The Czech Republic saw investment in real estate tail off slightly in the third quarter to €450 million, but following a strong start to the first half of 2017 when €2.25 billion worth of transactions were closed, total cumulative investment volumes had reached €2.67 billion by the end of September, according to Colliers International.

The strong investment flows, which by the end of the third quarter had already reached the full-year figure for 2015 and were up 71% year-on-year (y-o-y), came against a backdrop of continuing strength in the Czech economy. The latest 2017 growth forecast from the Czech National Bank (CNB) has been set at 4.5%, while unemployment at a record low of 2.7% by end-September means the shortage of labour is becoming the dominant theme of 2017.

The booming economic growth prompted the CNB to increase the base interest rate for the second time in four months to 0.5%. Colliers expects further interest rate hikes to continue in this trend of 25-basis-point increments to allow both investors and local businesses to adapt to the changing conditions without any sudden shocks. The exchange rate of the Czech Koruna against the Euro should also continue strengthening, tracking the interest rate hikes. In the last quarter of 2017, it could stabilise around the 25.5 CZK/EUR mark.

Investment market

The largest real estate investment transactions in the third quarter were in the range of €60 million to €70 million: The Blox office building in Prague 6 was acquired by CFH Group for €68.5 million, Oasis Florenc was purchased for €63 million by Corpus Sireo as it entered the Czech market for the first time and the Královo Pole shopping centre in Brno was acquired by CPI Group for an estimated €60 million.

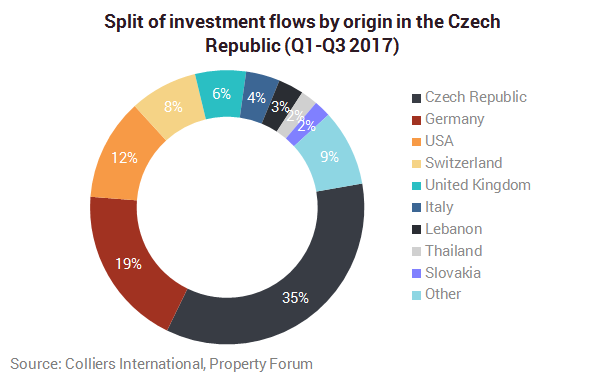

Overall, investment flows have come into the Czech real estate market from a remarkable 18 different foreign countries since the start of 2017. As well as international investors, Colliers noted an increasing number of local Czech (and Slovak) buyers active in the market. “We expect this will continue to develop and evolve as the market matures. This is excellent news, as it gives an increasing number of options for the investors seeking an exit and helps to make the market more liquid,” says Ondřej Vlk, Head of Research Czech Republic at Colliers International.

An interesting recent trend, Colliers identifies, is the export of Czech capital to other CEE markets, examples being REICO and CPI who have recently acquired properties in neighbouring CEE countries.

By the end of the third quarter 2017, total office stock in Prague had reached 3.28 million sqm, with three new office buildings completed during the quarter. These newly completed buildings on average were 65% leased at completion.

Gross office demand grew by 23% y-o-y in the first nine months of 2017, resulting in 389,300 sqm of deals closed. The office market vacancy rate continued in a downward trend, reaching 7.7% by the end of the third quarter. 71% of this vacant stock was Class A space, with the remaining 29% Class B space. This shrinking vacancy is good news for landlords, as some have been able to secure higher rents. Prime office space in city centre Prague is now leasing for €21/sqm/month; the rents for premium space can be even higher, however, this is limited to only a few trophy assets.

At the close of the third quarter 2017, some 349,000 sqm of new office space was being constructed in Prague, with 88,300 sqm due in the fourth quarter, of which 54% had been pre-let.

The pipeline for 2018 comprises some 166,700 sqm of office space, with 20% of that pre-leased. At current demand levels, Colliers expects vacancy levels to mildly oscillate below the level of 10%.

Industrial market

In spite of the increasing volume of speculative development being built, the industrial market successfully absorbed the 108,000 sqm of new space delivered to the market during the third quarter 2017 to take the total stock to 6.75 million sqm, with the vacancy rate falling further to 3.6% by the end of September.

Gross take-up in the third quarter reached 310,600 sqm, showing a 5% y-o-y increase. Net take-up in the quarter was 188,200 sqm and showed a significant increase of 84% y-o-y.

Premises totalling 681,000 sqm were under construction across the country by the end of September, which was up 18% (by 106,000 sqm) from the previous quarter, in spite of the new completions. Some 296,700 sqm of the new build space is due in the fourth quarter 2017, of which the vast majority has already been leased.

“Continued investor appetite for modern well-positioned industrial space will create opportunities for owner occupiers to re-engineer the capital employed in their business through a sale and leaseback transaction,” says Ondřej Vlk.