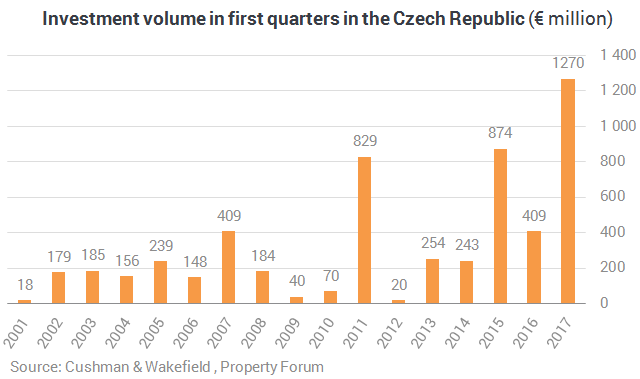

€1280 million was invested in commercial real estate in the Czech Republic in the first quarter of 2017. This is the largest ever amount of investment registered for a first quarter. The result is mainly attributed to three major transactions: the sale of the Letňany Shopping Centre the CBRE GI portfolio and the change of the Olympia Brno owner. The Czech National Bank’s exit from currency interventions should not slow the strong demand for commercial real estate down.

“Accounting for 78 % of the total volume, retail was the most active sector in the first quarter. Transactions such as the sale of CBRE Global Investors’ portfolio (in the Czech Republic, this includes Olympia Plzeň, the Nisa Liberec Shopping Centre and Zlatý Anděl in Prague) and the IKEA retail parks (including Avion Zličín in the Czech Republic) featured a pan-European dimension, thereby underlining investors’ interest in this well predictable sector in recent years. However, the fact that most of the centres have been sold to long-term investors will cause other segments, in particular offices, to strengthen in the coming years,” says Alexander Rafajlovič, Partner in the Capital Markets team at Cushman & Wakefield.

“The situation will not change in any appreciable way for international investors, because income from commercial real estate is denominated in the euro to a large extent. The same is true in most cases of acquisitions. On the other hand, an appreciating Czech crown may expose retailers to foreign owners exerting more pressure for rent increases. The position of Czech buyers, who will be able to offer more euros for properties, will also strengthen,” says Alexander Rafajlovič.