Over one million square metres of industrial space is currently under construction in the Czech Republic. Most of them are pre-leased. New completions reached a record 521,600 sqm, representing the highest-ever volume of new space delivered to the Czech market. This is a 295% increase compared to Q3 2021 and an incredible 340% increase compared to Q2 2022. However, possible pressure on the correction of market rents can be expected. Given the current rent levels, it is already possible to register a declining interest of some of the Czech and foreign companies in leasing industrial space in the Czech Republic, according to the latest Knight Frank report.

Key highlights:

- Total lettable area of modern warehouse and industrial space reached 10.69 million sqm in Q3 2022.

- A record 521,600 sqm of new space was delivered to the market, but 36% of this was a single hall built for Amazon.

- 1.1 million sqm of warehouse and manufacturing space was under construction, up 25% year-on-year.

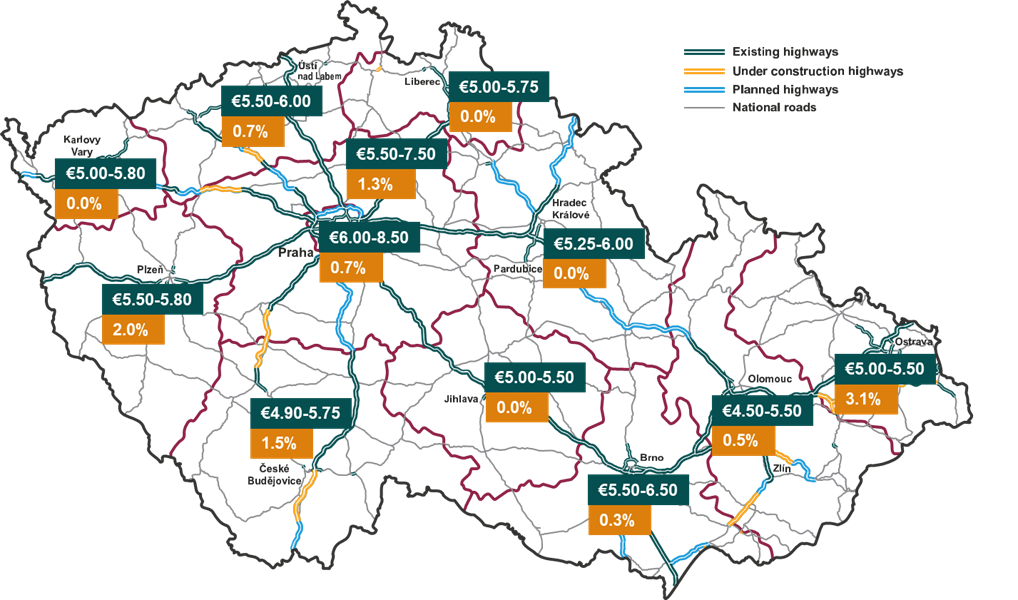

- The vacancy rate remained unchanged from the previous quarter at 1.0% on average across the country, with the vacancy in Prague and its surroundings increasing slightly from 0.5% to 0.7%.

- The highest achieved rents for warehouse and industrial space were €6.0-7.5/sqm/month in Q3 2022. Rents in the Prague region and surroundings were in some cases offered at €8.5/sqm/month.

"The law of supply and demand will be the one that will determine the further development of rental prices. There is currently more than one million sqm of industrial space under construction, most of which is already pre-let. The availability of warehouse space remains at a low level of 1.0%. Given the current rental levels, we are already seeing declining interest from some domestic and foreign companies in leasing in the Czech Republic. Prices of building material inputs are now stabilising and the supply of more projects could put downward pressure on market rental prices. It is also necessary to take into account other factors that our customers are facing, such as the price of containers, which has tripled in the last two years, or concerns about the upcoming winter season due to rising energy prices or increasing demands for sustainability", comments Markéta Vrbasová, Head of Industrial & Logistics at Knight Frank.

In Q3 2022, the total lettable area of modern warehouse and industrial space rose to 10.69 million sqm. Prague and its surroundings accounted for 32% of the total supply and remained the largest logistics market, followed by the Pilsen region with 15%, South Moravia with 12% and Moravia-Silesia with almost 10%.

New completions reached a record 521,600 sqm, representing the highest-ever volume of new space delivered to the Czech market. This is a 295% increase compared to the same period last year and an incredible 340% increase compared to the previous quarter. Most spaces were completed in the Olomouc (36%), Plzeň (16%), Moravian-Silesian (11%) and Central Bohemia (9%) regions. The largest completed space was the 186,800 sqm of space for Amazon at Panattoni Park Kojetín. This was followed by a 56,900 sqm hall in CTPark Bor for GXO Logistics. The third largest completed project was a 27,900 sqm hall in the new industrial park P3 Ostrava Central, which has been only half leased to three tenants so far. The total lettable area has also recently been increasing through sale & leaseback transactions.

At the end of Q3 2022, more than 1.1 million sqm of warehouse and production space was under construction. This was a 25% increase compared to the same period last year. Thanks to the start of construction of the hall with the largest lettable area in the country (233,700 sqm) in Panattoni Park Cheb, the largest amount of space under construction (29%) was located in the Karlovy Vary Region, followed by the Ústí nad Labem Region with 15%, the South Moravia Region with 14% and the Pilsen Region with 13%.

The vacancy rate remained unchanged in Q3 2022 and, as in the previous quarter, reaching 1.0%. Vacancy in Prague and its surroundings remains very low, up only slightly from 0.5% to 0.7% compared to the previous quarter. The most significant quarter-on-quarter decrease in vacancy rates was recorded in the South Bohemia Region (minus 7.3 percentage points) and the Olomouc Region (minus 2.4 percentage points). On the other hand, the Moravian-Silesian Region recorded a vacancy rate increase of plus 3.0 percentage points.

With financing becoming more expensive in virtually all currencies, yields are starting to rise in virtually all segments, including manufacturing and logistics, where the yield rate rose by half a percentage point in Q3 2022. We are seeing an increasing number of development projects in various stages of development in the market. In the case of manufacturing and logistics properties, this is currently one of the few opportunities to secure suitable space and potential buyers are also being recruited from among end users. Such buyers can then expect a sale & leaseback upon completion.

In Q3 2022, prime rents for warehouse and industrial space remained unchanged and amounted to €6.00 - €7.50/sqm/month. Rents in the Prague region and surrounding areas were in some cases offered €8. 50/sqm/month. Average rents increased the most quarter-on-quarter in the South Bohemia region by 15%. This was followed by the South Moravian Region (9%), the Karlovy Vary Region (8%), the Hradec Králové Region together with the Pardubice Region (7%) and the Pilsen Region (7%). In Prague and its surroundings, rents rose by 4% on average.

Expectations for future developments

According to the latest estimate, the gross domestic product grew by 3.7% year-on-year. Economic growth thus continued in the first half of the year, despite the adverse circumstances. However, the high inflation rate will have a negative impact on the second half of the year, resulting in a slowdown in growth. Nevertheless, the Ministry of Finance expects the economy to remain growing at 2.2% for the full year 2022. For 2023, the Ministry of Finance forecasts a further slowdown to 1.1%, as households will face the impact of rising prices of goods and services.

The labour market remains understaffed in virtually all sectors. During the summer months, the labour market was affected by seasonal work, resulting in an unemployment rate of 2.5% in August, down 0.4 percentage points year-on-year. Even given the deteriorated economic outlook, we expect unemployment to rise slightly in the coming months.

Yields on 10-year government bonds fell twice in a row after reaching 5.12% at the end of June. At 4.11% at the end of August, bonds had fallen below the low yields for premium real estate, which they were still beating in June. From a property investment perspective, this is good news as government bond yields are considered by many potential investors as a benchmark for where to park their funds for appreciation.