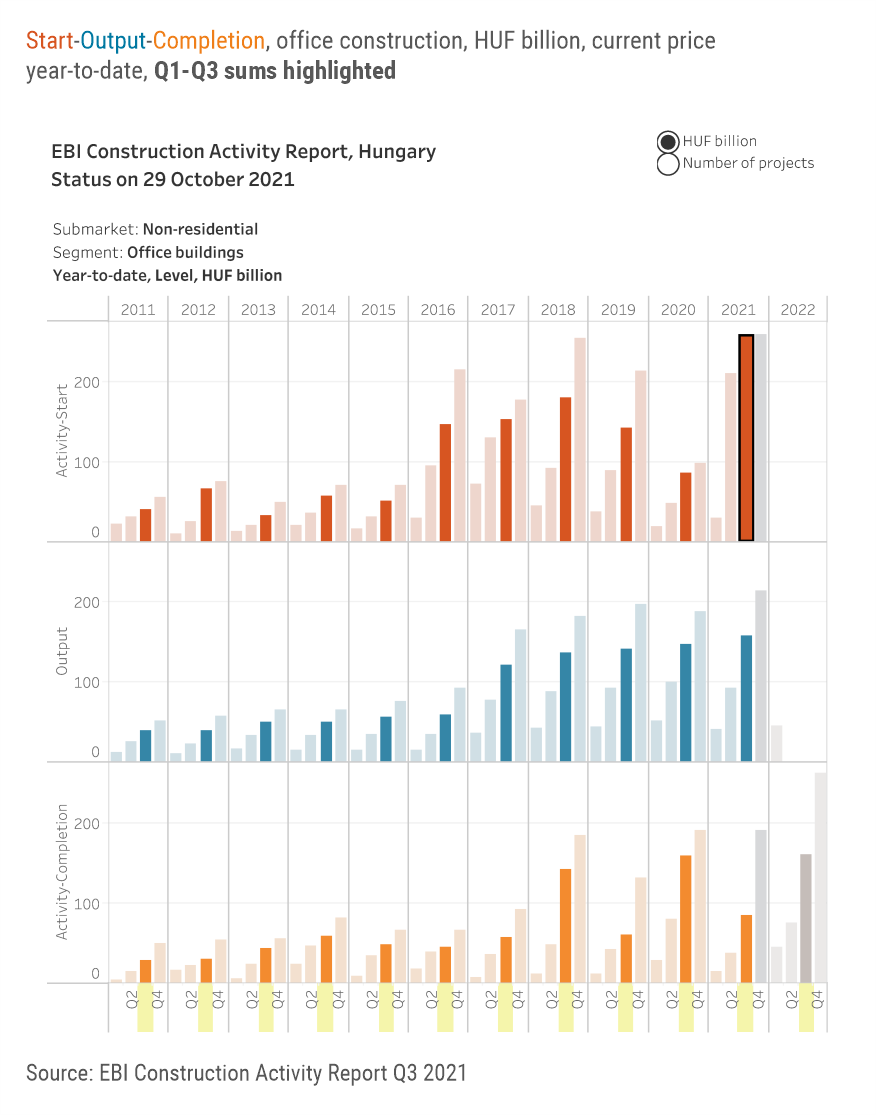

Office projects in 2021

Compared to the sharp decline in 2020, office projects have accelerated in 2021. The Activity Start of EBI Construction Activity Report for the first 9 months of the year surpassed the total annual value of the record year of 2018.

The reconstruction works of the former Joseph Archduke's Palace, the former Red Cross Headquarters and the buildings of the Ministry of Finance and the Hungarian National Bank have started. Also, the construction works of phase 4 of Madarász Office Park, phase 1 of BakerStreet Office Building, phase 1 of Dürer Park Office Building and the Richter Gedeon Headquarters have been launched.

This year there have been fewer completions. As per iBuild construction project information and company database, office construction works were completed on less than HUF 90 billion. For example, BudaPart City office building reached completion this year and in the last quarter, we might see further office building completions such as Aréna Business Campus B, Green Court Offices and OTP M12. This could greatly increase the value of this year's Activity Completion indicator.

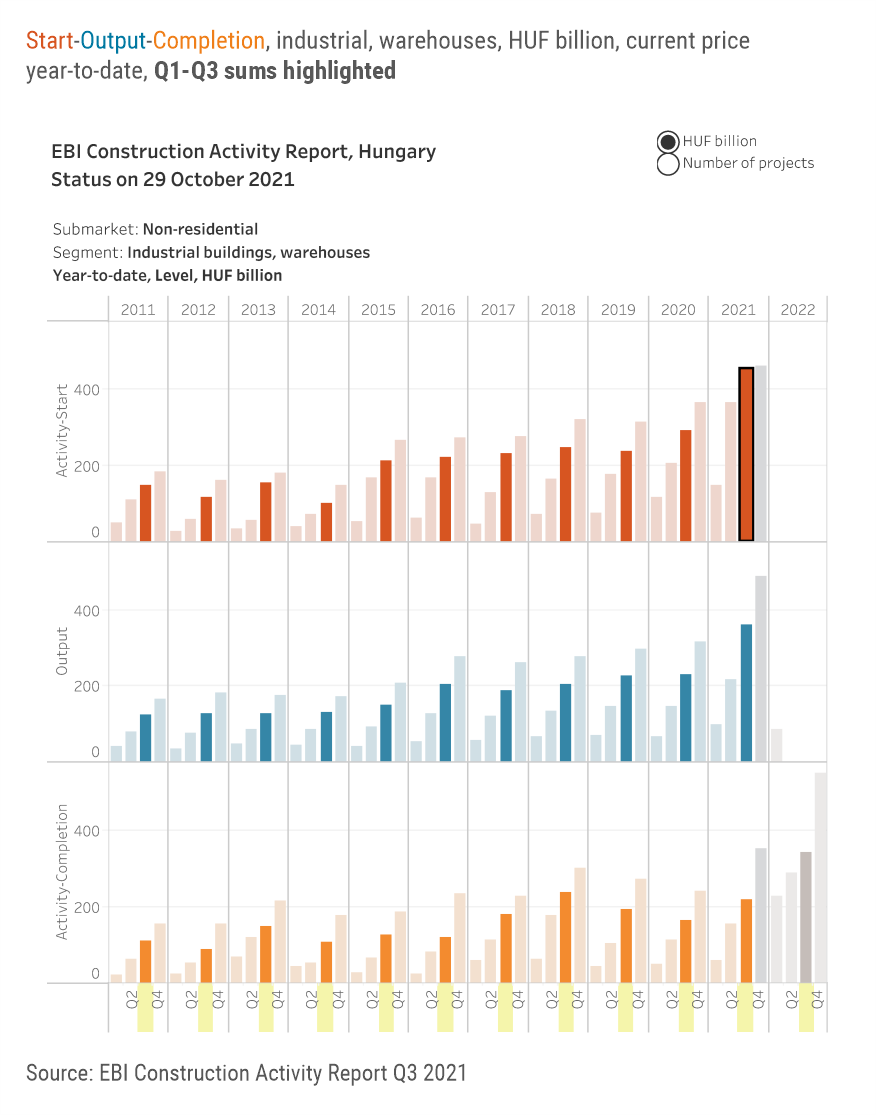

Warehouse projects in 2021

The construction of industrial buildings and warehouses has also been showing a strong upswing this year. The value of started works, after 2020, is hitting another record in 2021. The value of construction works started in the first 9 months of the year in the segment has already significantly exceeded last year’s total Activity Start.

This year has seen the construction start of SK Innovation battery plant in Iváncsa, Semcorp separator film production plant in Debrecen, Phase 2 of Mercedes-Benz K1 press plant in Kecskemét and East-West Gate intermodal logistics center in Fényeslitke.

Several completions have already taken place and more are expected in the last quarter, possibly making 2021 a record year for completions as well. For example, this year has seen the completion of phase 2 of SK Innovation battery factory in Komárom and the M0-M31 warehouse in Nagytarcsa. Nestlé Purina pet food plant in Bük and LIDL's logistics centre in Ecser are also set to be completed yet this year.