In previous quarters the analysts of the EBI Construction Activity Report broadly discussed the negative effects of the pandemic on Hungary’s construction industry. The latest figures also suggest that there is still no improvement in the sector after a weak first half of the year.

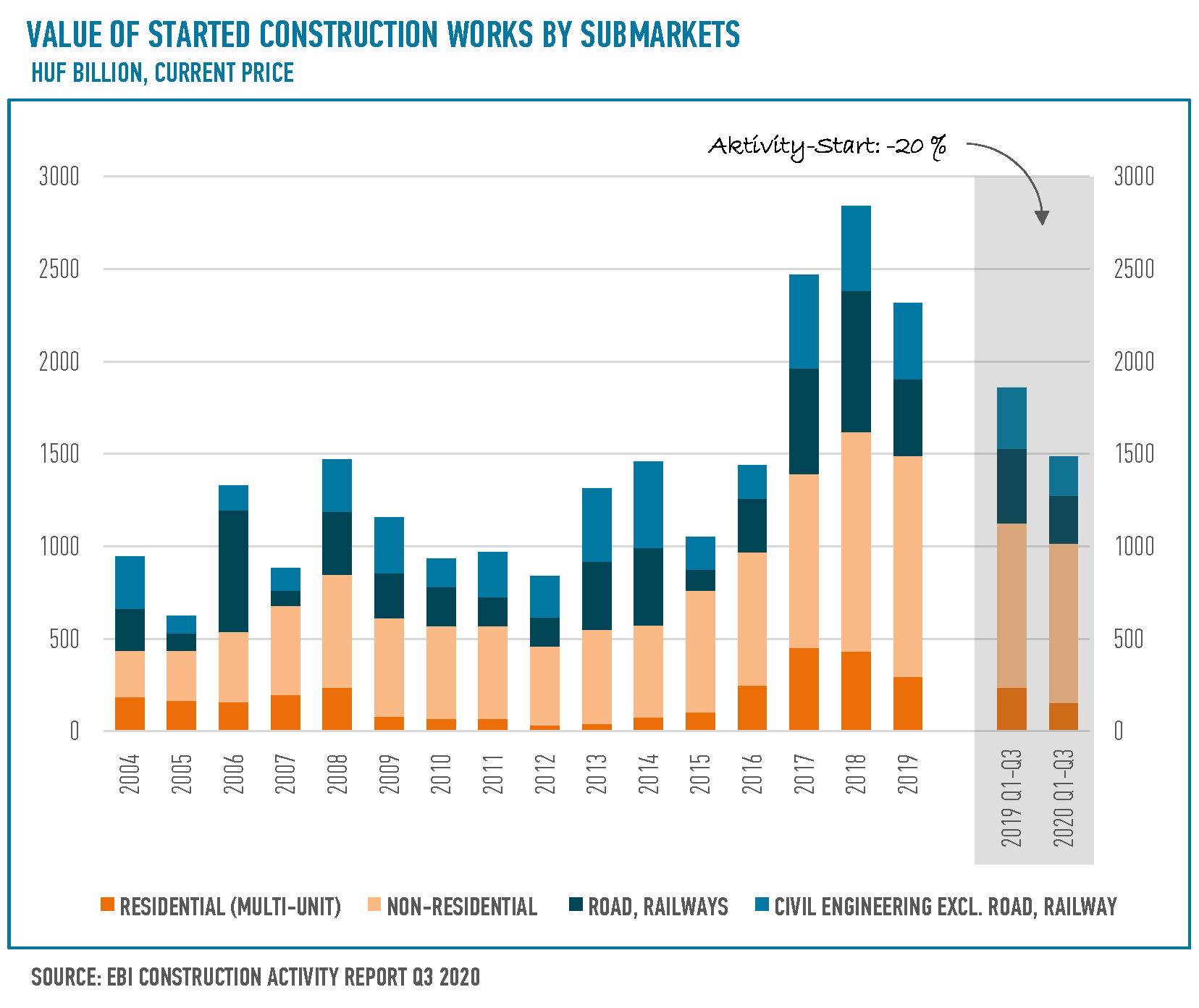

In the first three quarters of 2020, construction works started at a 20% lower value than in the same period of 2019, even though the beginning of the year got off to a good start in construction. The value of Activity Start indicator stood only at HUF 1,484 billion, the lowest amount in the last 4 years. Between July and September, less than HUF 390 billion worth of construction projects started, which is also a negative record because since Q4 2016 we haven’t seen such a low Activity Start in Hungary. Compared to Q2, there was an 18% slump between July and September, according to the EBI Construction Activity Report.

The EBI Construction Activity Report examines the situation of the domestic construction industry on a quarterly basis, including the volume of newly started construction works, and the value of projects completed in each quarter in aggregate and by sector as well. It is prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

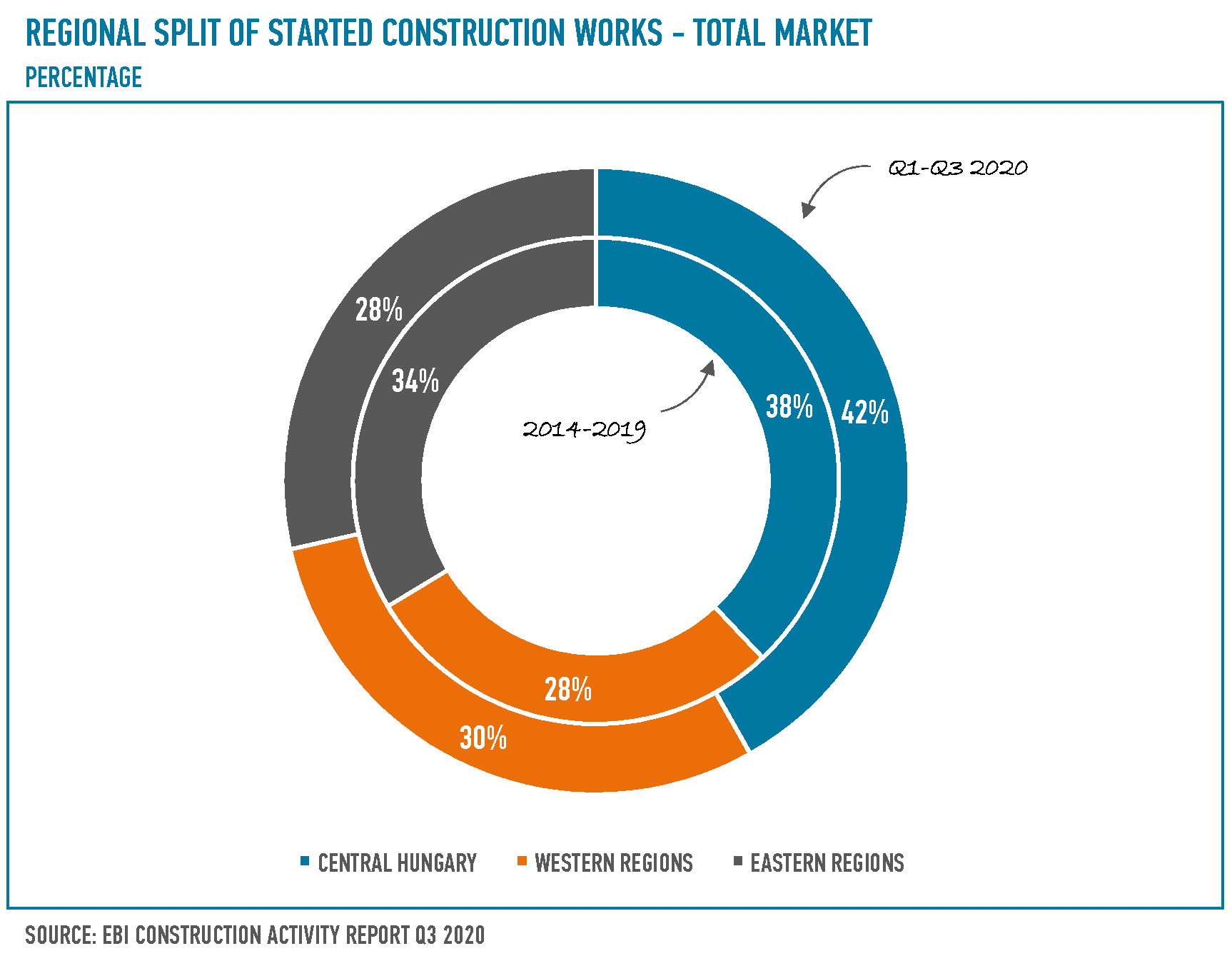

In the first 9 months of 2020, 42% of construction works started in Central Hungary and 30% in Western Hungary, so works started in both areas at a higher rate than the average of previous years. Looking at Q3 alone, Western Hungary's share is outstanding (45%) due to the launch of several major projects such as the one for Main Road 83 (Győr-Pápa).

Civil engineering projects fell back

Although Q2 saw higher numbers in civil engineering than Q1, Q3 registered another drop in Activity Start. Thus, overall, construction projects in the subsector started in a significantly smaller value in the first 9 months of 2020 than in the same period of 2019. Against the first three quarters of 2019, the value of started construction works was 36% lower. The Activity Start indicator accounted for HUF 470 billion (out of which only HUF 145 billion between July and September). Considering the past 3 to 4 years, figures for the first three quarters are rather weak. It was only in 2015-2016 when the value of projects entering construction phase was lower. In the first 9 months, road and railway, as well as non-road and non-railway civil engineering segments, were characterized by the same drop as in the previous year. Among civil engineering works, for example, construction phases 1 and 2 of Main Road 83 started in Q3.

Few building construction projects have been launched

Building construction did not improve in Q3 either. Between July and August, projects started at a lower value than in Q2, totalling HUF 244 billion - the lowest level since Q4 2016. According to the EBI Construction Activity Report, the value of Activity Start indicator amounted to HUF 1 billion for the first 9 months of the year (a 10% shrinkage like-for-like).

The rate of decline was bigger in case of multi-unit housing construction: January and September 2020 saw a 35% lower value of started such projects like-for-like. In case of non-residential buildings, the difference was only 3%, which was mainly due to the high numbers in Q1. The Activity Start indicator in Q2 (which was low compared to the last three years) was followed by an even weaker Q3. Yet, larger projects did start in this period. For instance, among non-residential projects Q3 2020 saw the start of Phase II of the University of Physical Education in Budapest (sports hall and underground garage: Csörsz block), renovation works of Csokonai National Theatre and Latinovits Theatre (Debrecen), Phase III of BalaLand FamilyPark (Szántód) and the revamp of Allee shopping centre (Budapest).

Multi-unit housing starts continued to deteriorate

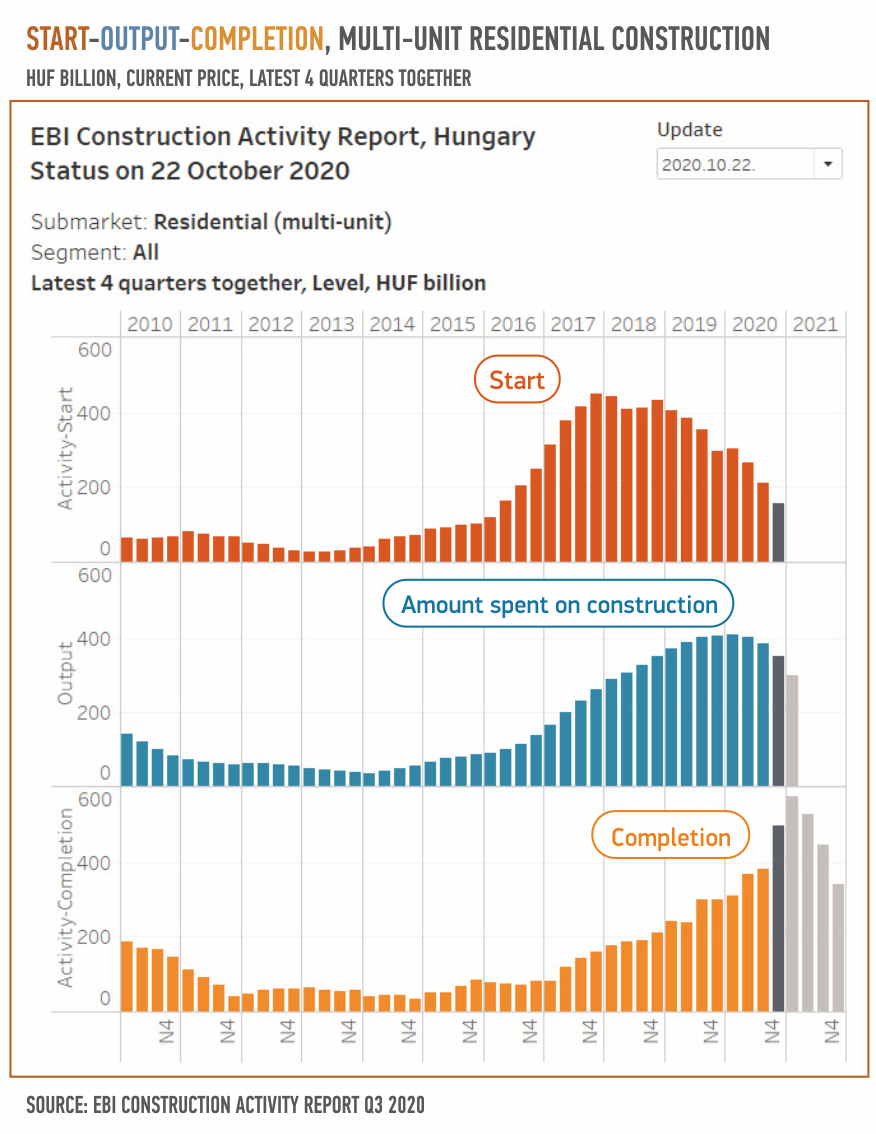

Even compared to the previous weak quarters, Q3 2020 brought a deteriorating Activity Start for multi-unit housing construction. Projects entered construction on a value of only HUF 21 billion, a level not seen since 2014, and the low number of projects already evoked the low levels of 2013 during the crisis. No wonder that figures for the first 9 months have been a multi-year negative record since 2015, with Activity Start amounting to only HUF 154 billion.

Q3 2020 also saw a record broken for completions of multi-unit housing projects, with homes never being completed in such a high value as in July-September. The value of the Activity Completion indicator was HUF 122 billion. This peak is estimated to be broken in Q4 with the value of Activity Completion being HUF 193 billion, according to the EBI Construction Activity Report.

But the announcements in recent weeks that affect the housing market may bring major changes in the segment. Although resetting the VAT rate on new homes from 5% to 27% this January largely contributed to this year's dramatic drop in Activity Start, the VAT rate is set to fall back to 5% from next January in case of constructions that start until the end of 2022. Moreover, families can even be exempted from paying the 5% VAT. The new regulations are set to kick-start projects again, so the analysts of the EBI Construction Activity Report expect a considerable improvement in the Activity Start indicator.

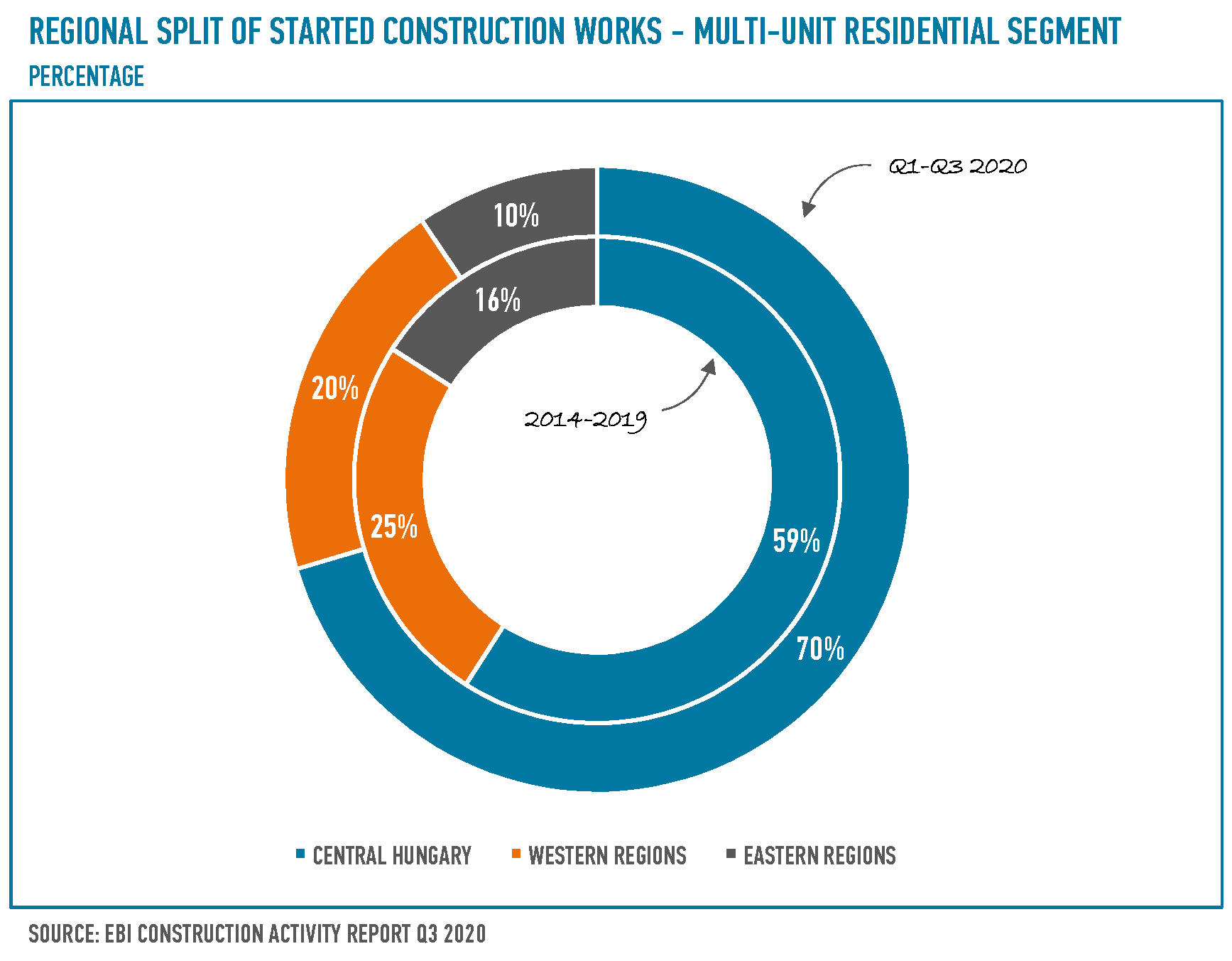

In Q3 2020 the share of Budapest and Greater Budapest in the Activity Start of multi-unit housing construction slightly dropped against the high numbers of previous quarters, sinking to the average level of previous years. Yet, it remained high for the first 9 months.

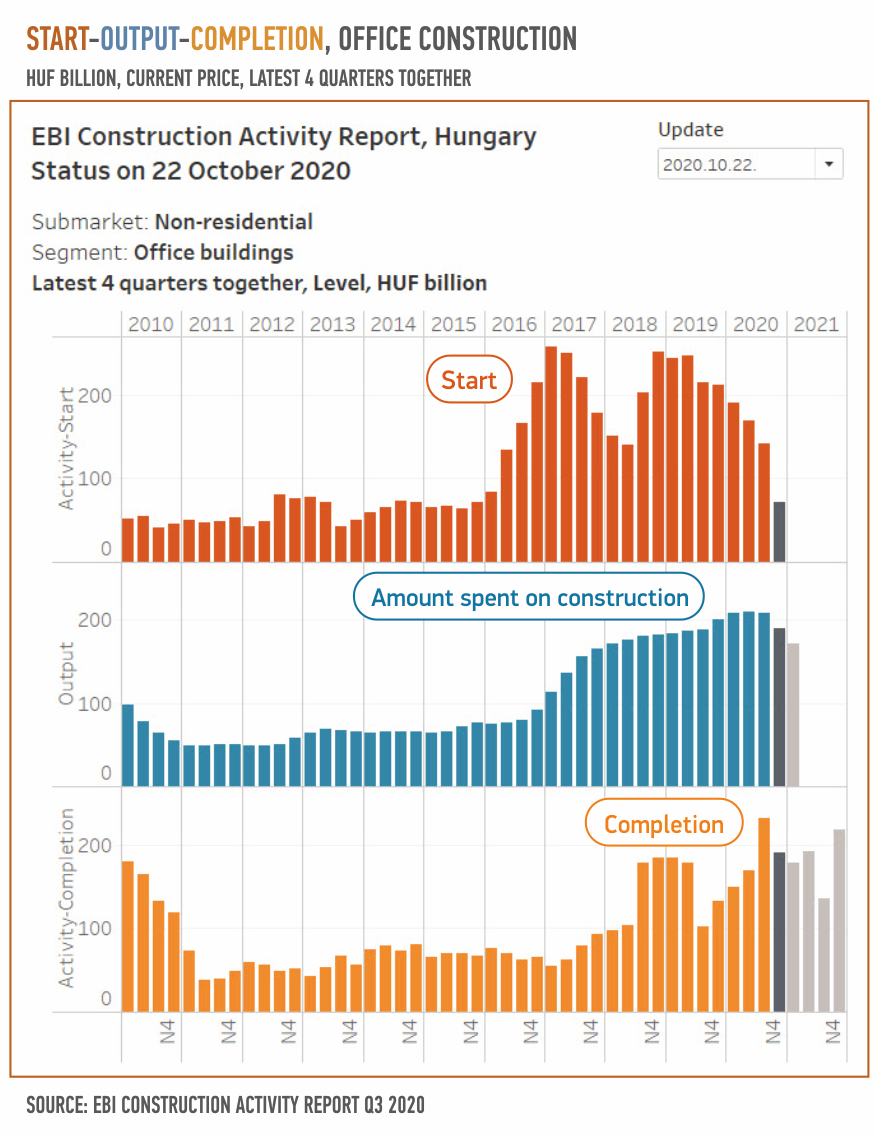

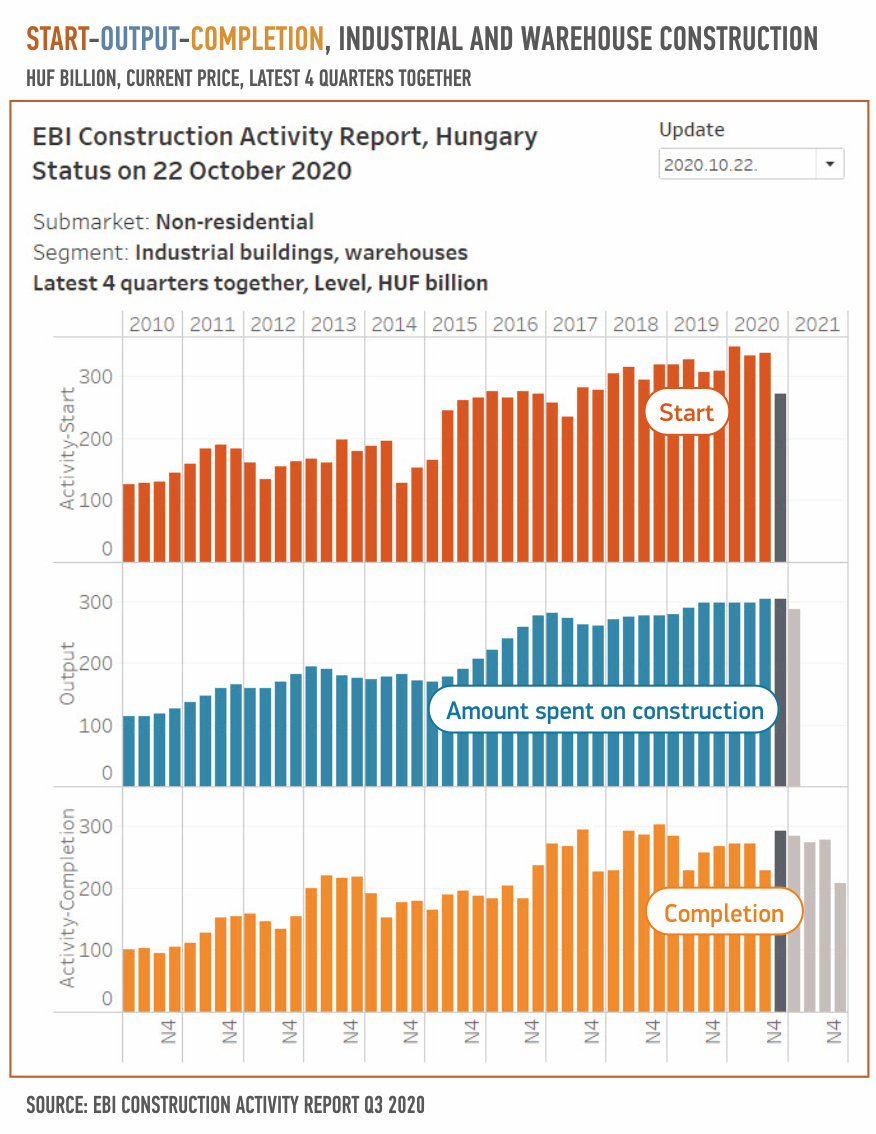

What did the year bring in office, and in plant and warehouse projects?

2020 brought a massive decline not seen since 2015 in the value of started office projects. In the first 9 months of this year projects started only in the value of HUF 72 billion. After the weak Q1, Q2 brought some expansion, but Q3 again saw a lower Activity Start, with projects entering construction phase on only HUF 26 billion. For example, Phase I of H2Offices (Skanska) entered construction and the renovations works of Városmajor 12 office building started. Office building developers may also be uncertain about the impact of the pandemic on office usage habits. It is not yet clear whether the current rise of teleworking will transform demand for offices in the long run. At the same time, there was no shortage in completions in 2020, the value of Activity Completion indicator amounted to HUF 159 billion, the highest value during three quarters. This year has seen, for example, the completion of BudaPart GATE C office building, Arena Business Campus Building A, Agora Tower, Agora Hub, and the buildings E and F of Váci Greens.

Q3 saw some decline over the previous two quarters in the start of plant and warehouse projects (which is treated as one segment as per the methodology of the EBI Construction Activity Report). In total, in the first 9 months of 2020, construction works in the segment started on HUF 263 billion, up 11% from the year-ago period. This, however, was only thanks to the strong start of the year. 2020, for example, saw the construction start of M0-M31 warehouse, Samsung's battery plant (Göd), JYSK’s new logistics and distribution centre (Ecser), LIDL’s new logistics hub (Ecser), Caadex steel structure production hall (Komló), and Phase II of the vegetable oil refinery plant (Foktő).