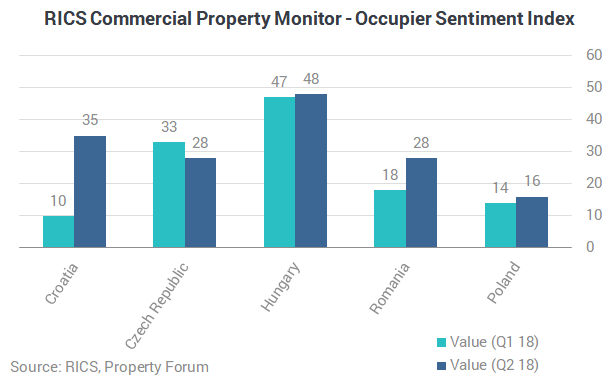

Occupier sentiment improves in most CEE countries

In Q2 2018 the value of the RICS Occupier Sentiment Index (an overall measure of occupier market momentum) increased in four of the five monitored CEE countries (Croatia, Hungary, Romania and Poland) and decreased in the Czech Republic.

Once again, Hungary posted the strongest reading in the region with occupier demand rising in all market segments. Croatia saw the strongest improvement of the quarter, driven by accelerated demand across the board. Occupier demand continued to rise at the headline level in the Czech Republic as well, although at a more moderate pace. In Romania, the pace of growth accelerated slightly over the quarter. Occupier demand in Poland increased sharply in the office and industrial sectors, as a result of which the occupier market sentiment is now stronger than at any other point since 2011.

“In recent years the specific dynamics of the different CEE markets have become more differentiated. The results in the current survey reflect this trend and also point to a more even balance between supply and demand for occupiers, developers and investors. This, in turn, implies a maturing of the markets which should lead to longer term stability. Even at historically attractive levels of pricing, CEE real estate remains an attractive value proposition compared to other regions in Europe. This underlines the continued positive outlook reflected universally in the survey,” added Noah M. Steinberg FRICS, Chairman & CEO of Wing, Chairman of RICS in Hungary.

Noah Steinberg

Chairman of RICS in Hungary, CEO-Chairman

WING

Noah M. Steinberg the Chairman and the CEO WING. He is an American citizen, but he has been working in Hungary since 1990, for Wallis, then with WING. Having over 15 years of experience in strengthening the cooperation among local and international companies, managing several companies present in the sales, services and real estate market. Works in his current position since 1999. He studied in Princeton college and at the Diplomat Academy of Vienna. He is married, the father of two, speaks 5 languages (English, German, French, Spanish, Hungarian). More »

Looking at supply, the availability of leasable space declined only in Croatia and the Czech Republic. Respondents in Croatia reported the sharpest quarterly decline in availability since the survey was formed in 2016. In Hungary, the availability of leasable space edged up for the first time in three years.

On the back of this, landlords reduced the value of incentive packages offered to tenants in Croatia, the Czech Republic, Hungary and most segments of the Romanian market. Landlords in Poland continued to increase the value of incentive packages, but at the slowest rate since 2012.

“The Croatian market has shown steady improvement over the past 24 months, and a lack of vacant office supply has led to a number of developers starting new office projects, something that we haven’t witnessed over the past five years. In terms of investment, we expect to see at least two notable office transactions in Zagreb by year end, whilst the retail sector has continued to witness transactions, both in Zagreb and the southern regional cities. There is also still significant growth potential in the leisure sector, with the majority of the Adriatic coast still lacking international quality hotels and facilities. In general, there is much to be positive about over the short to medium term”, highlighted Andrew Peirson MRICS, Managing Director SEE at CBRE.

Andrew Peirson

Managing Director SEE

CBRE

More »

Contributors in the Czech Republic trimmed their rent expectations for the year ahead across all submarkets. In Croatia and Hungary, average rental growth expectations were broadly similar to the previous quarter, whereas, in Romania, rental value projections for the year ahead remained elevated at an all-sector level. In these four countries, prime office and retail rents are anticipated to see the strongest growth. Projections are also positive in secondary locations, except for the Czech Republic where the outlook is rather flat. Expectations were revised up in Poland, where prime office and industrial are set to see the strongest gains in rental values. The outlook is slightly negative for secondary office and retail in the region’s largest market.

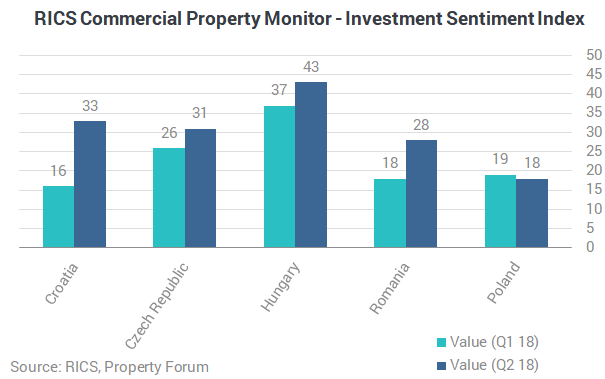

Hungarian and Polish markets are close to peaking

The value of the RICS Investment Sentiment Index (an overall measure of the investment market) also increased in four of the five monitored CEE countries (Croatia, the Czech Republic, Hungary, Romania and Poland) and decreased slightly in Poland.

Investor demand continued to rise at the headline level in all CEE countries surveyed by the RICS in Q2 2018. Croatia posted the strongest gain in the region with demand growth rising at the fastest pace since the local survey was formed in 2016. Respondents in Hungary and Romania also reported robust demand growth with office and retail being the standout sectors, respectively. It is worth noting that the pace of growth on the Czech investment market during Q2 2018 was the slowest for nearly five years. Demand from foreign investors remained unchanged in the Czech Republic while it rose modestly in the other four countries.

““The CEE market continues to be a key target for international and domestic investors. Strong macroeconomic fundamentals and a healthy occupational market support the long-lasting success story. Poland again outperformed the market with an over 50% share in the investment volume for H1 2018. Investor preference for retail continues, taking close to 50% of volume. Yield compression from previous years slowed down in 2018. Bank financing is available with competitive pricing for moderate leverage across CEE although banks have become more selective. As we look forward into the last quarter of 2018, it is to be expected that investment figures should achieve last year’s results”, commented Dieter Knittel, Director Europe at Deutsche Pfandbriefbank AG.

Dieter Knittel

Head of CEE

Deutsche Pfandbriefbank AG

Dieter Knittel is Head of Central and Eastern Europe at pbb Deutsche Pfandbriefbank. The regional focus is on Poland, Czech Republic, Slovakia, Hungary and Romania. Dieter has been active in the CEE market for more than twenty years, including five years based in Warsaw between 1997 and 2002 as Head of Credit and Senior Risk Management. More »

The supply of property for investment purposes increased marginally in Hungary, Romania and Poland, remained unchanged in Croatia and decreased in the Czech Republic.

In Croatia and Hungary, 12-month capital value projections were revised up from Q1 2018. Expectations remained unchanged for Romania and Poland, while they were scaled back across all submarkets in the Czech Republic. Solid capital value gains are projected across all prime submarkets in all countries but in Poland, where the outlook is only moderately positive. The outlook for secondary markets is more modest in every CEE country, turning flat to negative only in Poland.

“Poland appears to have restored its position as the commercial real estate powerhouse amongst the CEE-6 in 2018. The higher reliance on domestic demand rather than exports has seen the Polish economy sustain its strong 2016-17 momentum: the economies of the CEE-6 peers have slowed down. €3.2 billion, or 58%, of the region’s €5.6 billion commercial real estate investment volume went into Poland in H1 2018, more than doubling from H1 2017’s dip. Investors and real estate developers by now understand the Polish political environment and choose to price risk accordingly. Prime commercial office yields in Warsaw are squeezing lower, as a function of demand, whilst yields in other sectors are steady, similar to the rest of the CEE-6 region. The strong economic growth should keep vacancy rates nationally near to the recent low cycle levels over the next 12 months and keep rents firming, especially in the industrial sector and the office sector in some Polish regional cities”, highlighted Monika Rajska-Wolinska MRICS, Managing Partner | Poland at Colliers International.

Monika Rajska-Wolińska

Managing Partner, Poland

Colliers International

As Managing Partner for Poland, Monika is responsible for the strategic and operational activities of the company. Monika has 20 years of experience in the real estate sector. She is a member of RICS, the CEO Round Table, Young Presidents’ Organization and Women Leadership in Business Foundation. Monika’s passion for real estate and her focus on providing a complex and tailored service to clients has been recognised among market professionals. In April 2015, Monika was named Professional of the Year in the prestigious industry competition the CEE Quality Awards co-organised by the Financial Times. Monika is one of the twelve members of the Colliers EMEA Board, which determines the company’s strategy in Europe, the Middle East and Africa. More »

The majority of contributors feel that the market offers fair value at present in all five countries, although the proportion of respondents stating that valuations are stretched has been slowly creeping up in Hungary, Romania and Poland for several quarters now. On the Czech market, the share of those who feel that the market is already overly expensive increased further in Q2 2018.

“Despite the fact that we are starting to see an increase in the perception that some markets in CEE have peaked or are close to peeking, considering ongoing transactions and the current appetite, we believe in Romania there is room for growth in the near future. This is mainly driven by the quality of available product combined with the high returns that are still achievable. Unlike in the rest of CEE, yields in Romania have remained relatively stable in the last 2-3 years. Prime yields in Bucharest are currently at 7% for retail, 7,5% for office and 8,5% for industrial. In the meantime, the economy has grown significantly, the occupier markets have reached historic highs and financing has become more easily available and cheaper. While the core German investors remain cautious about the country, we are seeing a wide variety of regional (mainly Czech and Hungarian), US, Romanian, Middle Eastern and Asian capital actively pursuing deals in Romania, which will most likely be reflected into much improved liquidity in the near term,” added Andrei Vacaru, Head of Capital Markets Romania at JLL.

Andrei Vacaru

Head of Capital Markets

JLL Romania

Andrei has over 13 years’ experience on the Romanian real estate market which spans over different segments, including capital markets, consultancy, retail leasing and retail tenant representation. He joined JLL in May 2007 as Senior Consultant in the Retail Department. He then managed the Retail and, afterwards, the Research and Consultancy departments. Since joining the Capital Markets team in 2014, Andrei has contributed to landmark transactions. The JLL Romania Capital Markets team has advised on transactions with a total volume of close to €1 billion in the last 4 years. Andrei holds a Bachelor’s Degree in Public Communication, from the University of Bucharest. He has attended various education programs including a scholarship in humanities at Midsweden University in Sundsvall, Sweden. More »

The majority of respondents in Hungary (48%) sense that the market is close to peaking and almost all of the contributors in the Czech Republic (92%) believe the market has now reached its peak. In Poland, 52% of survey participants still believe that the market is in the growth phase of the current cycle, but 48% sense conditions may be close to peaking. The largest share of respondents in Croatia and Romania believe that market conditions are consistent with the early to middle stages of an upturn.

On balance, credit conditions improved in Croatia, Hungary and Poland and deteriorated in the Czech Republic and Romania. Respondents in the Czech Republic have now reported a marginal decline in credit conditions for three consecutive quarters.