Industrial property specialist Gazeley announced that it is adopting the GLP brand name following its acquisition by the global investment manager in 2017. In addition, GLP announces that it has closed on the acquisition of Goodman Group’s Central and Eastern European logistics real estate portfolio.

GLP currently has US$7 billion of assets under management across the UK, Germany, France, Spain, Italy, Poland and the Netherlands. The addition of this portfolio spread across Poland, the Czech Republic, Slovakia and Hungary expands GLP’s European presence to 11 countries placing it within a select number of logistics real estate investors with a truly pan-European platform.

Nick Cook, President, GLP Europe, said: “Since entering the market in 2017, GLP has strategically expanded its presence across Europe to meet investor demand and support its disciplined pan-European growth strategy. We believe attractive macroeconomics, urbanisation, e-commerce growth and proximity to major distribution hubs across Europe are helping to drive Central and Eastern Europe’s logistics real estate market.”

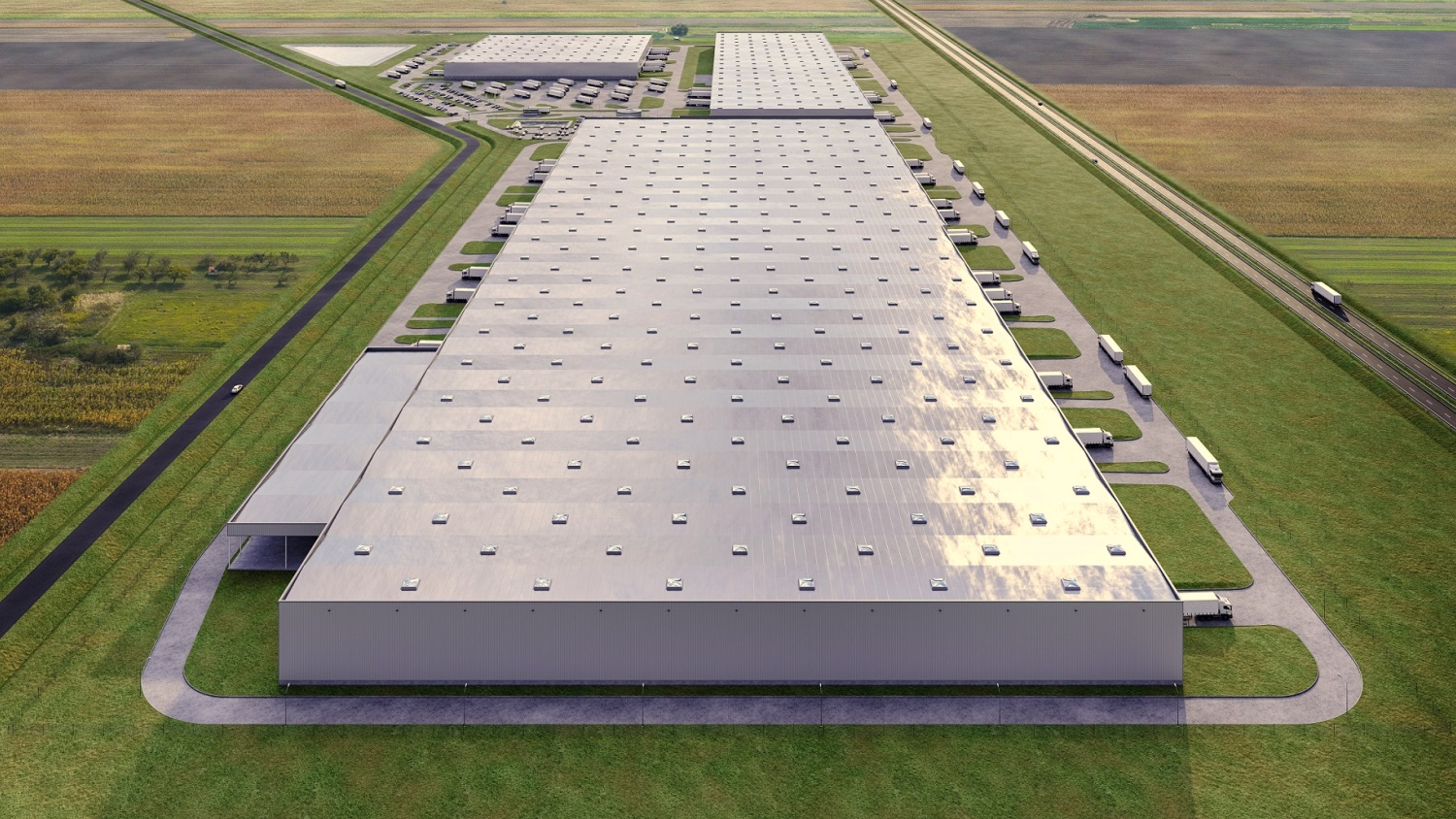

The acquired portfolio is concentrated on key logistics routes across the region with access to growing markets for e-commerce and distribution. It will bring a number of new customers into the business and allow it to better support existing customers with their expanding supply chain requirements across Europe. To support the acquired portfolio and the Company’s growth in the region, Goodman Group’s Central and Eastern European local teams will join GLP’s European business.

Kirkland & Ellis served as legal counsel to GLP on the acquisition of the CEE portfolio, with Greenberg

Traurig and Kinstellar providing local legal advice. Cushman & Wakefield served as advisors to GLP. Goldman Sachs and Citi financed the acquisition.