The European Central Bank has highlighted growing vulnerabilities in housing markets and stretched financial asset valuations in its Financial Stability Review for November 2021. The ECB has also warned of an increased likelihood of a correction in both residential and commercial real estate markets.

Key messages for commercial real estate markets

- An elevated share of investors still sees the market in a downturn, especially the lower-quality end of CRE markets

- Pandemic-related experience with remote working, health concerns and stronger demand for more environmentally friendly buildings may move demand towards modern, high-quality office spaces over the medium term

- The shift towards e-commerce may also have an outsized impact on lower-quality retail space

- Investors expect rents for non-prime office and retail properties to decrease strongly over the next 12 months

- Exposures to the most vulnerable CRE asset types could be substantial for both investors and banks

- Risks to financial stability stemming from real estate markets remain elevated

Vulnerabilities are growing in euro area property markets

Euro area residential real estate (RRE) prices showed robust growth throughout the first half of 2021. Nominal house prices grew at 7.3% at the euro area aggregate level in the second quarter of 2021 – the fastest rate observed since 2005. Policy measures have helped to maintain household incomes during the pandemic, while favourable financing conditions have allowed households to obtain financing for house purchase at record low interest rates. Together with a possible preference for more living space as people worked from home, this fuelled demand for housing during the pandemic. Despite the recovery in residential construction, labour shortages, global supply chain bottlenecks and input price increases are weighing on the construction sector’s ability to expand housing supply, which is putting upward pressure on house prices. Rents have not followed the strong increases in house prices in most countries, which may partly reflect regulations in many rental markets.

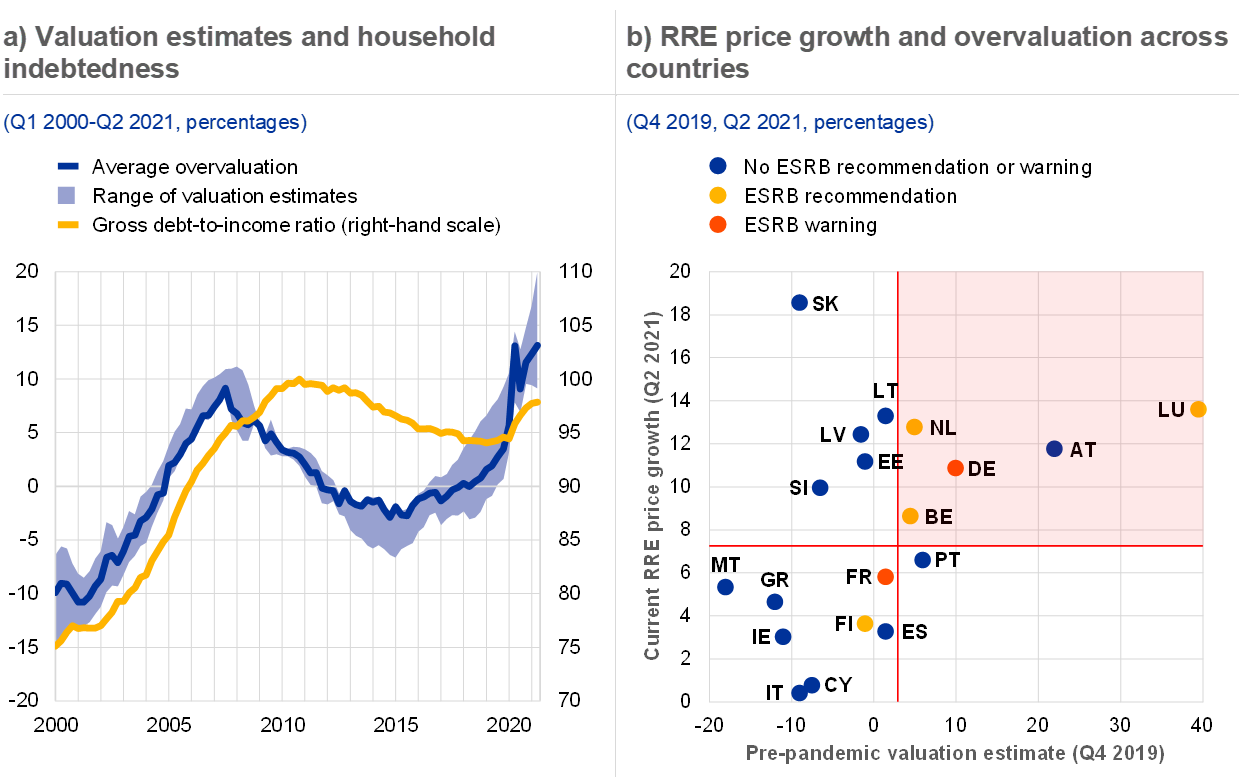

Medium-term vulnerabilities in euro area residential property markets have continued to build up. While short-term risks have declined markedly since the height of the pandemic as financial conditions have eased, risks of price corrections over the medium term have increased substantially amid rising estimates of house price overvaluations. As price and lending dynamics are outpacing household income growth, household indebtedness and RRE overvaluation are increasing, adding to the build-up of medium-term vulnerabilities and concerns over a debt-fuelled housing bubble. In particular, households with variable rate mortgages or shorter fixed-rate periods on their mortgages are exposed to an unexpected rise in interest rates, which could adversely affect their ability to service their debt.

House price and lending dynamics have been much stronger in many of the countries with pre-existing vulnerabilities. House prices have generally risen more in countries which had stretched valuations prior to the pandemic, resulting in further increases in estimated overvaluation. Coupled with higher mortgage lending growth in some countries where households face higher debt levels, the risks of a price correction and the build-up of vulnerabilities appear unevenly spread across euro area countries. Particularly notable are developments in countries that had already received a warning or recommendation from the European Systemic Risk Board (ESRB). This has strengthened the case for considering activating further macroprudential policy measures. Lending standards like loan-to-income and loan-to-value ratios had eased prior to the pandemic and there is some indication that they have eased further, adding to concerns about household and bank resilience going forward.

Estimates of house price overvaluation have been rising alongside prices, particularly for some countries

What about commercial real estate?

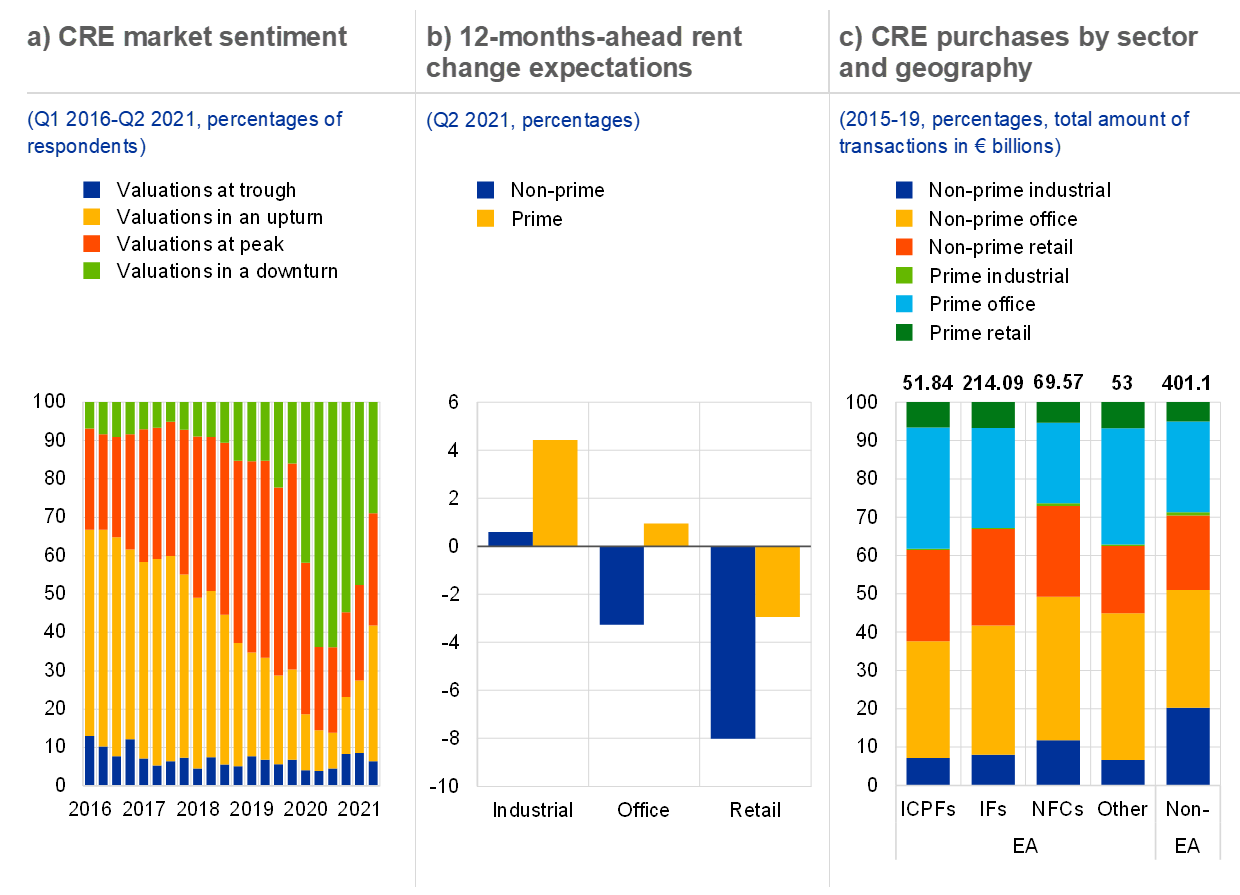

Commercial real estate (CRE) markets started to recover following marked declines during the pandemic, but the outlook for the non-prime segment remains poor. While overall market sentiment has improved in tandem with the wider economy, an elevated share of investors still sees the market in a downturn. Recent market intelligence suggests that this downturn is particularly pronounced for the lower-quality end of CRE markets. Pandemic-related experience with remote working, health concerns and stronger demand for more environmentally friendly buildings may move demand towards modern, high-quality office spaces over the medium term. The shift towards e-commerce may also have an outsized impact on lower-quality retail space. This division is clearly visible in survey data which show that investors expect rents for non-prime office and retail properties to decrease strongly over the next 12 months. Should these trends prove to be lasting structural changes, non-prime segments could face risks of pronounced market corrections.

A sustained decline in CRE markets could feed through the wider financial system and negatively affect the real economy. The financial system is exposed to a deterioration in CRE prices via increased credit risk, decreased collateral values and losses on direct holdings. Transaction data show that over the five year period preceding the pandemic, euro area insurance corporations and pension funds, investment funds and non-financial corporations (NFCs) predominantly purchased non-prime retail and office properties, suggesting that exposures to the most vulnerable CRE asset types could be substantial. In addition, banks in some countries have high exposures to CRE via loan purposes and collateral. A significant drop in CRE prices and the associated reduction of collateral values could hamper NFCs’ access to finance and thus result in lower scope for investment and economic activity. Other market participants, such as investment funds faced with redemption pressure, could behave procyclically and amplify the price decline, thereby exacerbating negative feedback loops.

Conditions in CRE markets have improved somewhat, in tandem with the wider real economy, but the outlook for lower-quality buildings remains poor

Risks to financial stability stemming from real estate markets remain elevated and have increased for the medium-term horizon. A sharper than expected decline, particularly in lower-quality CRE valuations, might set off negative economic feedback loops. In residential property markets, while credit dynamics and household balance sheet vulnerabilities look less concerning than in the run-up to the global financial crisis, buoyant expansion of RRE prices and a sense of deteriorating lending standards may warrant monitoring going forward. Against this background, the financial sector may be exposed to the risk of real estate market corrections, especially in those countries where debt levels are elevated, exposures are high and properties are overvalued.

Will the bubble burst?

The ECB also notes that credit-fuelled residential real estate booms can pose major risks to financial stability. Residential real estate (RRE) booms and busts have frequently been associated with deep recessions and financial crises, especially when the RRE boom is fuelled by debt. The real estate bubble in the United States ahead of the global financial crisis (GFC) is possibly the most prominent recent example. In a boom, a feedback loop of rising prices and rising credit growth can result in a later correction of overvalued RRE prices affecting the economy and financial system through several channels. A collapse in RRE prices can weigh on household expenditure via wealth effects and/or confidence. High household indebtedness can further contribute to a reduction in consumption and can lead to defaults on loans if debts prove unsustainable. Investment and corporate loans can be impaired if the RRE price boom has been accompanied by a twin construction boom. Finally, the bursting of a real estate bubble can severely affect the credit supply and amplify the downturn as the value of available collateral shrinks and losses impair banks’ intermediation capacity.