A huge increase in urban logistics property space is required across key centers in Europe in the next few years to meet the exponential growth of e-commerce and the resultant need for last mile delivery in cities, according to a new research report from Cushman & Wakefield.

The Urban Logistics report uses Cushman & Wakefield’s ‘Urban Space Model’ – developed in partnership with P3 Logistic Parks – to quantify total urban logistics space requirements in Europe’s top e-commerce markets based on current and future online sales volumes. The ‘Urban Space Model’ expects delivery volumes across Europe to increase by a further 69% by 2021, with variations by market impacting space required. Its methodology includes a number of inputs and assumptions based on actual urban logistics practices and current online transactional data.

“The number of Czechs shopping online is increasing, making it crucial for big cities to manage an increasing amount of deliveries. The use of urban logistic space will be vital for online retailers and parcel shipping firms in the future. This is the only way they can satisfy the growing customer requirements for the speed and reliability of delivery,” says Ferdinand Hlobil, Partner and Head of Industrial in Central and Eastern Europe at Cushman & Wakefield, adding: “Online shopping has also expanded in the food sector in recent years. Whilst before it was a rare practice in connection with big brands such as Tesco, more and more people use these services nowadays. In our country, we can speak about a strongly competitive environment with players such as Rohlík and Košík. According to GfK, food sales via the internet in the Czech Republic are ranked third in all of Europe, therefore it can be expected that the issue of urban logistics will be especially important for this segment.”

“Urban logistics has huge potential for small and big companies, for local and international players alike. This is also an opportunity for the development of urban locations and specific sites that, while currently maybe not attractive in terms of new residential development, still need investments into revitalisation and development adequate to the state of affairs in 2017/2018,” says Ferdinand Hlobil.

In terms of population and buying power, London is the largest and most mature e-commerce market in Europe with a current urban logistics space requirement of 870,000 sqm. This total is expected to exceed 1.2 million sqm in 2021, an increase of 42%.

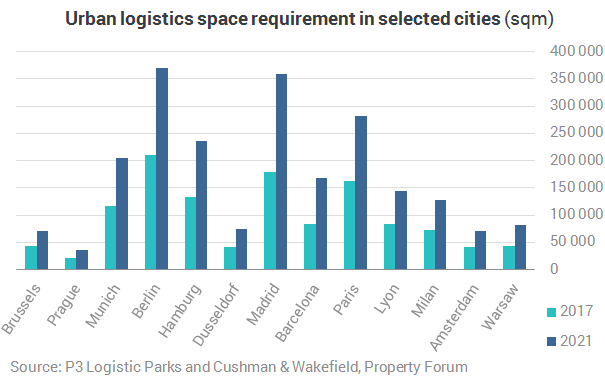

After the UK, Germany is the next key e-commerce market in Europe, in part due to its multiple major cities, and its head start in online shopping relative to the rest of the continent. Required space across German markets is expected to increase by 77%, although the 370,000 sqm requirement in its largest market, Berlin, will still be less than a third of London’s requirement in 2021.

Less mature e-commerce markets on the continent will benefit from strong online sales growth which will fuel increasing levels of demand for space by 2021. Requirements are set to expand most in percentage terms in Spain, with Madrid and Barcelona increasing by 102% to 360,000 sqm and 167,000 sqm, respectively. Urban logistics space requirements in Warsaw, a relatively small market that has outperformed growth estimates in e-commerce volumes over the past couple of years, are expected to expand by 90% from only 43,000 sqm to 82,000 sqm by 2021.

The report also shows that the cost of urban deliveries is high, up to 50% of total supply chain costs in Europe, totalling €70 billion and expected to grow 7-10% over the next five years. Currently, real estate solutions are situated on the outskirts and unable to enter cities due to competing higher-value land uses and city stakeholders’ opposition to logistics.