The longer-term trend of price increases on the residential market continues to be the most likely scenario as demand continues to outpace supply in many of the larger cities of Romania, according to a report by the Eastern European Construction Forecasting Association.

EECFA (Eastern European Construction Forecasting Association) is conducting research on the construction markets of 8 Eastern-European countries such as Bulgaria, Croatia, Romania, Russia, Serbia, Slovenia, Turkey and Ukraine.

This report was written by Dr. Sebastian Sipos-Gug - Ebuild srl, EECFA Romania.

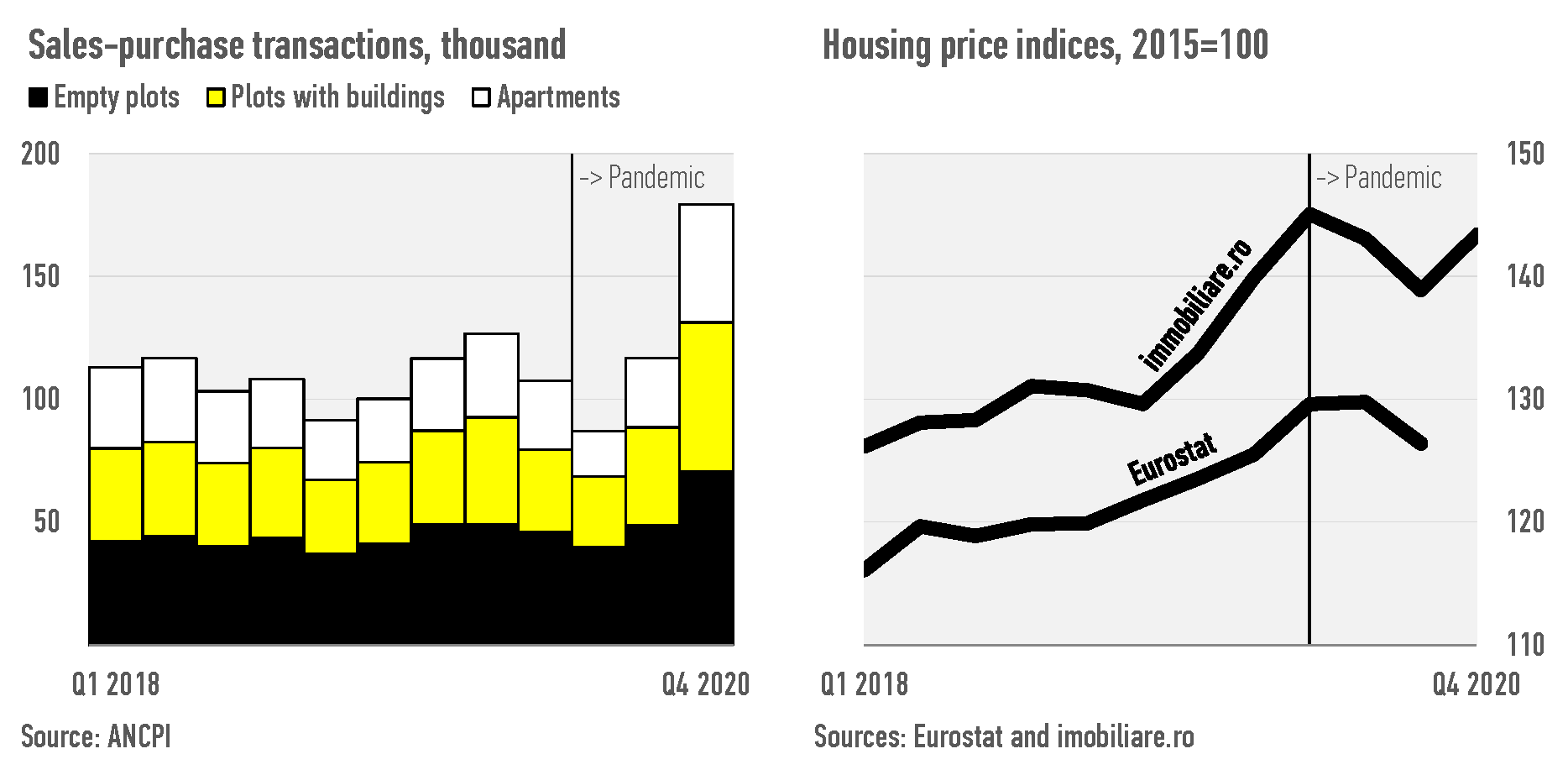

Prices on the Romania residential real estate market in Q1 2020 reached their highest value in the past decade and an unease started to permeate the market with flashbacks to the 2008 credit crunch and the massive drop in prices and transactions that followed. This made many developers rush to complete projects before the market collapse.

Prices did indeed start to drop slightly by Q3 2020, but they remained at a level higher than that of the previous year and by the end of the year the early indicators pointed to a return to growth. This has been pointed out in other markets as well and seems to have impacted a large number of developed and developing economies. However, each country is different, and in the case of Romania, albeit some of the causes of this phenomenon are shared, the outcome and forecast might be different.

Everything is relative and so are prices

One can wonder if these prices are too high, and if they might grow further or if we're looking at a potential bubble that will burst in the near future. Since then, the main factors have changed in light of the pandemic, but it might still be useful to look at the same ratio between income and home prices that we analyzed then and bring it up to date. In 2007, the average net monthly income could buy you approximately 0.20 sqm of an average located two-room apartment. By 2017, when we last ran this test, one could buy 0.46 sqm with the average wage. For 2019 and 2020 alike, our estimates place this indicator at 0.50 sqm and so home prices relative to income actually seemed to be relatively stable.

Why some prices were expected to fall and why they haven’t

While in general there might be a plethora of reasons for residential prices to drop, in the case of the pandemic-related economic downturn we were initially looking at several factors, somewhat similar to those we saw in 2008, such as unemployment, lower income, higher mortgage default rates, stricter lending criteria, higher interest rates and/or a rush to sell off properties by underfunded developers. In the case of the pandemic, some of these did indeed happen.

- Employment did indeed decline between March and November 2020, but only by 2%-3% compared to the same months of the previous year (source: NSI). This was largely due to the employment protection measures taken by the government, which provided incentives to furlough personnel rather than firing them.

- Average income rose during the pandemic. Even in April and May, the months worse hit by the lockdown, net wages actually grew by 2% over the same months of 2019 (source: NSI). This was also maintained by the furlough scheme that provided payments of up to 75% of wages for the employees of companies affected by the pandemic.

- Loans past due declined. By November 2020, the share of loans past due in total loans was 4.83%, down from 5.46% in November 2019 (source: NBR). Granted, this is still far from the 1.24% average we saw in 2008 but is well within the general descending trend of the previous three years. There was some government support in this segment as well, with the possibility of postponing loan repayments for those negatively impacted by the pandemic, and some banks also took their own measures in this direction.

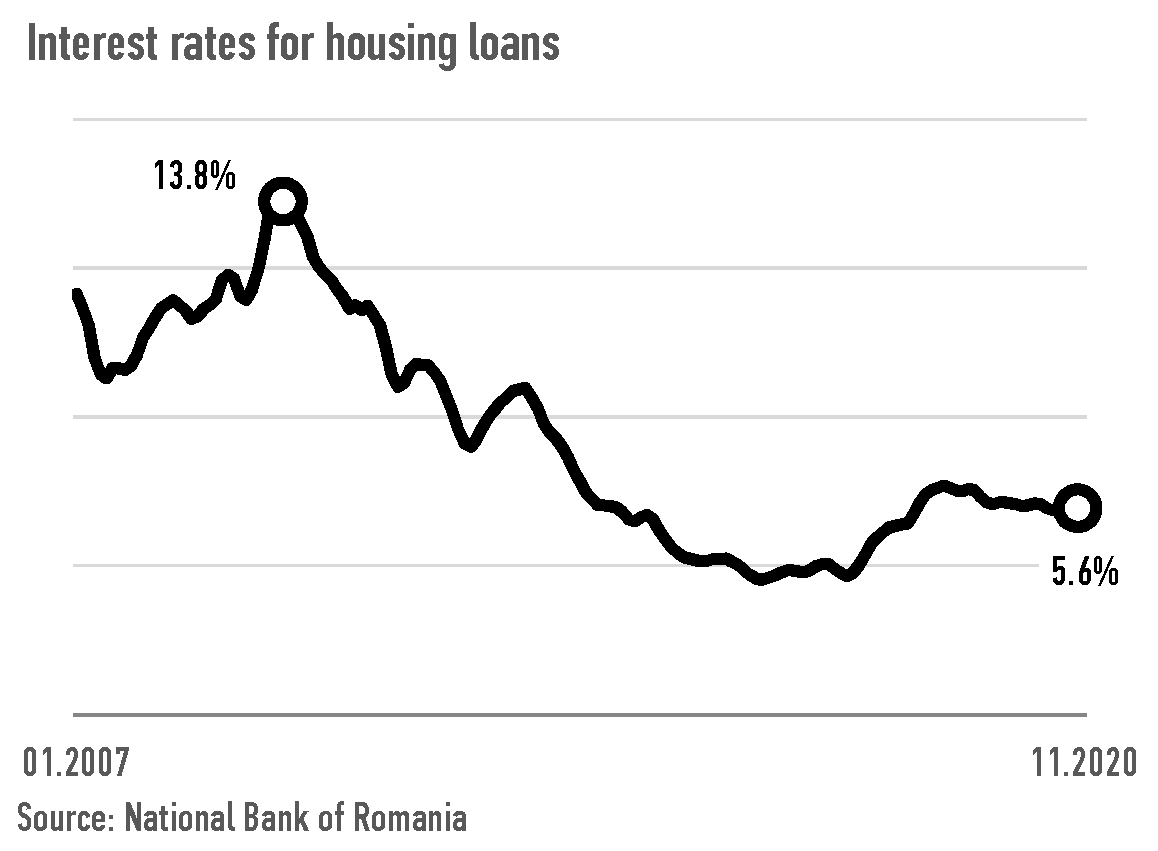

- Lending criteria and interest rates. Lending conditions remained relatively stable while interest rates for mortgage loans declined slightly by November 2020 over November 2019 (-0.5pp, source: NBR). This was partly due to the impact of the tax change in late 2018 that raised interest rates in 2019 over their trend and was later reversed.

- Developers had a more secure line of financing. While during the previous recession in 2008 a lot of development was carried out through credit, by early 2020 many properties under construction were pre-sold, and down payments on these provided the necessary cashflow to continue building and even wait longer to find buyers in order to sell at a better price.

- Furthermore, due to the reduced spending possibilities with the shutdown of non-essential travel, in-restaurant dining and entertainment venues, spending habits changed. Despite income slightly growing (on average), the saving rate went up and thus by end 2020 the population had a lot more money saved on their accounts, even if the term deposits didn’t go up as much. This high level of very liquid capital can be used to fund residential investments, be it renovation, construction or purchasing a new home.

Where the market is heading?

The longer-term trend of price increases on the residential market continues to be the most likely scenario as demand continues to outpace supply in many of the larger cities like Bucharest or Cluj Napoca. Some potential events would bring merit to a more pessimistic outlook:

- Changes in employment and income might be ’ticking bombs’. As said, a lot of the market stability is due to government intervention in preventing mass unemployment and ensuring a minimum income. Once these braces come off, there are genuine concerns that the labour market might see a correction, which would have a negative impact on the residential real estate market. The risk of this is somewhat low, though, since a large portion of those furloughed has returned to work (with some notable exceptions in the hospitality industry), but a small correction could still happen.

- Medium- and long-term changes in work trends. With the surge in remote work due to the pandemic measures, one can wonder if this would lead to more structural changes in the way people work in the future. If remote work becomes more common for a significant proportion of people, this will have a massive impact on the residential market. It would lower demand in large cities and increase it in metropolitan areas and smaller cities. This would be somewhat limited in the case of Romania, though, as the country still has relatively large economic segments being less prone to remote work such as manufacturing and construction.

- We are already noticing some changes in home buyer preferences. After spending more time at home, either in lockdown or from working at home, homebuyers now focus on larger homes, preferably with a yard or at least a large balcony.

Case in point: Cluj Napoca

Taking Cluj Napoca as an example, the local real estate market is seeing massive demand increases as young people, mainly in the IT field, move to the city to study and take up work. They enjoy higher-than-average income and living in the city gives them proximity to various entertainment and services options, access to a booming labour market, entrepreneurship, and business opportunities. But they also have some major downsides: high rents and residential prices that chip away at their income, gridlocks, light and noise pollution and many other disadvantages of living in a city. With the advent of the work-at-home scheme, they might be more interested in relocating to homes in the neighbouring rural area (even more so than they are now) and thus retain a higher share of their wages without the downside of commuting. This would put less pressure on the residential market in the city itself, and lead to lower rents and prices. The city thus becomes less interesting for developers and construction might slow down.

The conclusion

Despite the pandemic, home prices are seemingly growing. While this might seem strange at first, the actual impact of the current recession on home purchases is limited since the average individual still has their job with a similar or even higher income and is actually spending less of their income on goods and services and thus can afford to save for a down payment. In the shorter run, the market shows some signs of overheating but is far from brittle. If the pandemic recovery turns out to be lengthy and there are major changes in the way work is done, it could limit prices and drive them down temporarily. However, if you are holding out in buying a home waiting for prices to collapse, you might be in for a bit of a disappointment.