According to the latest report published by Newmark Polska, in 2024, leasing activity in Poland’s key regional city office markets (Kraków, Wrocław, Tricity, Katowice, Poznań, Łódź, Lublin, Szczecin) showed stability, with annual take-up exceeding the average for the past five years. The strongest demand was recorded in Kraków, Wrocław and Tricity, which solidified their leading positions among regional cities. Additionally, lease renegotiations outnumbered relocations last year. While the overall vacancy rate edged up, developers remain cautious about starting new projects.

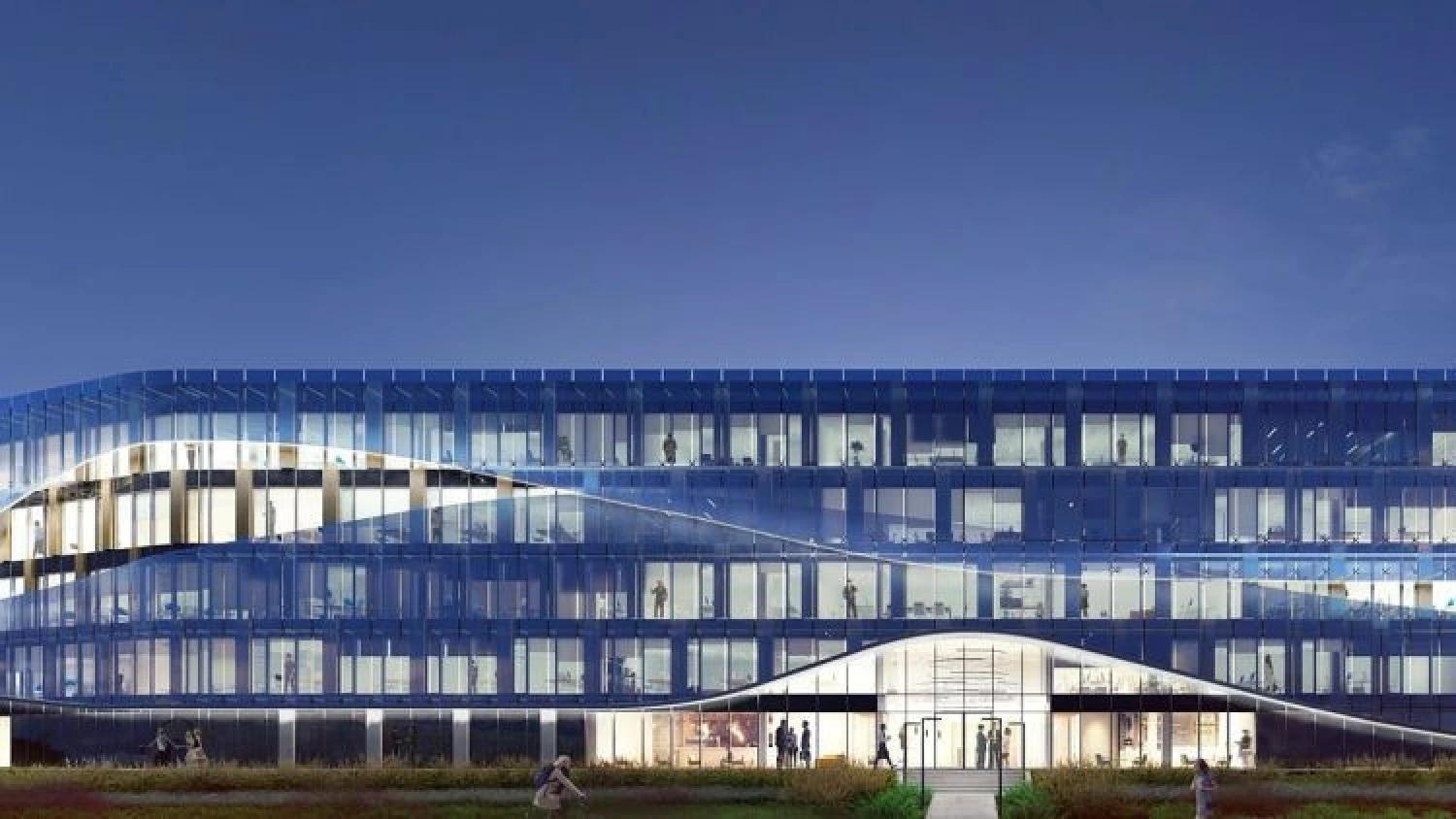

At the end of 2024, the combined office stock of Poland’s eight key regional cities amounted to nearly 6.8 million sqm. New completions totalled 123,800 sqm across 17 projects, down by almost 56% on 2023. This total included more than 47,100 sqm of new deliveries in the fourth quarter, accounting for over 38% of last year’s new supply. Key projects completed in 2024 included Grundmanna Office Park A (20,650 sqm, Q4) in Katowice, Quorum Office Park A (18,200 sqm, Q1) and B10 (14,150 sqm, Q2) – both in Wrocław, and Brain Park C (13,000 sqm, Q1) in Kraków.

At the end of December 2024, new build office space due for completion totalled approximately 220,400 sqm, up by 5% from the previous quarter but down by 25% year-on-year and by nearly 80% from the record high of 1.1 million sqm in the fourth quarter of 2017.

“Despite a quarterly uptick in construction activity, the office development pipeline remains low. The highest concentration of development activity was in Poznań and Krakow, accounting for almost half of all projects underway in regional cities. However, with rising office availability in existing buildings and the widespread adoption of hybrid working, developers remain cautious about launching new projects”, says Karol Wyka, Executive Board Director, Head of Office Department, Newmark Polska.

Leasing activity in the final quarter of 2024 reached nearly 220,000 sqm, up by 4.5% over the quarter and by 4.6% year-on-year. This marked the best quarterly result since the fourth quarter of 2018, which saw over 226,700 sqm transacted. Gross take-up for January-December 2024 hit 714,000 sqm, representing a slight 3.7% decline from the record high of 2023 but a 10% increase on the 2019-2023 average. It is also worth noting that the average new lease size increased over the last year by 10.4% to over 1,100 sqm.

“In 2024, leasing activity in Krakow reached a record high of 266,700 sqm, representing over 37% of total take-up in regional cities. Wrocław came second with 146,450 sqm of lease transactions, followed by Tricity in third place with 116,300 sqm. Together, these three cities accounted for over 74% of regional take-up. Demand came predominantly from the IT sector (27% of all deals) and professional services (17%)”, adds Karol Wyka.

2024 was the first year in the history of regional city office markets in which take-up was dominated by renegotiations and renewals, accounting for nearly 51% of the total, an 11 pp increase year-on-year. The remaining 49% was spread across new leases (39%), owner-occupier deals (5%), expansions (3%) and pre-lets (2%). This trend is likely to continue in 2025. Additionally, the significant incentive for companies to remain in their current locations is the opportunity to avoid the costs associated with fitting out new offices.

At the end of December 2024, the overall vacancy rate in the key regional city office markets stood at 17.8%, up by 0.5 pp over the quarter and by 0.3 pp year-on-year. Vacancy rates were above 10% in all the regional cities but Szczecin and 19% or higher in four of the surveyed locations. The strongest year-on-year upward movements in vacancy levels were recorded in Szczecin (+2.9 pp) and Łódź (+2.4 pp). At the end of the fourth quarter of 2024, total office availability in the regional cities amounted to a record 1.2 million sqm. However, the low levels of new office projects scheduled for completion are likely to push vacancy rates down in the long term.

High office availability in existing buildings keeps rental rates stable. At the end of the fourth quarter of 2024, prime office rents stood at €16.00-17.00/sqm/month.

“Occupier demand remains focused on ESG-compliant offices in prestigious locations, where landlords are less willing to make concessions in rent negotiations. Service charges in older, less energy-efficient office buildings are typically significantly higher, motivating their owners to invest in refurbishments to enhance the competitiveness of their properties in attracting tenants”, comments Agnieszka Giermakowska, Research & Advisory Director, ESG Lead, Newmark Polska.