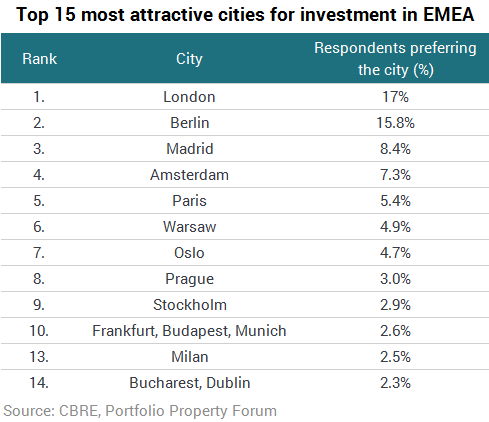

London has been ranked as the most attractive European city for real estate investment for the sixth consecutive year, according to CBRE’s annual Investor Intentions Survey being launched at MIPIM 2017. At 6th place Warsaw is the most attractive CEE city among investors. Prague placed 8th, with Budapest (10th) and Bucharest (14th) also making in the top 15.

In terms of the immediate challenges impacting the acquisition of real estate assets, availability of product and pricing of assets were considered the greatest obstacles facing investors this year. This is reflected in the results for some of the gateway cities in Europe, with Hamburg, Milan and Munich dropping out of the top 10, and Paris retaining a top-5 position as one of Europe’s most attractive cities, expressing keen interest in the city despite aggressive pricing and potential political risk. Meanwhile Oslo and Stockholm were prominent new entries in the top 10 most attractive investment cities, reaffirming the strong investor interest in the Nordics.

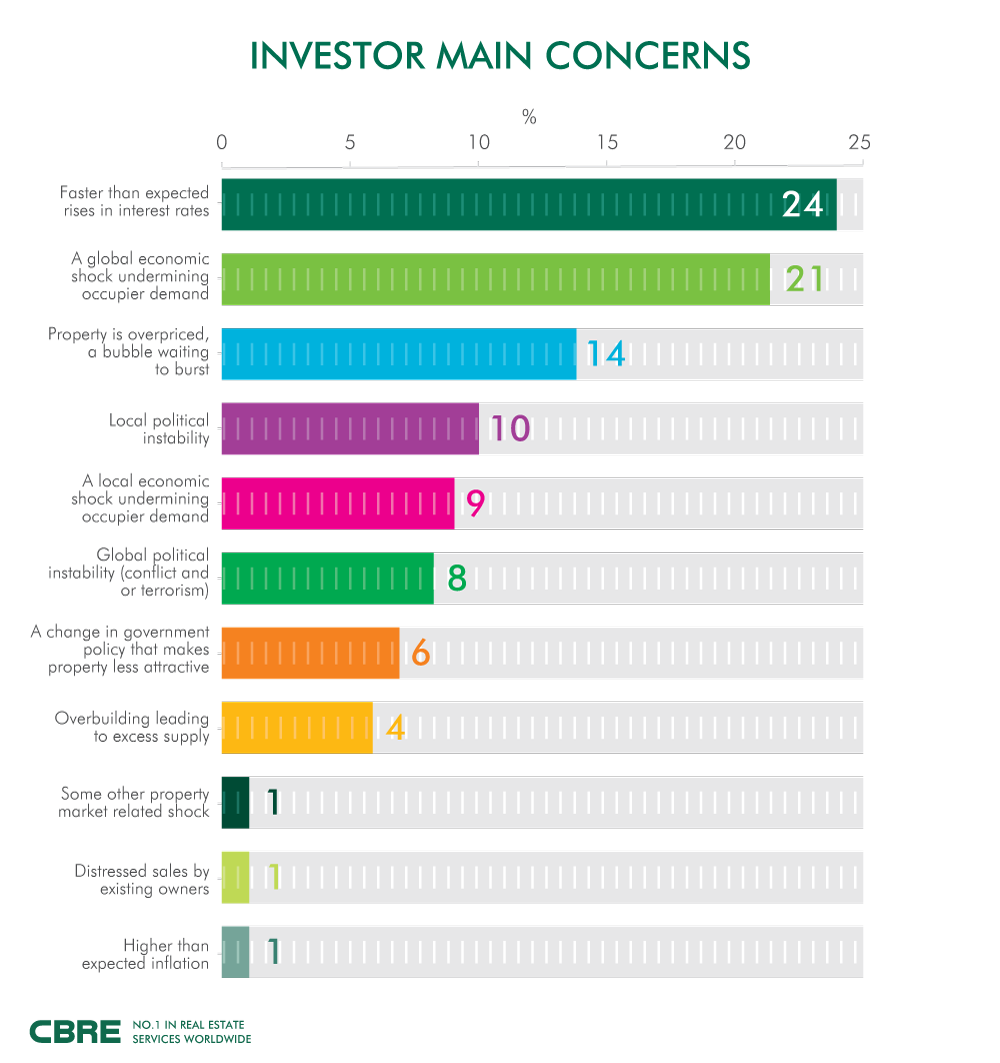

While 2017 will be an eventful year, with several major elections in Europe, investors’ focus appears to be more concentrated on the economic climate rather than geopolitical events. The most frequently cited risk for 2017 was “faster than expected interest rate rises”.

Jonny Hull, Managing Director of EMEA Investment Properties at CBRE adds: “Europe remains a key target for property investors globally and the economic outlook for the European economy remains positive. Whilst the core markets of the UK and Germany remain the largest investment destinations, markets such as the Nordics and CEE are increasingly important components of global investment strategies. Furthermore, cities such as Madrid, Budapest and Dublin are both ranked within the top 15 most attractive European investment destinations, highlighting the popularity of Europe’s recovery markets as investors seek value-add investment opportunities.”