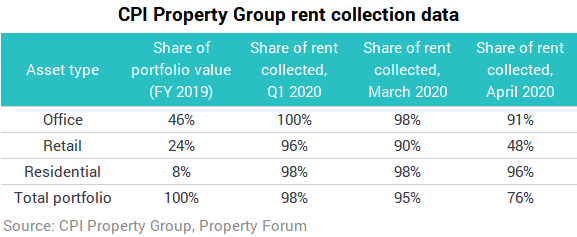

As of 29 May, CPI Property Group collected 76% of rents in April 2020. The company published unaudited financial results for the first quarter of 2020.

Key highlights for the first quarter of 2020 include:

- Total assets increased to €11.1 billion (up 4% from year-end 2019), driven by the acquisitions of four office properties in Warsaw and a 29.4% stake in Globalworth. The total property portfolio stood at €9.8 billion.

- Net rental income of €84 million (up 14% versus Q1 2019), reflecting the positive impact of 3.1% like-for-like growth in gross rental income, a slight improvement in occupancy to 94.4% and the income from recent office acquisitions.

- Total revenues were €164 million (up 0.4% versus Q1 2019). Net business income was €91 million (up 9% versus Q1 2019) and consolidated adjusted EBITDA was €85 million (up 18% versus Q1 2019).

- CPIPG continued accessing multiple financing channels, issuing GBP 350 million (€411 million equivalent) of 8-year green bonds, SGD 150 million (€99 million) of perpetual hybrid bonds, and HKD 250 million (€29 million) of 10-year bonds during Q1. CPIPG also drew €116 million of secured bank loans and repaid €49 million of Schuldschein loans maturing in 2025.

- Total available liquidity (including cash and undrawn revolving credit facilities) at the end of the first quarter was above €1 billion.

Updates on the impact of COVID-19

Governments across CPIPG’s region have successfully eased lockdown restrictions in recent weeks. More than 95% of the Group’s property portfolio is now open, excluding hotels.

In the Czech Republic, hotels were permitted to open on 25 May. The Group will gradually increase hotel capacity based on demand, with a continued focus on costs. During the closed period, the Group reduced hotel operating costs by about 70%.

Footfall and turnover in CPIPG’s regional shopping centres in the Czech Republic have improved every week since full reopening on 11 May, with some centres now reporting volume near 2019 levels. Tenants and shoppers are adjusting to new hygiene rules and demand for certain non-essential categories (such as services, sports equipment and shoes) have been strong. Restaurants and food courts also opened on 25 May.

Rents are invoiced and collected on varying timetables across CPIPG’s portfolio. Following the outbreak of COVID-19, some tenants are paying later than usual, creating a lag in collections. For example, total March collections were reported at 84% on 23 April, versus 95% on 29 May. Similarly, the Group expects April collection rates to continue rising.

In partnership with retail tenants in the Czech Republic whose units were closed, and in anticipation of Czech government aid to tenants, CPIPG agreed to delay some rental payments until shops were permitted to reopen. On 18 May, the Czech government approved a programme to pay 50% of the rent for tenants whose premises were subject to mandatory closure between 13 March and 30 June. Details around implementation, including the amount and nature of any discounts provided by landlords (expected to be about 30%), are forthcoming.