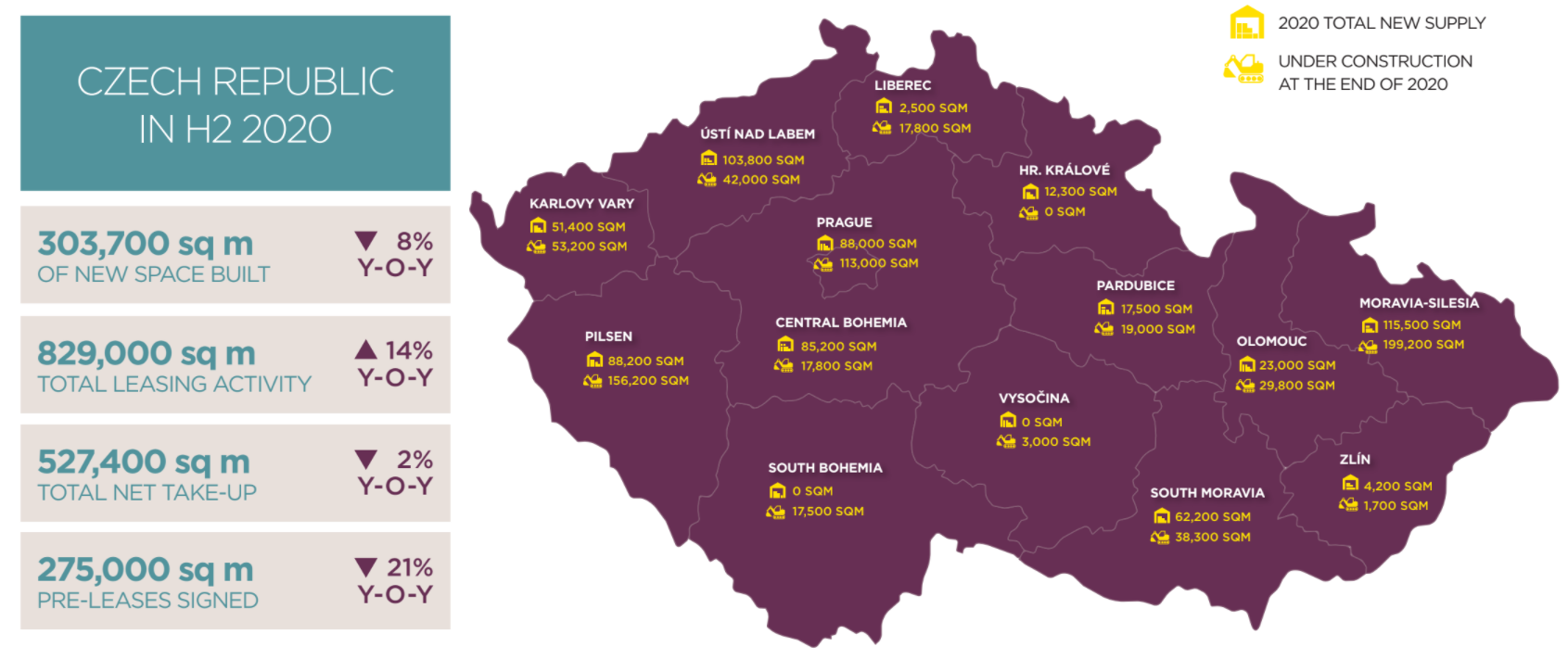

Modern industrial stock in the Czech Republic grew by 314,800 sqm in H2 2020, indicating a mild (7%) decline in construction activity compared to H1. The total industrial inventory intended for lease according to the latest Savills report totalled 9.11 million sqm and 62% of the total inventory was held within the three largest submarkets of Prague (3.21 million sqm), the Pilsen region (1.33 million sqm) and the South Moravia region (1.15 million sqm).

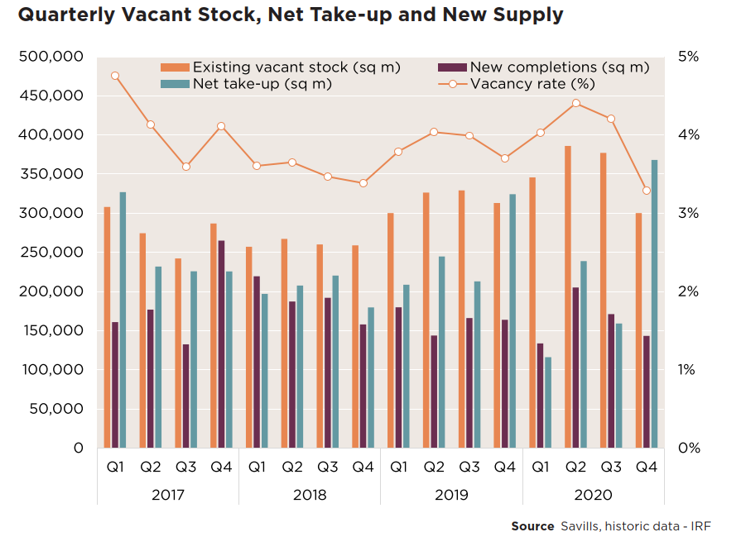

The nationwide vacancy rate fell to its historical low of 3.3%, having dropped by 111 basis points (bps) from the middle of 2020 and by 41 bps since the beginning of the year. The share of unoccupied space in Prague declined from 2.7% in mid-2020 to 1.5% at the close of 2020, indicating vacant premises in a total area of 49,300 sqm.

At the end of 2020, industrial premises totalling 692,500 sqm were under construction across the country, being only marginally (1%) below the development pipeline 12 months ago. 26% of this construction pipeline represent buildings completed to a shell & core finish.

Lenka Pechová, Senior Research Analyst at Savills CZ&SK, says: “Although a high level of economic uncertainty persists, increasing occupancy levels and demand for non-existent larger units has been driving new industrial development across the country. 2020’s fourth quarter saw construction commence at a number of brand new parks, mostly in Prague and the Moravia-Silesia region, which is likely to see much more attention also in the coming 1-2 years.“

Leasing activity on the industrial market demonstrated strong results, proving it to be one of the most resilient asset classes during the COVID-19 pandemic. Gross leasing activity in H2 2020 amounted to 829,000 sqm, an increase of 14% compared to the volume of transactions signed in H2 2019. The cumulative gross take-up for 2020 added up to 1,544,600 sqm, indicating a 5% increase against 2019. Net demand in the last six months of 2020 totalled 527,400 sqm, which was almost identical to the net take-up recorded in H2 2019. The annual net take-up in 2020 reached 882,600 sqm, being only 11% below the 2019 results.

Chris LaRue, Head of Industrial Agency, Savills CZ&SK, adds: “According to the sectoral analysis, the 2020 net take-up in the Czech Republic was powered by e-commerce and to a certain extent also by retailers. Although at a slower pace, e-commerce growth is likely to continue even in 2021. Take-up levels will continue to be supported by 3PLs, while we may also start seeing demand from the automotive sector.”