In 2017, investments in the Czech Republic totalled €3,274 million as indicated by a Cushman & Wakefield report. Contrary to expectations, they declined only slightly compared with 2016, which was a record year. The biggest transactions in 2017 included the sale of Olympia Brno, the CBRE GI portfolio (Nisa Liberec, Zlatý Anděl and Olympia Plzeň), Metropole Zličín and of the Letňany shopping centre.

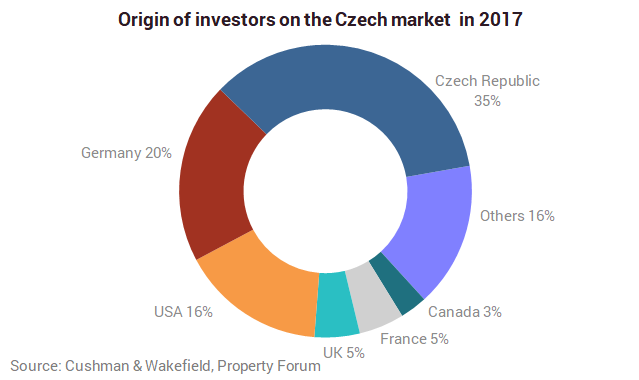

Czech investors were the biggest investors in 2017, but German and U.S. investors also accounted for a large proportion of the volume. Combined, Czech, German and U.S. investors accounted for 70% of the total volume of investments.

The number of transactions was very similar to that in 2016. In 2017, investments were primarily channelled into offices; 37 transactions took place in this segment, but they accounted for only 31% of the overall volume of transactions while their share in 2016 was almost 50%. In the retail segment, 28 transactions took place, accounting for 53% of the overall volume of transactions. More than one half of the transactions were carried out in the Czech capital.

Investors continue to be able to accept the record-low yields and C&W expects this trend to persist again this year.

The capital market is facing a slight contraction of the transaction volume in 2018. The office segment is expected to predominate. In the retail segment, the shrinking stock on offer will cause the transaction volume to contract, with demand shifting to the shopping parks that are dominant in their area. In the office segment, C&W expects investment to be directed into prime large-area office buildings with a selling price of more than €60 million. Sales totalling around EUR 1 billion are now expected only in Prague alone. The industrial and logistics market will benefit from investors’ demand and a shortage of other real estate property.

“In 2018, offices will be investors’ primary target again, while retail will be subdued compared with 2017. This is partly driven by the fact that many shopping centres are now held by long-term investors. In 2018, more capital is expected to flow from local institutional and private sources. The limited stock of prime real estate property on offer will probably also compel investors to explore for some other alternative commercial real estate assets in the coming years,” says Jeff Alson, International Partner CEE Capital Markets at Cushman & Wakefield.

Smaller investors may begin focusing on alternative sectors such as homes for the elderly, living quarters for students, or flexible warehouse space. Investors’ other targets will include industrial property, where growth is driven by e-commerce and the automotive industry. In the light of the limited offer of real estate C&W expects investors to be more willing to enter into joint ventures and portfolio transactions, adds Alexander Rafajlovič, Partner in Capital Markets Team at Cushman & Wakefield.

“In 2018, we expect the overall investment volume to amount to about EUR 2.5 billion. But this figure may be different in case of a larger portfolio investment, which the major players are increasingly seeking out. As regards the structure of investors we believe that in addition to Czech and German investors, the activity of new players from South Korea, Malaysia and South Africa, who have gained their initial experience with the Central European region, will continue.”