Given that only 4% of modern industrial space is available throughout the Czech Republic, it is not possible to realize the projects as fast as future tenants would imagine. Therefore, interested parties must respect the offer, not dictate the terms. Even last year's record-breaking supply of modern A class industrial properties for rent with a total volume just under 7 million square meters did not change the situation in the Czech Republic. 2017 was a very good year for the Czech market and witnessed several records and successes. What were they?

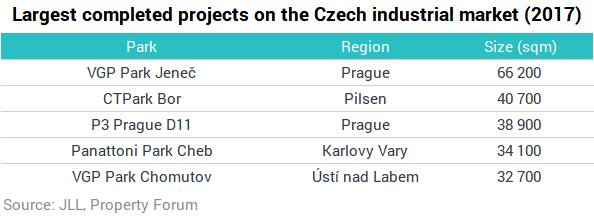

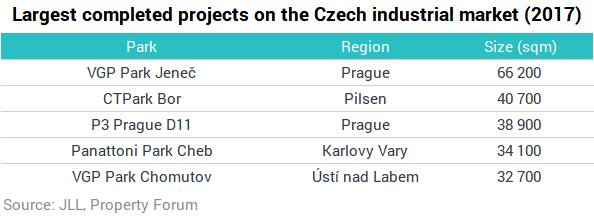

Last year, a total of 662,200 sqm of new developments were delivered to the market, achieving the best result since 2008. Compared to 2016, when 510,000 sqm of new space was placed on the market, we can see a remarkable increase in the supply. Last year's total volume of modern A-class industrial property for rent rose to 6.98 million sqm in the Czech Republic at the end of the year compared to the end of 2016, when we recorded 6.27 million sqm of warehouses and industrial space. Achieving the milestone of seven million square meters can be expected in the upcoming months. Prague continues to be the largest sub-market, with 39% of all space. This is followed by Plzeň region with a 16% share and the South Moravian region with a 13% share.

For the entire 2017, gross demand reached 1,320,800 sqm which is 11% below 2016 figures. More than 40% of transactions were realized in Prague. The second most active market was surprisingly the South Moravian region (11%). In the past years, it appeared in the third to sixth place, while the Pilsen region traditionally ranked second. In 2017, however, the region of Pilsen recorded a drop to fourth place (9%) just behind the South Moravian region and the Ústí nad Labem region (9%). Net take-up amounted to 937,300 sqm representing an annual increase of 3%. Even in net demand, Prague was the most active market with 42% of net demand followed by the Ústecký region with 11%.

“We have registered a shift in occupiers’ interest in 2017 with the Brno and South Moravian regions ranking the second in terms of gross demand. It has replaced the Pilsen region which was in several last years the second most demanded market after Prague. In 2017, the Pilsen region has ranked fourth with gross demand registering a decrease of nearly 49% y-o-y. On the other hand, in Brno, the gross demand annually rose by more than 80%.” adds Blanka Vačkova, Head of Research at JLL.

Due to constant strong demand, the national average vacancy rate stood at 4.1 % at the end of 2017, which is the decade´s low and one of the lowest indicators in the history of the market.

Thanks to the fact that on average 96 % of the Czech industrial parks were occupied and sought-after locations were unable to accommodate the constant demand, a number of developers took a business risk and continued with the speculative development of industrial premises, i.e. without having their tenant secured in advance. The current speculative development volume of approximately 33 % of the total volume is however still far below 2007/2008 pre-crisis levels when it represented approximately 70 %.

“Yet again another strong year for the Industrial sector, seeing the comeback of speculative construction and with construction passing the 500,000 sqm mark for three consecutive quarters in a row. 2018 has started well and there is no sign of a slow down at this point. Tenants will need to think further ahead due to restricted land availability, especially with the much higher demands of electricity, gas and clear height. We will continue to see the rise of e-commerce in the take-up in 2018, with many major and local players seeing the Czech Republic as the heart of Europe. Within the first quarter of 2018 the stock should pass the 7million sqm mark, securing CZ position as the second largest and mature market within CEE.” says Harry Bannatyne, Head of JLL Industrial Agency.

As a result of the predominance of demand over supply, an increase in rental prices could be expected in 2018. However, this is not the only factor that will increase the costs for tenants. They have to reckon with the fact that, due to the constantly falling unemployment rate, workforce shortage will also affect wages in this sector. The situation depends on the location where the project will be realized.