Sixteen office buildings have been completed in Warsaw in the first half of 2016, totalling 350,000 sqm. 100,000 sqm is scheduled for completion in H2 2016, which will bring the annual supply to a new record high of 450,000 sqm. Cushman & Wakefield has published its Property Times report on the Warsaw office market for H1 2016.

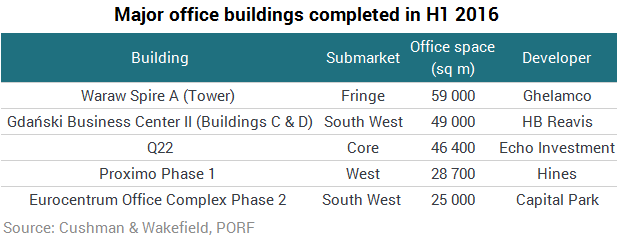

In H1 2016, total modern office stock in Warsaw reached nearly 5 million sqm, of which around 3.5 million sqm (70%) was in non-central locations. With buildings totalling around 1.33 million sqm Upper South remains the capital city’s largest office zone. The highest volumes of new office space were delivered in the city centre, where office schemes offering 180,000 sqm were given occupancy permits, in South West (60,000 sqm) and North (50,000 sqm). This supply trend is expected to continue given the large number of office buildings planned or under construction in or close to central locations. The largest office completions in H1 2016 included Ghelamco’s Warsaw Spire A (59,000 sqm), HB Reavis’ Gdański Business Center 2 (buildings C and D totalling 49,000 sqm) and Echo Investment’s Q22 (46,400 sqm).

Katarzyna Lipka, Associate Director, Consulting and Research, Cushman & Wakefield said: “Sixteen office buildings received occupancy permits in the first two quarters of 2016, providing a total of 350,000 sqm, which represented a nearly 30% increase on the last year’s total supply. Approximately 100,000 sqm is scheduled for completion in H2 2016, which will bring the annual supply to a new record high of 450,000 sqm.”

Richard Aboo, Partner, Head of Office Agency, Cushman & Wakefield, said: “Given the expected supply and take-up trends, prime headline rents are likely to remain flat by the end of 2016 at EUR 24/sqm/month in central locations and at EUR 13–16.50 in non-central locations. Tenants continue to enjoy the upper hand in negotiations benefiting from the strong availability of office space both in existing buildings and schemes under construction or in the pipeline. Therefore, owners of office buildings will continue to offer attractive incentive packages that include rent-free periods or fit-out contributions.”