At the beginning of the pandemic, it seemed that many coworking centres or serviced offices could not survive the measures implemented under the Covid-19 pandemic. Shared workspaces, whose philosophy is based on meeting, personal communication, and collaboration, were hit hard by governmental restrictions. But a December analysis by JLL shows promising results; with the retreat of anti-pandemic measures, most coworking and serviced office operators have already felt a new wave of interest, and 2022 has confirmed this trend.

In some cases, demand has even surpassed the pre-covid period. Thanks to this, the supply of flexible offices, which currently stands at over 133,000 sqm, is forecasted to grow this year and next. In addition to Prague and Brno, the expansion also affects other cities. According to major operators in the flexible office market segment, the last few months have shown stabilization and gradual growth. New companies are entering the flexible office market by leasing coworking spaces. These are often larger corporations, which are an important source of income for many operators, given the length of leases and the size of the leased space.

The return, or rather the entry, of larger companies to coworking spaces means for most flexible operators a greater diversification of the membership base. The share of corporate clients, i.e. companies with more than 500 employees, varies from operator to operator. For example, IWG, which operates Spaces or WeWork, confirm that large, often multinational corporations currently account for 60 - 75% of their total leases. „Other operators like Impact Hub or WorkLounge continue to base their business on smaller and medium-sized companies, often individuals/freelancers. This group can often account for up to 90% of members. And it requires real flexibility in terms of lease terms," says Kamila Breen, Market research and advisory analyst at JLL.

All the major operators contacted agree that their clients and members have come up with new requirements in the wake of the lockdown and pandemic measures. Closed offices were popular before the first wave in the spring of 2020, but demand for them has now risen steeply. At the same time, renting single-occupancy offices is a brand new trend, which surprisingly also applies to the aforementioned corporations.

There is also further consensus on technological innovation. Operators are investing in even more convenient booking systems, video conferencing facilities and other self-service processes. All improvements are aimed at even greater flexibility in terms of operations and the rental relationship between operator and client. “Customers currently demand the minimum space, the shortest possible lease, and the lowest commitment. Shorter relocation times for flexi centres, and therefore shorter decision times, also play a big role in the selection of new offices. In this respect, flexible space still has a big advantage over the traditional form of the office lease," concludes Silvie Dudychová, Flexible office consultant at JLL.

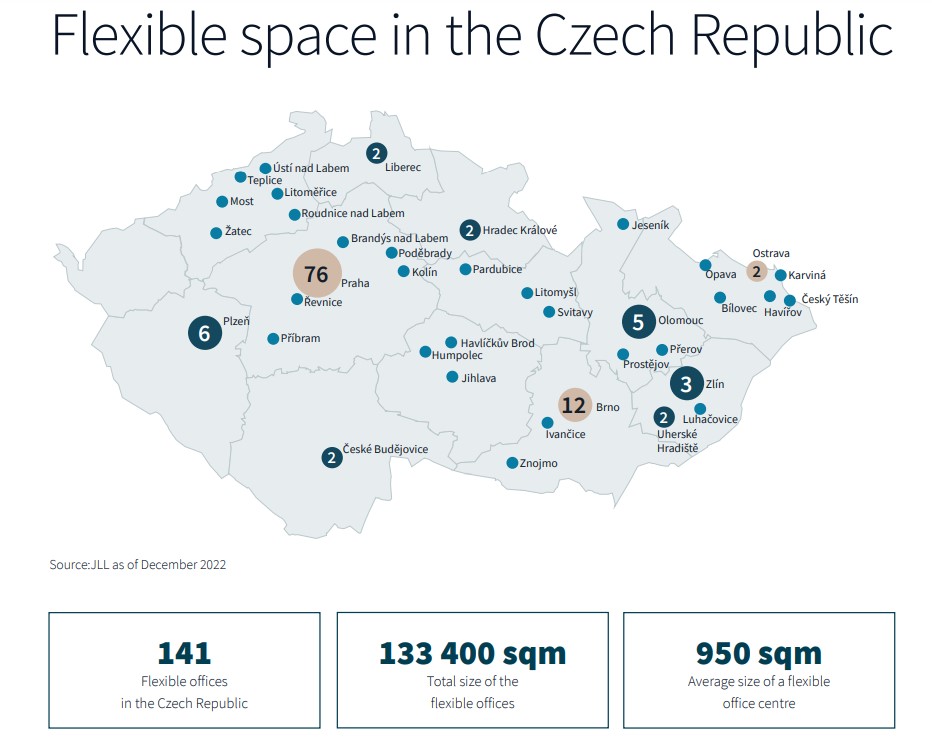

Most of the flexible centres are in Prague (76) totalling an area of 103,300 sqm. The second most important flexible office hub is Brno with 12 centres and a total area of 11,500 sqm. Among the larger cities offering a network of flexible spaces is Pilsen with 6 centres and a total area of 1,900 sqm.

Evidence of the continued interest in flexible workspaces can be seen in the recently opened centres operated by developers. The developer CTP opened its coworking centre Clubco (3,700 sqm) in the Vlněna building in Brno during the pandemic and further expanded it by 2,000 sqm in 2022. Another developer, Passerinvest,, has been operating its flexible space under the name FLEKSI with a total area of 3,300 sqm in its Prague office complex Brumlovka since November 2021. They intend to further expand their flexi concept. In February 2023, Passerinvest also opened another space in Brumlovka in the Beta building with a total area of 2,900 sqm, and this year they plan to open their third centre, also in the Brumlovka complex, with an area of 3,800 sqm. In total, Passerinvest will provide over 10,000 sqm of flexible space. In related news, at the end of February 2023, HB Reavis announced the closure of its two Prague HubHub flexible centres in Na Příkopě and ARA Palace, both located in Prague 1. The company will cease operations in the Czech Republic at the end of May 2023.

Conversely, other operators plan to expand or open flexible centres in 2023 The Scott.Weber Workspace company will open two centres this year – in The Park building in Prague (2,500 sqm) and in the newly completed Port7 building also in Prague (4,400 sqm). By transforming a Pilsen brownfield into a technology park, TechTower opened another flexible space of 2,500 sqm in February 2023.